Philanthropy

Future foundations for giving

Draft report

Released 30 / 11 / 2023

This report sets out the Commission’s draft findings and recommendations relating to motivations for philanthropic giving in Australia and opportunities to grow it further.

Philanthropy makes an important contribution to our way of life.

It brings communities together, funds innovation and supports people in need.

The proposed reforms would establish firm foundations for the future of philanthropy, so that the benefits of giving can continue to be realised across Australia.

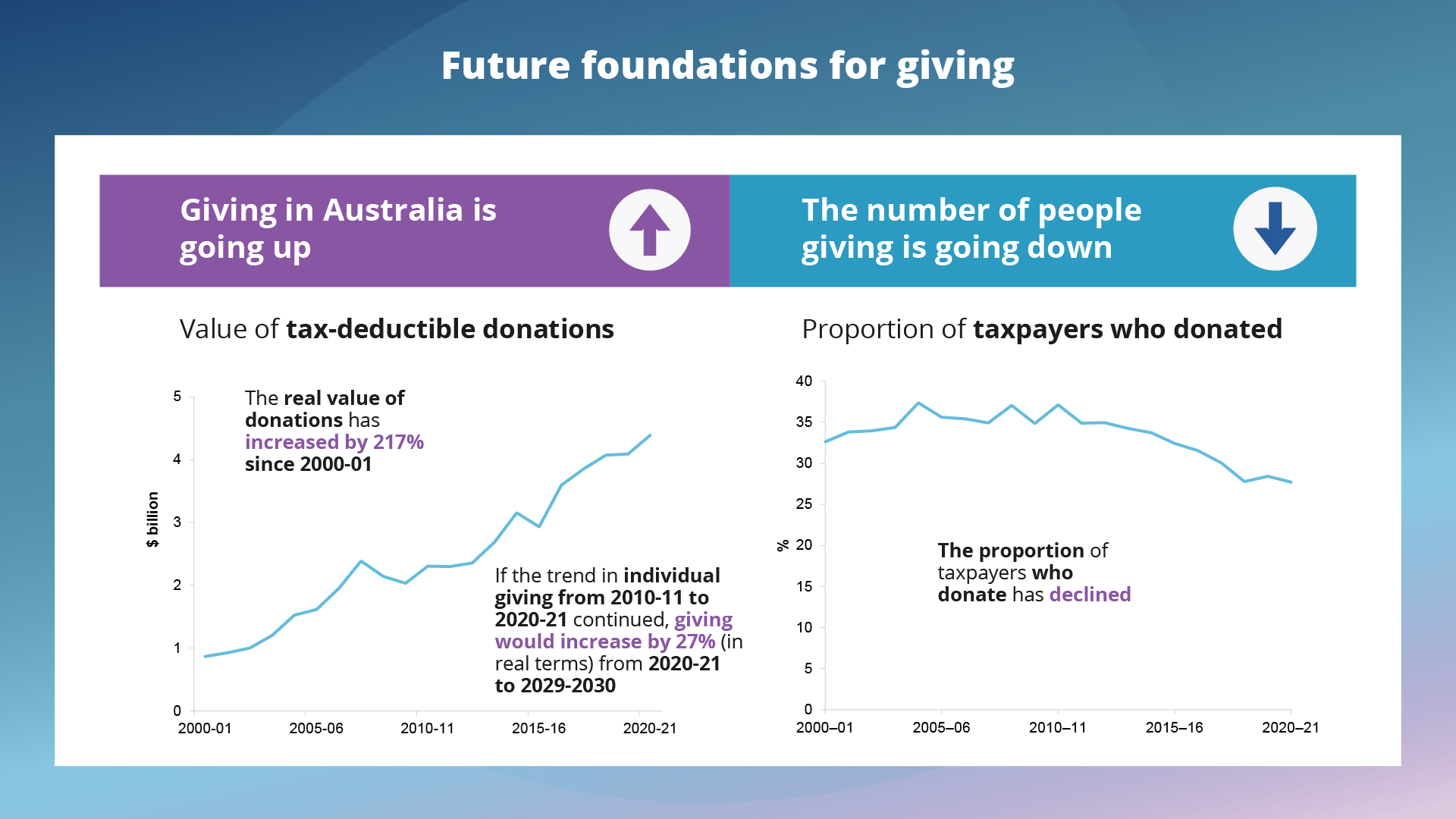

Giving in Australia is going up

The real value of donations has increased by 217% since 2000-01.

