Productivity priorities post-pandemic

Speech

Chair Michael Brennan delivered a speech via a CEDA Interactive livestream on 8 June 2021.

Download the speech

Read the speech

Economic growth has arguably become more important today than it has been for some time. It has become more important to our long-term fiscal sustainability and our ability to afford high quality services.

If we want to avoid the scarring effect of unemployment on young people, or the discouragement of our finite band of small business owners and risk takers, then growth is essential.

We start from a better position than most. Last week’s national accounts data confirm that GDP has returned to its pre-pandemic levels.

Employment returned to pre-pandemic levels in roughly a quarter of the time it took to do so following the 1990s recession. The participation rate is at a record high.

The lockdown in Melbourne is a sobering check on triumphalism, but it is notable that twice now in the last 12 years, Australia has dealt with a global economic crisis better than almost any other economy in the developed world.

It is not hubris to objectively acknowledge that we went into those crises having gotten some big things right.

Those big things include strong fiscal buffers, a reasonably flexible labour market, openness to trade, well capitalised banks, independent monetary policy, credible public sector institutions and a targeted, but redistributive tax-transfer system.

Those are among the key planks of Australia’s economic policy framework, much of which was developed and bedded down over the last forty years.

A key lesson from COVID and a message for today is that that framework is not broken.

The worst possible response to the pandemic and the recession would be to dismantle, or walk away from, the very policy architecture that has supported our relative success thus far.

That isn’t to say that there isn’t more to be done, or that the next wave of reform should look exactly like the reforms of the past.

Just as we should be objective about our successes, we need to start with an honest appraisal of the productivity growth challenge.

First, productivity growth has slowed across all developed economies in recent decades, leading to subdued growth in living standards.

In Australia, the decade since 2010 – even excluding last year – has seen our slowest growth in GDP per capita of any decade in at least 60 years.

France, Germany, the UK and the US have all seen labour productivity growth more than halve in the period 2006-17, compared with the ten years from 1996 to 2005.

Second, the causes of that slowdown are much debated, but without a clear consensus.

Economists have pointed to mismeasurement issues, a shift towards lower productivity industries, population ageing, a slowdown in the pace of technological discovery, a slowdown in the pace of technological diffusion, a plateauing of improvements in human capital, reduced rates of firm entry and exit, increased concentration and market power, lower capital investment, a shift to intangible capital and the slowing of growth in global trade.

Perhaps the closest we could get to consensus would be the view that there is no clear individual cause, which if addressed would singly reverse the trend.

Hence, productivity policy is not a mechanical process, where specific policy levers make known, quantifiable contributions to growth rates.

It is more a mindset than a recipe, and it involves having policy settings that at least stack the odds in your favour.

In broad terms, that comes through fostering flexibility so that labour and capital can move easily across industries and firms, by having even-handed policy settings that avoid locking in an inefficient or just a rigid allocation of resources, having strong credible public institutions to set the rules of the game and deliver public goods efficiently, creating the right incentives for innovation and risk taking and boosting the capability of the workforce through general education and targeted skill formation as well as physical and mental health.

But because the future path of innovation is unknown, we can’t easily know which existing rigidities will hold us back.

Often it will be about detail.

This week I am talking with the nation’s Treasurers (state and Federal) about:

- Innovations in health care which are already improving the management of chronic disease in cost effective and patient-centred ways.

- Our work on resources regulation identified good practices that individual regulators have adopted to deliver better and more timely decisions with more clarity for investors.

- Our work on planning has identified steps we could take to make zoning regulations more flexible and more agnostic about the location of economic activity.

- Our work on reg tech has focused on instances where digital technology can cut compliance costs for business, inform more targeted enforcement by regulators and generate data which can often then be a public good.

- Our work on skills has emphasised the importance of choice and efforts to lift quality, and to focus the system more on lifelong learning as well as the initial acquisition of formal qualifications.

One overarching observation about these efforts is that they all contribute to aggregate productivity growth, but to be enacted they have to make sense to people in their own right.

Reforms are usually best sold on their concrete particulars – how changes can improve everyday life for individuals, businesses and communities.

Productivity growth is ultimately about living standards, broadly conceived. In other words, better outcomes at lower overall cost to the community.

At the Productivity Commission, part of our job is to make specific recommendations to government for their consideration.

But governments have a lot on their plate, especially now. And they operate within constraints. One of which is the nature, direction and quality of the public debate.

We (all of us) have a role in influencing that debate.

Rather than exhorting government to do more, we could ask ourselves the question:

- Is our public debate on economic policy helping to foster a pro-productivity, pro-flexibility mindset?

- More modestly, is it even setting us up to avoid bad policy? To do no harm?

When I look at the current debate – with contributions from economists, policy commentators, business and community leaders – I see two dark clouds on the horizon.

The first is the renewed promotion of ideas of national self-sufficiency and sovereign capability coming out of the pandemic. This is not a new phenomenon, but it has found new voice.

The second is an overly sanguine view about ever-expanding debt and deficit as an ongoing approach to fiscal policy – effectively that government can and should go yet further with fiscal expansion in more normal economic times at no effective cost.

