Business set-up, transfer and closure

Draft report

This report was released on 21 May 2015. You were invited to examine the draft report and to make written submissions by 3 July 2015.

The report deals with the key drivers of business set-ups, transfers and closures. It considers innovative new business models and entrepreneurial activity.

It also examines a wide range of regulatory, institutional and financial factors that influence primarily set-ups, but ultimately can also impact on the manner and ease with which businesses close.

Finally, the report examines the closure of businesses - through voluntary exits, personal insolvency (bankruptcy) or corporate insolvency.

This inquiry has concluded. The final report was sent to Government on 30 September 2015 and publicly released on 7 December 2015.

Please note: This draft report is for research purposes only. For final outcomes of this inquiry refer to the inquiry report.

Download the draft report

Key Points

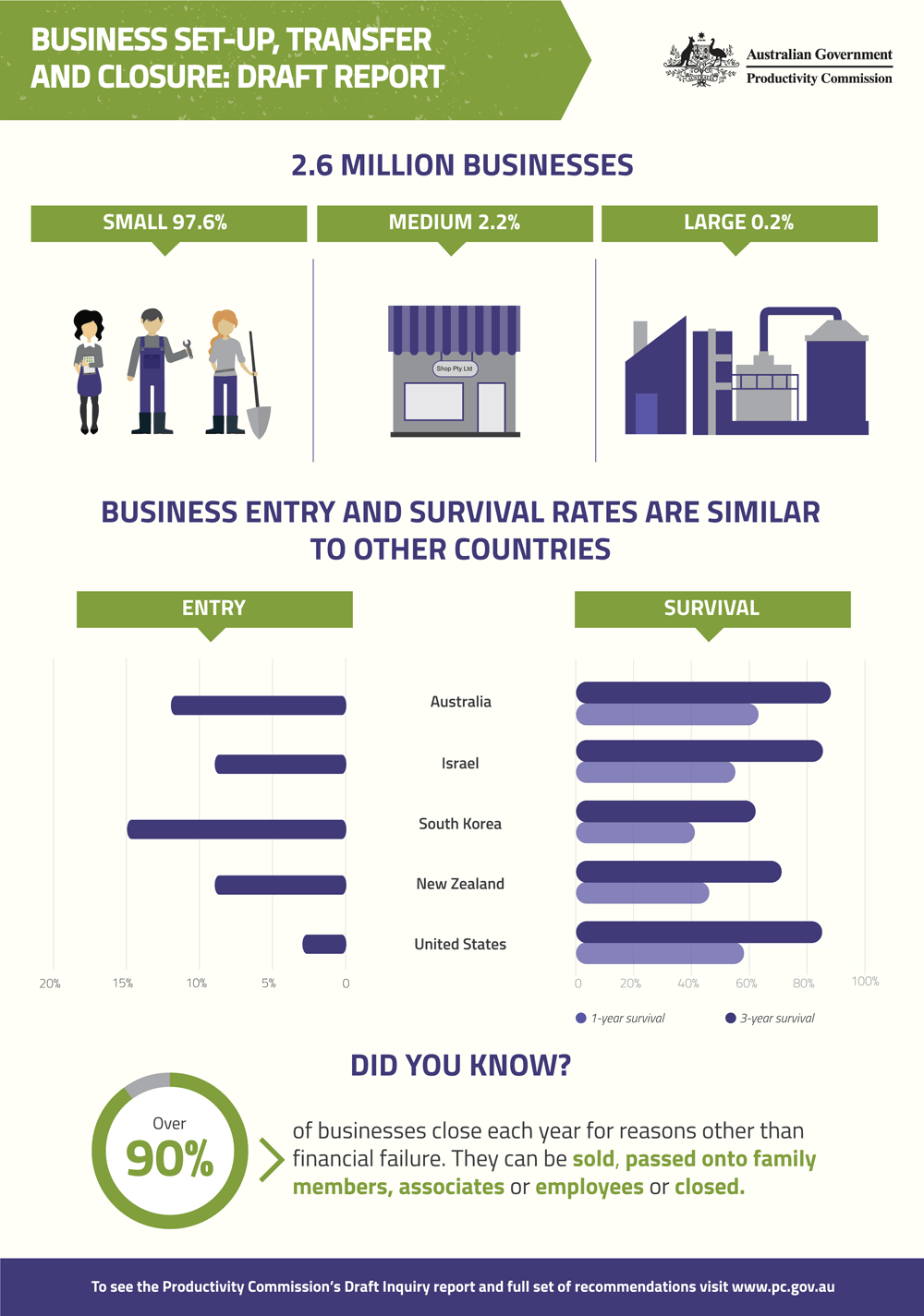

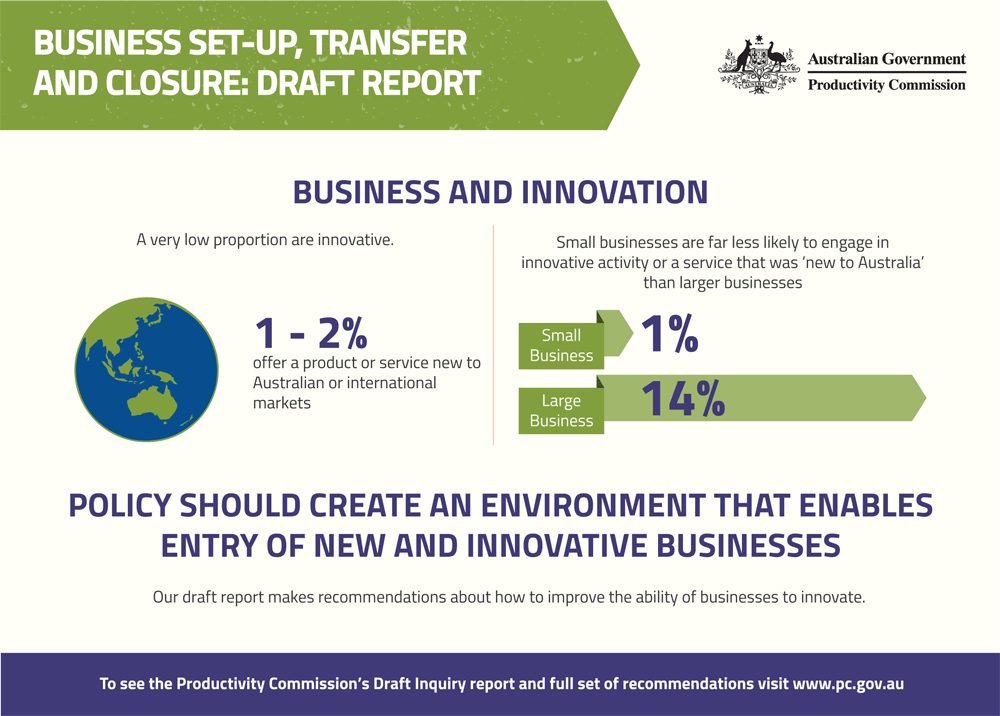

- Businesses are set-up for a variety of reasons and in any one year there is a churn of entries and exits that is comparable with other countries. Most businesses are small and a very low proportion are innovative, producing a product or service new to Australian or international markets. The propensity to be innovative is highest amongst larger businesses.

- While it is generally relatively easy to start a business, a number of longstanding issues with specific regulatory requirements and regulator engagement and funding remain unaddressed and are making new business entry unnecessarily complex or costly.

- Some new business models - particularly those that exploit digital technology to make better use of information - are challenging existing regulatory arrangements or causing others to operate in regulatory grey areas. Regulators should have the capacity to exempt businesses for a fixed period, from particular regulatory requirements where these deter entry but exemption does not threaten consumer, public health and safety, or environmental outcomes.