If the trend in individual giving from 2010-11 to 2020-21 continued, giving would increase by 27% (in real terms) from 2020-21 to 2029-2030.

The number of people giving is going down

The proportion of taxpayers who donate has declined.

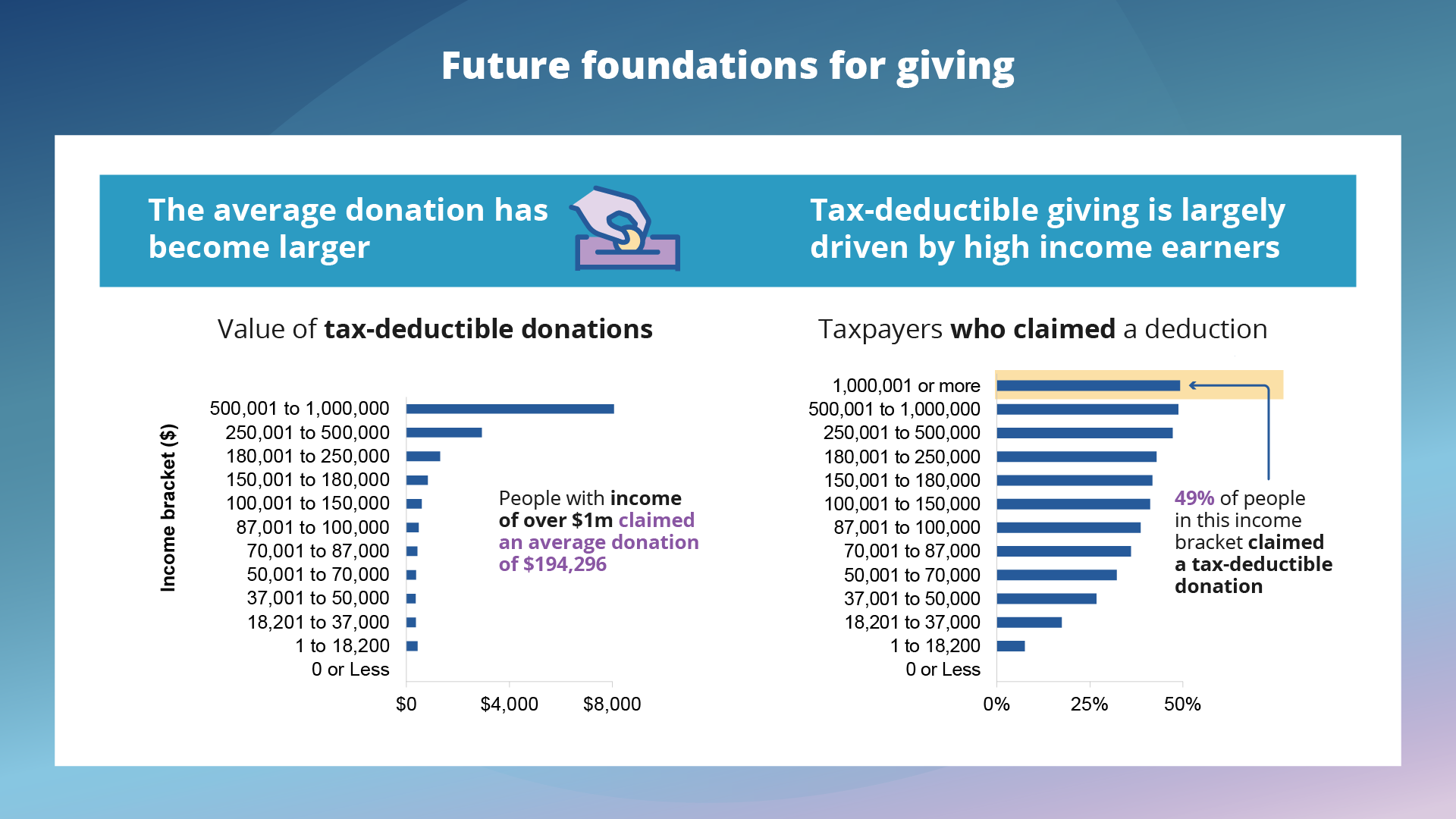

The average donation has become larger

People with income of over $1m claimed an average donation of $194,296.

