Why our Super system needs to be modernised

'Australia’s $2.6 trillion super system has become an unlucky lottery for many Australian workers and their families. The system is working well for many members, but not for all,' Deputy Chair of the Productivity Commission Karen Chester said on release of the Commission’s draft report Superannuation: Assessing Efficiency and Competitiveness.

The Government tasked the Commission to assess the performance of the super system — to determine if it is meeting the needs of members and retirees and providing the best possible investment returns. And the Commission has today delivered a mixed report card. Too many members are getting subpar returns, at a substantial cost to their income and wellbeing in retirement.

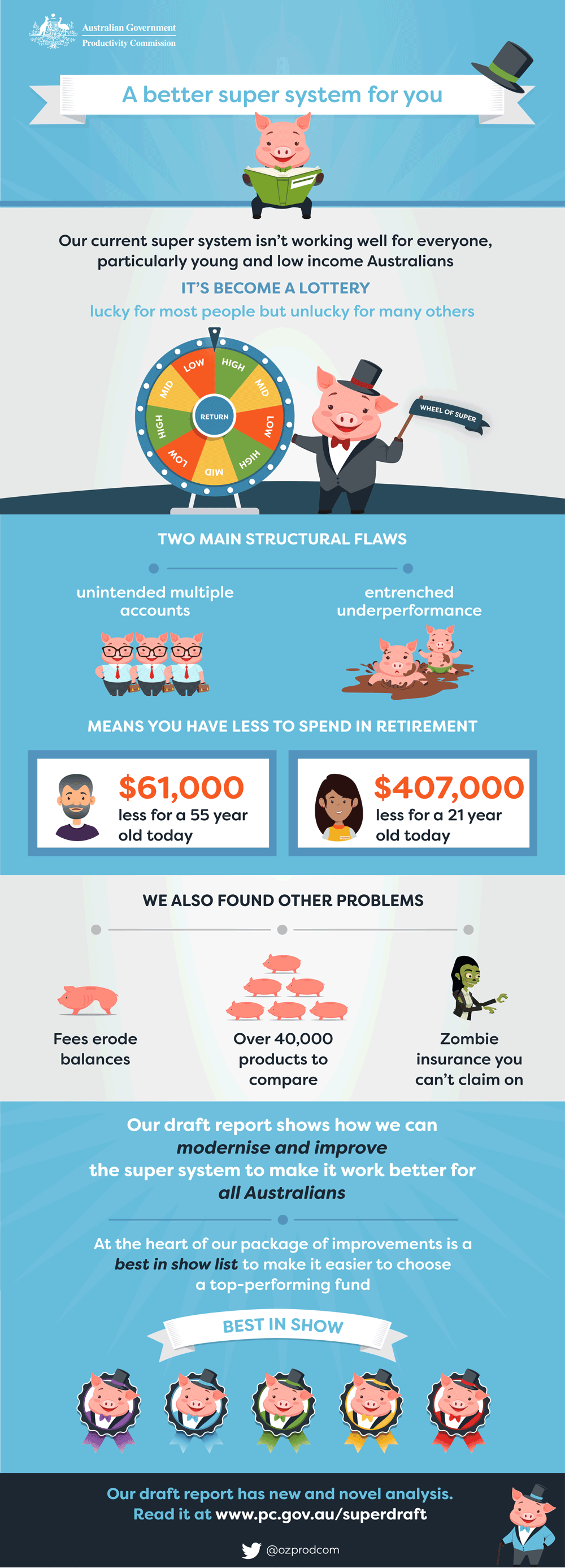

'We have had compulsory super for nearly 30 years, but its architecture is outdated,' Ms Chester said. 'The system suffers from two structural flaws — unintended multiple accounts and entrenched underperformance.'

'With default funds being tied to the employer and not the employee, many members end up with another account every time they change job,' Ms Chester said. A third of accounts (about 10 million) are unintended multiples. The excess fees and insurance premiums paid by members on those accounts amount to $2.6 billion every year.

'These problems are highly regressive in their impact — and they harm young and lower income Australians the most,' Ms Chester said.

Most members are in funds that deliver good investment returns, but millions of members are in funds that persistently underperform — over one in four funds. Over an average member's working life, being stuck in a poor performing default fund can leave them with almost 40 per cent less to spend in retirement.

'Fixing these twin problems of entrenched underperformance and multiple accounts would lift retirement balances for members across the board. Even for a 55 year old today, the difference could be up to $60,000 by the time they retire. And for today’s new workforce entrant, they stand to be $400,000 ahead when they retire in 2064,' Ms Chester said.

'The Commission has proposed a package of changes — focused on delivering for all members — to modernise the system and deliver the best possible returns and products,' said Commissioner Angela MacRae.

Foremost, members should only be defaulted once, when they start working for the first time. The Commission is proposing that they should get to choose from a ‘best in show’ list of high performing funds that have been identified by an independent and expert panel. And existing members should be able to readily switch to these funds.

'All members should be able to engage with their super without being bamboozled. Members today face a confusing proliferation of products, some 40 000 options, and information they don’t understand. It’s hardly surprising that many end up in a bad product,' Ms MacRae said. 'Super needs to be simpler and safer for all Australians.'

Part of the problem is that products are most complex during accumulation and most simple in retirement. 'But what we found is that the reverse is needed for most members,' Ms MacRae said. 'No two retirees are the same, so members need good guidance and advice to navigate retirement. But impartial and affordable advice is hard to find.'

Super funds need to do more to provide insurance that is value for money for all members. 'While many members are getting affordable life insurance through their super, some end up with cover that is manifestly unsuitable, including ‘zombie’ insurance policies they can’t even claim on. And many unknowingly have duplicate insurance policies, which can erode their super balances at retirement by over $50,000,' Ms MacRae said.

'And, as in other parts of the financial system, governance needs to improve — trustees of underperforming funds should be merging with better performing funds. And the best people with the right skills must sit on the boards of super funds,' Ms MacRae said.

'To date, most interest in this inquiry has come from the funds themselves. So we are asking all Australians with super (especially young members) to tell us what they think about our ideas and how to make the super system work better for them,' Ms MacRae said. Click on the draft report at www.pc.gov.au and use the brief comments link.

Formal submissions on all aspects of the draft are also welcome.