If you are in either of those camps, my advice is: be careful what you wish for.

On self-sufficiency, two high level points:

- Australia’s experience with the protection of domestic manufacturing – roughly an 80-year experiment – was not an overly happy one.

- And in the last two economic crises, including today, trade has been a big part of Australia’s recovery.

It is true that individual firms are taking their supply chains more seriously in light of COVID, as ‘just in time’ gives way to ‘just in case’ in some instances.

It is also true that global trade has flatlined since the GFC and support for multilateral trade liberalisation is at a low ebb, though this pre-dated the pandemic.

And it is arguable that trade and foreign investment policy for Australia are more complex than they were thirty years ago.

But it is also true that the death of free trade is much exaggerated, and the push to encourage domestic production as a policy priority is likely to undermine growth.

Our work on vulnerable supply chains shows that the proportion of our imports which come from a concentrated source, for which there are few substitutes and which flow into essential industries, is low. About 2 per cent of imported goods fit this description.

Even in many of those cases, domestic production would be a prohibitively costly option, compared with some stockpiling or measures to diversify sources of supply.

Similarly, whilst some might think we are highly dependent on a small number of export markets, in fact our levels of export concentration (by country and by product) are similar to those of our peers.

And in the height of the pandemic, while some shortages were met through domestic manufacturing (like gin makers shifting to hand sanitiser) mostly we dealt with emerging needs – like for PPE – through trade. And it worked.

As the OECD pointed out in February, global access to COVID vaccines relies critically on trade – as they require inputs from multiple different source countries.

Trade – rather than self-sufficiency – is the only feasible way to deal with these interdependencies.

That is not to say vulnerabilities will never arise, and that policy should not respond.

But as always it should be determined on the evidence and the particulars of the case, rather than a general claim that we can no longer rely on trade and have to make things here.

We can’t make everything here, but we could certainly make ourselves poorer in the attempt.

Our first best policy is to keep up our international efforts to strengthen the global trading system – to update its rules and shore up the dispute resolution process.

My second dark cloud concerns the fiscal debate.

The right sort of fiscal debate is one that brings together insights from both macroeconomics and microeconomics (which I will term the ‘supply side’ view) because the fiscal response to date has had elements of both.

I have no argument with the current Federal fiscal stance. Active fiscal policy was necessary in the recession and it remains important in the early stages of recovery.

In the pandemic, the fiscal response was not really a conventional Keynesian stimulus, because it wasn’t trying to boost activity in a period of weak demand.

Rather it provided income to those most affected by supply side restrictions, akin to a form of ex post collective insurance. It provided some protection against what amounted to uninsurable risks, the costs of which were concentrated on particular firms, households and sectors.

The fiscal response helped to smooth that cost across the community and through time – a more efficient form of insurance than would have been possible in private markets.

As restrictions have lifted and the economy recovers, the fiscal response has looked more conventionally Keynesian – boosting aggregate demand to stimulate confidence and activity. At the same time, there has been a focus on removing the rigidities associated with policies like Jobkeeper, to allow some reallocation of resources across the economy.

The duration of that stimulus is a matter for macroeconomic judgment.

Ultimately, the Government’s policy is to return to a stable debt to GDP ratio once the recession is behind us and we are closer to full employment.

The prudence of that approach is supported by the likelihood that bond yields will remain below nominal growth rates.

This means that the debt to GDP ratio will gradually decline. Alternatively, we can afford to run small deficits in the future, and still maintain a steady debt to GDP ratio.

The risk in the public debate is that this insight – that GDP growth tends to exceed interest rates – is taken to imply something altogether different and much bigger: that debt and deficit no longer matter at all…

…that we can afford the next and the next ‘one-off’ rise in debt on the grounds that growth rates will continue to outpace bond yields – noting that in other developed economies, the very same observation is being used to justify debt to GDP ratios more than twice as high as ours.

In the economists’ language, the view that growth rates will outpace interest rates provides some comfort about the sustainability of existing steady state debt levels, but it gives no guidance as to which steady state debt level we should choose.

In choosing a debt level, there is both a macroeconomic and a microeconomic case for caution.

The macro case is, first, that we need to rebuild fiscal buffers for the next emergency.

Second, that if inflation did re-emerge, or if bond yields exceeded nominal growth for a period (not impossible for a resource exporter like Australia) then, by implication, we would need a fiscal consolidation.

Successful fiscal consolidations in history are rare. They are not often popular. And they would likely be even less popular in a period of rising inflation or falling terms of trade or slow real growth or rising interest rates: but those are the very circumstances in which our currently favourable debt dynamics would reverse.

The reason fiscal consolidation is hard in practice comes down to incentives:

- spending proposals tend to look attractive individually but add up to an unattractive and unaffordable total; and

- future taxpayers are under-represented by today’s voters.

Then there is a microeconomic case for caution.

This is based on the observation that fiscal choices come back to the use of real resources in the economy. And there are some limits on the extent to which real resources can actually be borrowed from the future. One way this happens in practice is through a decrease in capital accumulation.

The real cost of government spending is measured in the labour, capital and materials used that would otherwise be employed elsewhere, such as in pursuit of some private entrepreneurial aim —innovation or investment.