Tax-deductible giving is largely driven by high income earners

49% of people in this income bracket claimed a tax-deductible donation.

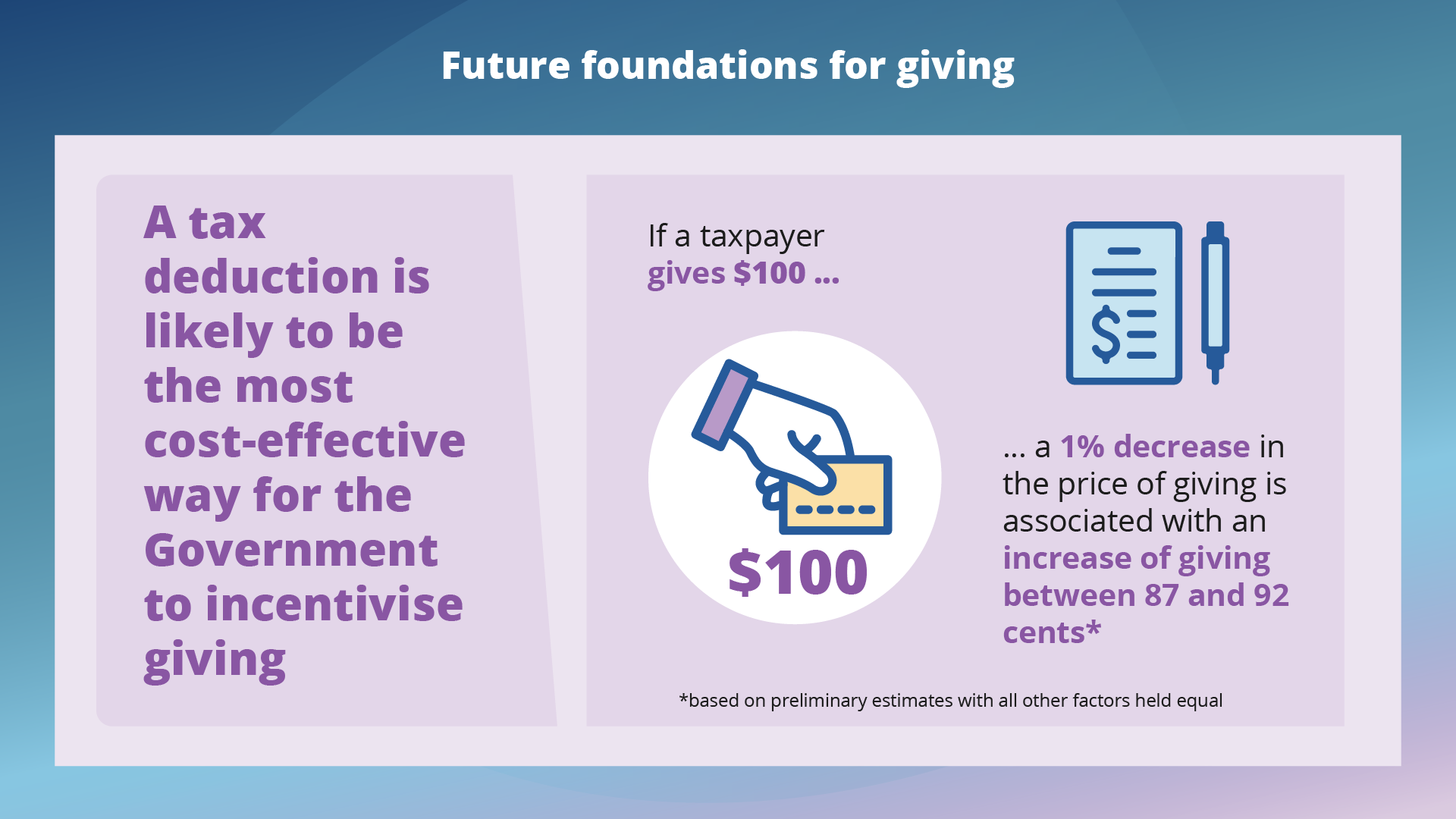

A tax deduction is likely to be the most cost-effective way for the Government to incentivise giving

