Service exports

Draft report

The draft report was released on 12 August 2015. You were invited to examine the report and to make written submissions by 18 September 2015.

The report includes draft recommendations directed at establishing priorities for international negotiations and improving domestic policy settings.

This study has concluded. The final report was released on 7 December 2015.

Please note: This draft report is for research purposes only. For final outcomes of this study refer to the research report.

Download the draft report

- Barriers to Growth in Service Exports - Draft report (PDF - 2588 Kb)

- Barriers to Growth in Service Exports - Draft report (Word/Zip - 1647 Kb)

Additional file

Please note: The following appendix is only available online and is not in the printed copy.

Key Points

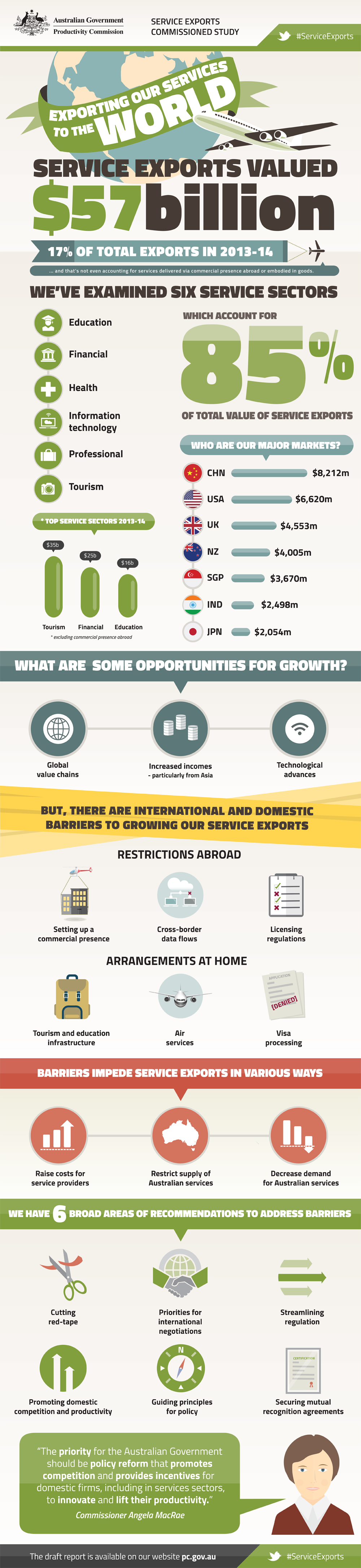

- The total value of Australian service exports was $57 billion in 2013-14 and about 17 per cent of total exports. The six services sectors covered in this study — tourism, education, financial services, professional services, information technology and health services — accounted for around 85 per cent of the total value of service exports.

- The total value of service exports from all sectors has doubled (in real terms) over the past two decades.

- Rising household incomes, particularly in some countries in Asia, have been an important driver of increasing global demand for services. Visitors from Asia account for much of the growth in Australian tourism and education exports over the past decade.

- The costs of exporting services have fallen due, in part, to lower airfares and the development of internet tools including email, online video and audio calls, and electronic payment systems.

- The priority for the Australian Government should be policy reform that promotes competition and provides incentives for domestic firms, including in services sectors, to innovate and lift their productivity. Specific reforms to reduce domestic barriers to service exports include:

- implementing visa processing arrangements for short-term visitors and international students that are no more onerous than is necessary to meet a single policy objective of immigration integrity

- liberalising air services arrangements for the major gateway cities of Brisbane, Melbourne and Perth and, following this, Sydney — unless a published assessment shows the costs of liberalising access to Sydney Kingsford Smith Airport would outweigh the benefits to the community

- simplifying Australia's regime of withholding taxes through greater uniformity in the rate applied to different types of investment and reducing the range of exemptions

- implementing consistent screening thresholds for Foreign Investment Review Board examination of foreign investment proposals across investors from different countries.

- International barriers to services trade can be costly.

- Restrictions on setting up a commercial presence abroad affect the education, health and professional service sectors, but are particularly costly for exports of financial services in key markets in Asia such as China, India and Indonesia.

- Licensing requirements and regulation are used to maintain standards of quality, consumer protection and safety but can impose unnecessary restrictions on services trade, particularly for professional services.

- All services providers seeking to export rely on the ability to move data across borders, making data restrictions costly. The financial services sector can be especially affected by restrictions on data flows, as are exporters who rely on cloud computing services.

- Realising benefits from trade depends on governments committing to further reducing barriers at and behind the border. No one mechanism will be sufficient to address international barriers to services trade.

- Trade agreements can be a precursor to market access, including establishing a commercial presence abroad, but realised benefits may be limited without supplementary measures, such as mutual recognition. The Australian Government can help by putting in place a framework in trade agreements for developing mutual recognition agreements.

- The Australian Government is well-placed to help facilitate cross-border data flows through trade negotiations and other international forums, and as leader of a project on harmonising standards for the movement of data across APEC economies.