Superannuation

This inquiry is now completed. The Australian Government asked the Productivity Commission to undertake a review of the efficiency and competitiveness of the Australian superannuation system.

The final report was handed to the Government on 21 December 2018 and publicly released on 10 January 2019.

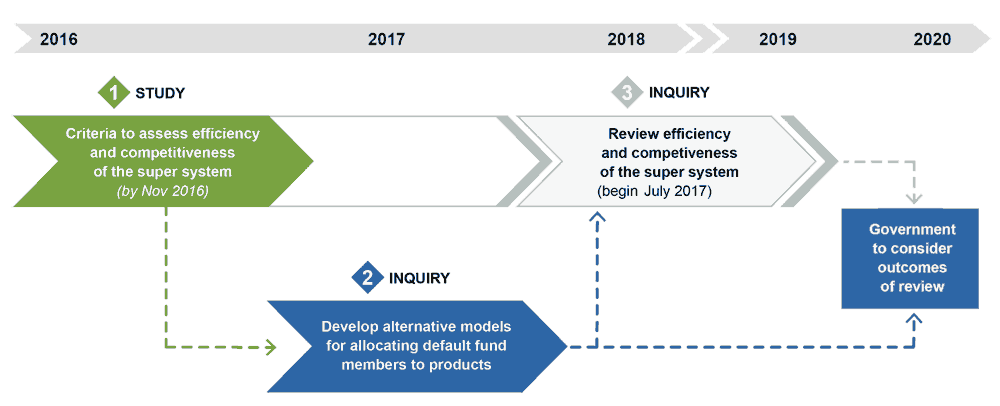

Stage 1 developed a framework for assessing the efficiency and competitiveness of the superannuation system, which forms the basis for the assessment in stage 3. The final report for stage 1 was published in November 2016.

Stage 2 examines alternative models for a formal competitive process for allocating default fund members to default superannuation products. In the context of receiving the terms of reference for the stage 3 inquiry into the Efficiency and Competitiveness of Australia's Superannuation System, the Treasurer has agreed that the stage 2 inquiry be incorporated into and finalised as part of the stage 3 inquiry.

Stage 3 is an assessment of the efficiency and competitiveness of Australia's superannuation system using the framework developed in stage 1.

More detailed information can be found via the links below.