If a taxpayer gives $100, a 1% decrease in the price of giving is associated with an increase of giving between 87 and 92 cents - based on preliminary estimates with all other factors held equal.

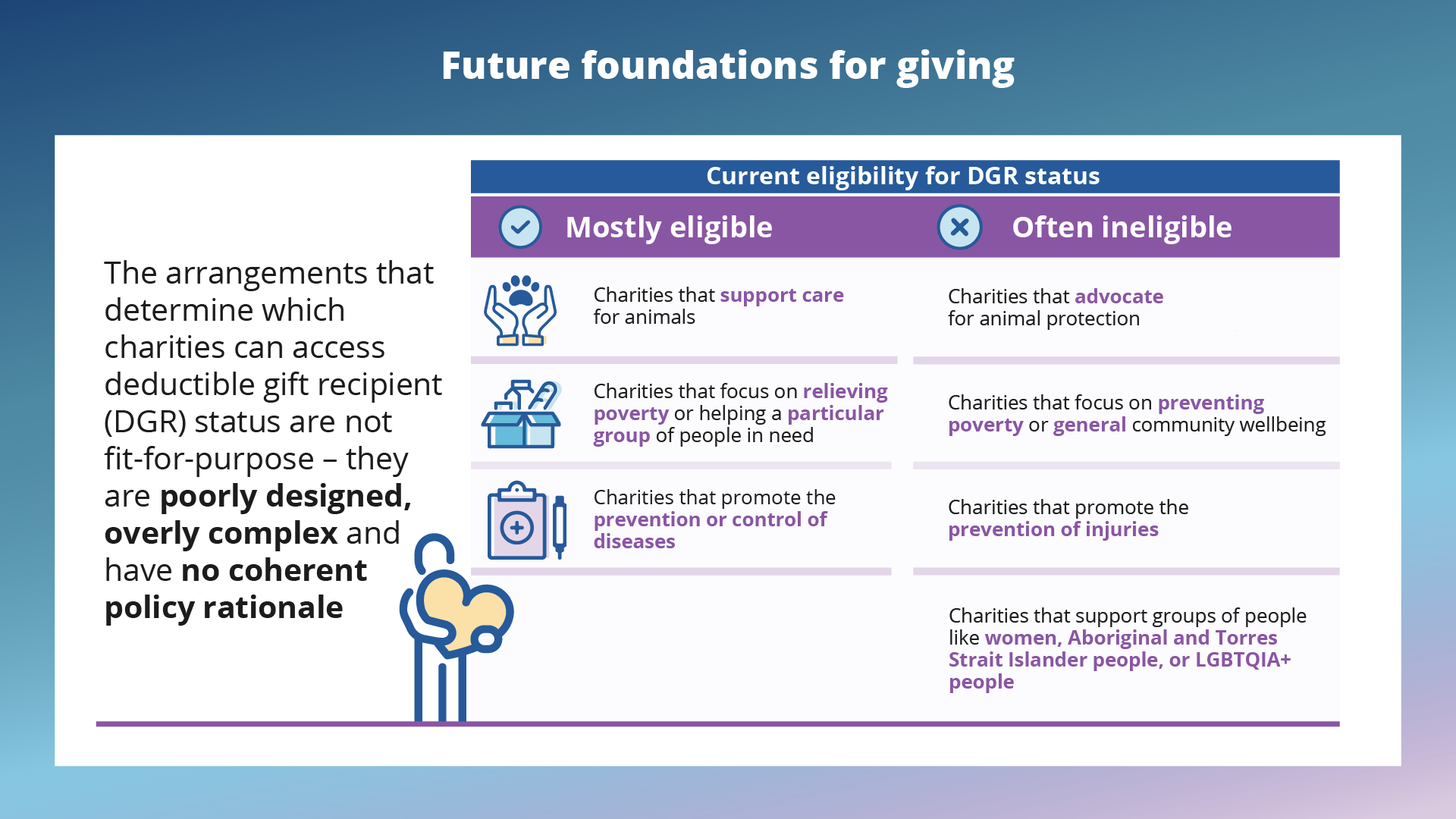

Current eligibility for DGR status

The arrangements that determine which charities can access deductible gift recipient (DGR) status are not fit-for-purpose – they are poorly designed, overly complex and have no coherent policy rationale.

Mostly eligible

- Charities that support care for animals.

- Charities that focus on relieving poverty or helping a particular group of people in need.

- Charities that promote the prevention or control of diseases.

Often ineligible

- Charities that advocate for animal protection.

- Charities that focus on preventing poverty or general community wellbeing.

- Charities that promote the prevention of injuries.

- Charities that support groups of people like women, Aboriginal and Torres Strait Islander people, or LGBTQIA+ people.

A simple, transparent and fair DGR system

We are proposing a principles-based approach to develop a simple, transparent and fair system for determining which charities can receive tax-deductible donations that will refocus donations towards activities that provide the greatest net benefits to the community as a whole.