- Government assistance to business set-ups should not be directed at particular business models, technologies, sectors or locations - criteria based on desired outcomes (such as technology transfer and spillovers) with matching private sector investment, are less likely to distort incentives and behaviours, particularly in a rapidly evolving environment. Any assistance should focus on those areas where there are economy-wide net benefits, and in the absence of a business set-up, there would be a justifiable need for other forms of government assistance.

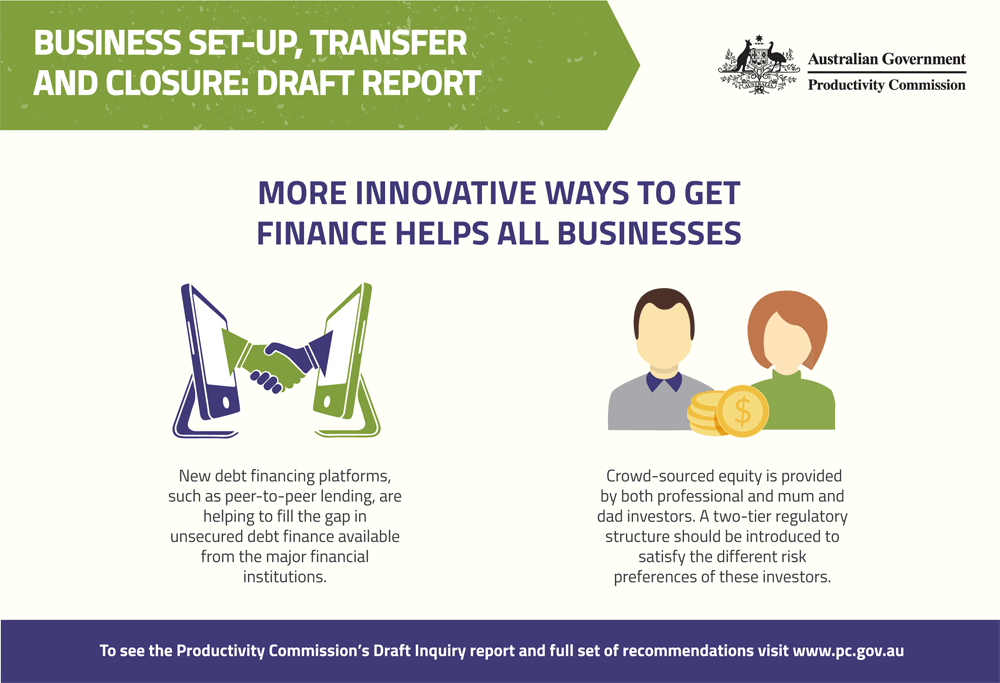

- Access to finance is generally not a significant barrier to business set-up.

- New debt financing platforms, such as peer-to-peer lending, are helping to fill the gap in unsecured debt finance available from the major financial institutions. The voluntary participation by lenders in comprehensive credit reporting should be reviewed.

- A two-tier regulatory structure should be introduced for crowd-sourced equity to balance the financing needs of business against the risk preferences of different types of investors.

- Most businesses are closed or transferred without financial failure. Governments' role in such situations should be limited to provision of clear guidelines for businesses, associations and advisers on exit and succession planning, and ensuring government processes are timely.

- While some specific reforms to Australia's corporate insolvency regime are warranted, a wholesale change to the system, such as the adoption of the United States 'chapter 11' framework, is not justified.

- Formal restructuring of companies through voluntary administration should be enabled as an option for when a company may become, but is not yet, insolvent.

- There should be provision for a 'safe harbour' to allow company directors to explore restructuring options without liability for insolvent trading.

- A simplified liquidation process should be introduced to reduce the time and expense toward winding up businesses with little or no recoverable assets.

- All directors should be required to obtain a director identification number to enable the easier detection of disqualified or fraudulent directors.

- The default exclusion period and associated restrictions applying to bankrupts in relation to access to finance, employment (including being a company director) and overseas travel should be reduced from 3 years to 1 year, with the trustee and courts retaining the power to extend this period where necessary to prevent abuse of the bankruptcy process.