Remote area tax concessions and payments

Draft report

You were invited to examine the draft report and to make written submissions by 11 October 2019.

Please note: This draft report is for research purposes only. For final outcomes of this study refer to the study report.

Download the overview

Download the draft report

Key Points

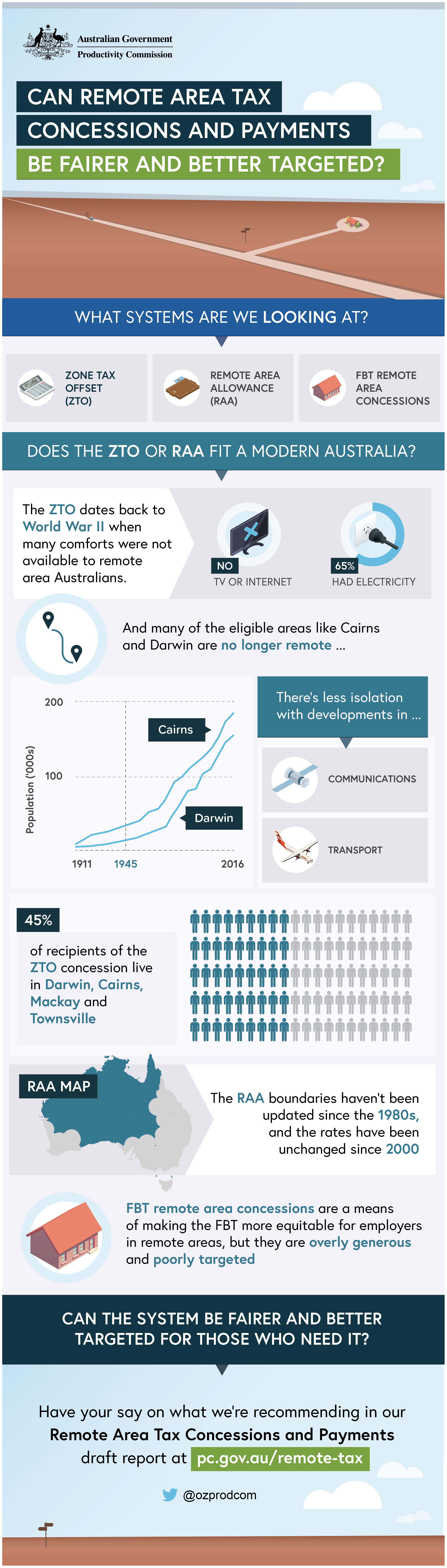

- Remote area tax concessions and payments are outdated, inequitable and poorly designed. They should be rationalised and reconfigured to reflect contemporary Australia.

- Remote Australia has changed considerably since 1945. Many areas once considered isolated are no longer remote, and improvements in technology have helped reduce the hardships of life in remote Australia, although expectations have risen.

- Today, close to half a million Australians live in remote places. The tyranny of distance can make living and doing business challenging. Some things that most Australians take for granted are not readily on hand. Yet many of those in remote Australia hold a strong personal or cultural connection to a place and their community as well as the way of life it offers. Others are attracted by job opportunities.

- The zone tax offset (ZTO), the remote area allowance (RAA), and the fringe benefits tax (FBT) remote area concessions are broadly designed to mitigate some of the inherent challenges, and facilitate development in regional and remote Australia.

- The ZTO is an ineffective and blunt instrument. There is no evidence to suggest that the ZTO currently affects where people choose to live or work. Some areas are no longer isolated, but remain eligible. Were it to be retained, the ZTO would need to be overhauled.

- Reforms to eligibility would still leave the ZTO without a compelling rationale. There is no general role for Government to compensate taxpayers for the disadvantages of life in particular areas. Higher wages in the zones across a wide skill spectrum suggests that the market compensates workers, at least to some extent, for the disadvantages of remote living. For those looking to settle in remote communities, issues of liveability and lifestyle also play an important part, with remote living largely a matter of choice. The ZTO should therefore be abolished.

- The RAA is a supplementary payment directed to people on income support in remote areas. It is a means of partially compensating for higher living costs. The majority of recipients are from areas with socio-economic disadvantage and face barriers to mobility. Being out of the labour market, RAA recipients do not benefit from the wage premiums that apply to ZTO recipients.

- While the RAA has a legitimate role, it needs a refresh — with boundaries updated to contemporary measures of remoteness, payment rates reviewed and transparency enhanced.

- FBT concessions for remote areas have dual objectives: equitable tax treatment where employers have operational reasons to provide goods and services to employees, and regional development.

- The most compelling argument for these concessions is the former. But current concessions are poorly targeted for this purpose. They are overly generous and complex, thereby creating other inequities.

- FBT remote area concessions should be redesigned to be consistent with the fundamental principle of equitable tax treatment while reducing the cost burden on taxpayers.

- Most significantly, concessions on employer-provided housing should change. The current exemption should be reverted to a 50 per cent concession (as it was prior to 2000), and provisions allowing employers to claim housing exemptions solely because it is 'customary' to do so should be removed.

Download the infographic

Download the infographic