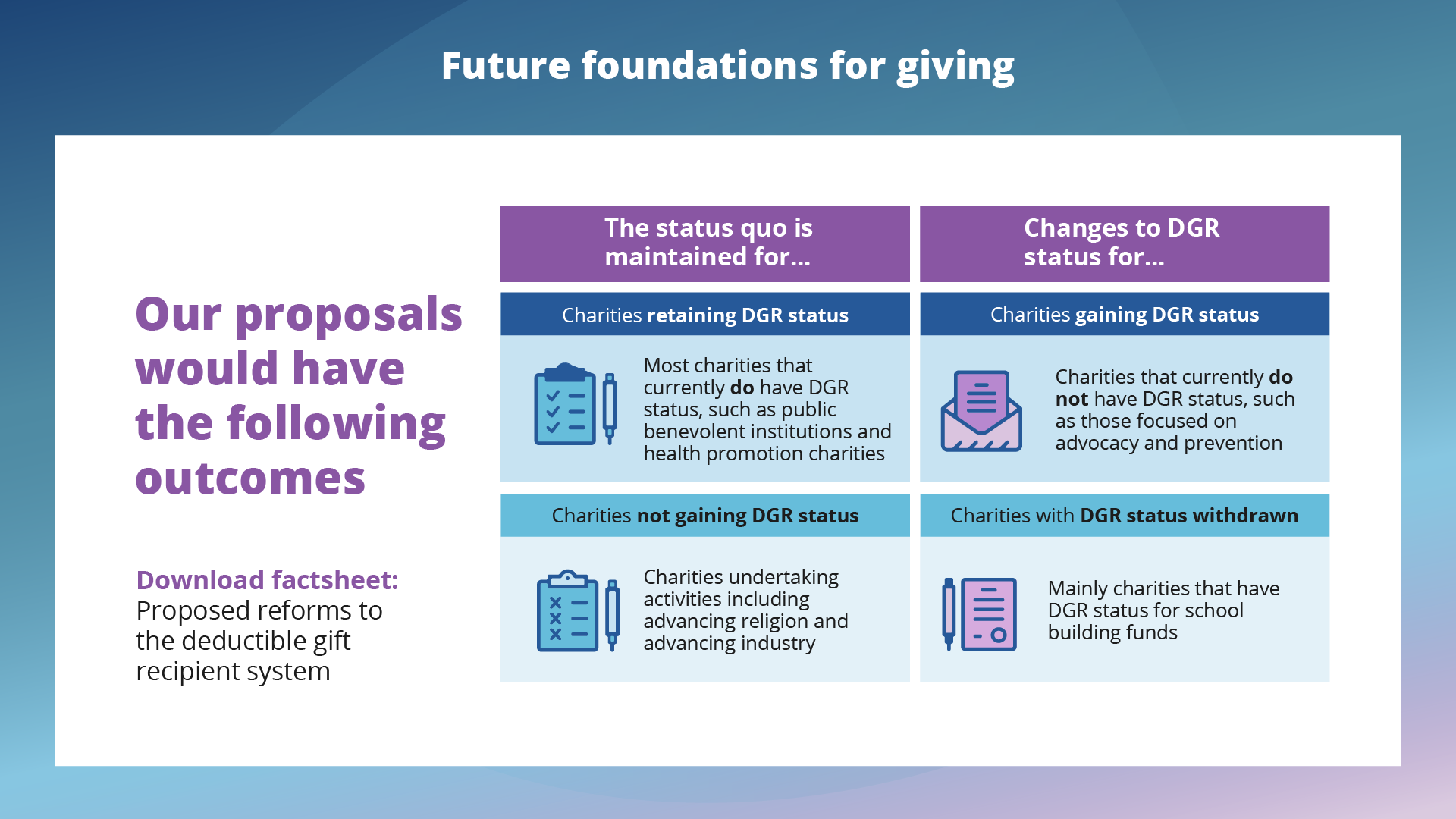

Our proposals would have the following outcomes

The status quo is maintained for ...

Charities retaining DGR status

Most charities that currently do have DGR status, such as public benevolent institutions and health promotion charities.

Charities not gaining DGR status

Charities undertaking activities including advancing religion and advancing industry.

Changes to DGR status for ...

Charities gaining DGR status

Charities that currently do not have DGR status, such as those focused on advocacy and prevention.

Charities with DGR status withdrawn

Mainly charities that have DGR status for school building funds.

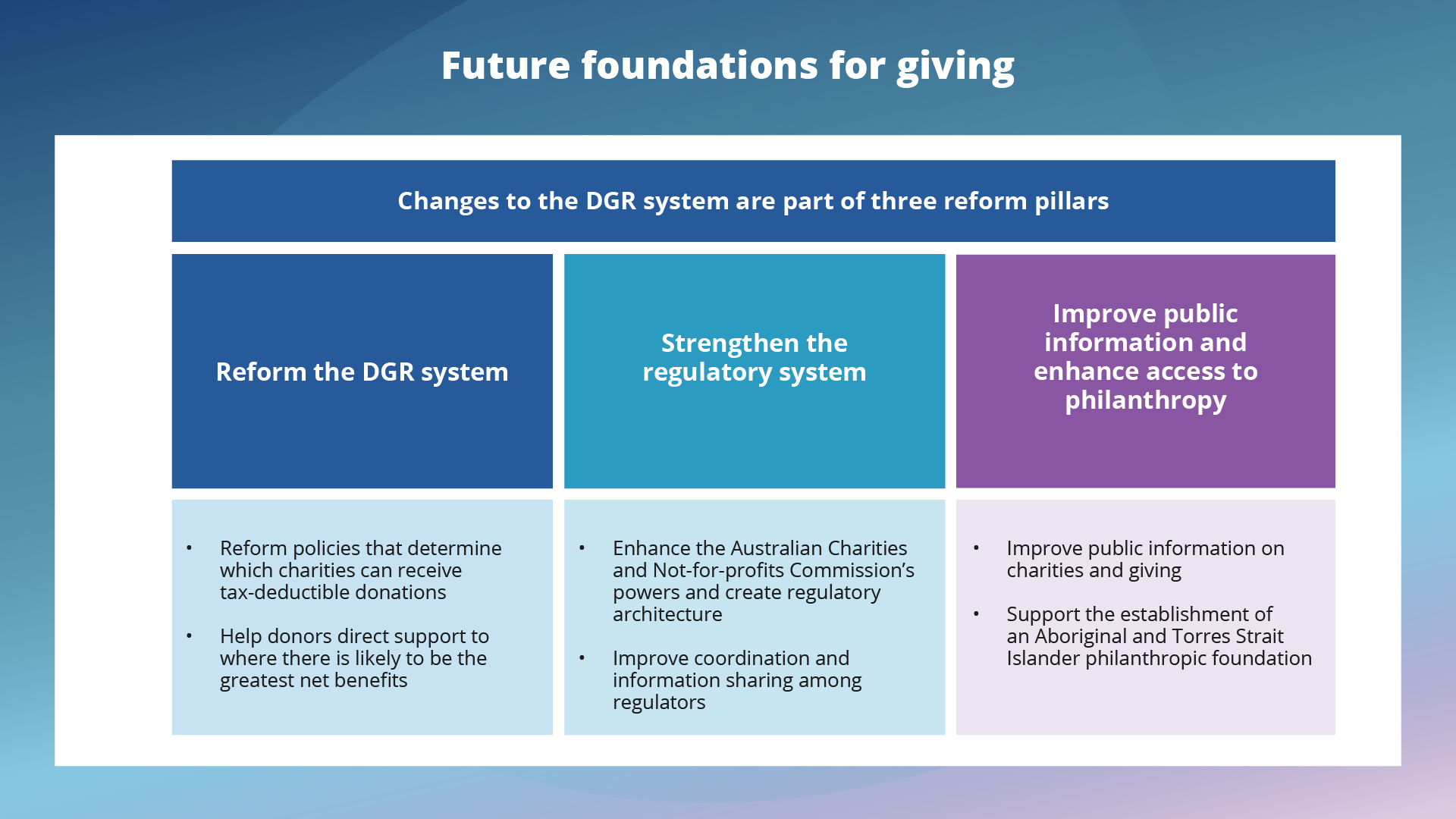

Changes to the DGR system are part of three reform pillars

Reform the DGR system

- Reform policies that determine which charities can receive tax-deductible donations

- Help donors direct support to where there is likely to be the greatest net benefits.

Strengthen the regulatory system

- Enhance the Australian Charities and Not-for-profits Commission’s powers and create regulatory architecture

- Improve coordination and information sharing among regulators.

Improve public information and enhance access

- Improve public information on charities and giving

- Support the establishment of an Aboriginal and Torres Strait Islander philanthropic foundation.

We are also proposing an independent philanthropic foundation led by Aboriginal and Torres Strait Islander people to strengthen their capacity to access philanthropy ...

“The stories and experiences shared with us have shaped a proposal for the establishment of an Aboriginal and Torres Strait Islander philanthropic foundation, to facilitate new partnerships with philanthropy that further the goals and aspirations of Aboriginal and Torres Strait Islander communities.”

Deputy Chair Alex Robson

“Governments should consider how changes to policies and programs affect volunteers. This includes adopting measures that may mitigate any adverse effects on volunteer participation and identifying opportunities for volunteers as part of policy or program design.”

Commissioner Julie Abramson

... And reforms to make information on charities and giving more accessible to donors and the wider public.

“The design of the Australian Charities and Not-for-profits Commission charity register should be shaped by the needs of donors, helping ensure it’s a useful tool for guiding their giving decisions.”

Associate Commissioner Krystian Seibert

- Philanthropy draft factsheet 1: Volunteers (PDF - 244.2 KB)

- Philanthropy draft factsheet 1: Volunteers (Word - 1.4 MB)

- Philanthropy draft factsheet 2: Indigenous people (PDF - 232.4 KB)

- Philanthropy draft factsheet 2: Indigenous people (Word - 1.4 MB)

- Philanthropy draft factsheet 3: DGR (PDF - 311 KB)

- Philanthropy draft factsheet 3: DGR (Word - 1.4 MB)

- Philanthropy draft factsheet 4: Donors (PDF - 244.3 KB)

- Philanthropy draft factsheet 4: Donors (Word - 1.4 MB)

- Philanthropy draft factsheet 5: Charities (PDF - 247.9 KB)

- Philanthropy draft factsheet 5: Charities (Word - 1.4 MB)

- Philanthropy draft factsheet 6: Religious charities (PDF - 256.5 KB)

- Philanthropy draft factsheet 6: Religious charitie (Word - 1.4 MB)

You were invited to make a submission by 9 February 2024.