That sense of scarcity can seem less evident during a conventional demand-side recession, or when inflation is low.

But as we move along the path of recovery – even in an economy operating at less than its potential – it is a mistake to think that government spending has no opportunity cost.

Resources have an alternative use, with an alternative value to society – a value which might even be higher than that which a government program produces. Obviously, this is particularly true if government spending is not universally of high quality.

An infrastructure project that doesn’t pass a cost benefit analysis, or a funding model that rigidly locks in an existing business model, or an industry program that diverts resources into a favoured sector, can all act to reduce growth and wellbeing.

In other words, in addition to observing aggregate fiscal rules, governments have to ensure that their interventions (backed by coercive powers like taxation) are consistent with allocating scarce resources to their highest value.

Often as microeconomists we look at prices and observed behaviours (‘revealed preference’) to provide clues as to where that value lies.

For example, in the Commission’s recent Mental Health report, we tried to calculate the cost-effectiveness of various policies and programs by looking at the improvement in ‘quality adjusted life years’ which they bring about – to try and compare alternative programs and prioritise them according to their ‘bang for buck’.

For the same reason, it is important to undertake cost benefit analysis of infrastructure projects, and rigorous evaluations for social programs.

And also to try and include a clear sense of the efficiency loss from taxation where new spending is involved.

It is important to apply similar rigour to choices about consumption through time (i.e. today vs. the future).

The simple story of debt dynamics (growth rates greater than bond yields) is incomplete if not grounded in some sense of well-being through time (or utility as economists refer to it) – that is, the trade-offs between consumption today and consumption in future years or by future generations.

Some might see a long-term reduction in interest rates as indicating a good time to borrow – and this logic fits well for a household or a business.

But a government, trying to manage the scarce resources of the economy as a whole, might want to understand why real interest rates are actually lower and what that means for its resource allocation decisions.

Could it be, for example, that lower real interest rates reflect some shift in societal preferences in favour of the future?

If so, then when it comes to project assessment, this might boost the case for capital investment: at a lower ‘discount rate’ we might find it more attractive to sacrifice consumption today, to invest for a future pay-off.

It does not necessarily follow that at the same time we should (or can) bring forward significant consumption by borrowing heavily from the future, even if bond markets make that look feasible and attractive.

These are complex considerations, so the approach to inter-temporal choice and inter-generational equity needs to be thought through carefully. In the face of uncertainty about future growth the case for a precautionary principle is even stronger.

The imposition of fiscal limits, as per current stated policy and the budget’s medium-term projections, fits with such an approach. The view that debt and deficit no longer matter does not.

To return to my earlier theme, luckily for Australia, our fiscal frameworks and adherence to budgetary rules has served us well.

They have been backed by a public consensus around fiscal restraint. That consensus has been a significant intangible asset for Australia over the last few decades.

If that public consensus fragments, or is undermined by ‘expert’ opinion, then gross debt is unlikely to stabilise at 51 per cent of GDP.

So the public debate is important in shaping future policy for good or ill.

We should have an open debate about our productivity challenge; but it should include an honest appraisal of the things we had right before the pandemic and from which any departure would come at great cost to current and future generations.

Hugh Stretton Oration

Chair Danielle Wood delivered the 2024 Hugh Stretton Oration at the University of Adelaide.

Download the oration

Read the oration

I would also like to begin by recognising the Kaurna people as the traditional owners of the land on which we meet today. I acknowledge their deep connection to this place and pay my respects to their elders, past and present and to any Aboriginal or Torres Strait Islander people with us this evening.

Thank you everyone for being here. It is very special for me to be back at the University of Adelaide, the place where I experienced the heady years of my undergraduate Economics degree. Lots of long afternoons in the Reading Room of the Barr Smith library, the occasional equally long one at the Uni Bar (RIP), but an incredible spirit of learning, thinking and debate that was so foundational for me.

A huge thank you to the Provost, Professor John Williams AM, Deputy Vice-Chancellor and Vice-President (Academic) Professor Jennie Shaw and Professor Adam Graycar for having me back. I am honoured to have the Governor Her Excellency the Honourable Frances Adamson in attendance, as well as the University Chancellor, the Honourable Catherine Branson AC KC.

There are also a couple of other very special guests in the audience, my parents Rae and Simon Wood, who are hearing me speak for the first time in a professional setting this evening. And I am grateful that after listening to my almost constant talking from the age of two, they are still willing to come back for more.

Hugh Stretton’s legacy

It is also a huge privilege to have the opportunity to honour the professional contribution of Professor Hugh Stretton AC. Professor Stretton’s incredible intellect and impressive CV has been well detailed by the Vice Chancellor.

Three things stood out to me in reading about his professional life.

The first was his intellectual energy and imagination. I particularly enjoyed the reference provided by one of his former supervisors on his application to lead the School of History:

The first impression is of extremely high intelligence. He uses his gifts quietly, however, and is given as much to listening as to talking... He is quite clearly an exact and energetic scholar, though … I am not at all confident that he will publish either quickly or much. I have no doubt that he would build a School of History soundly and with imagination. 1

Now today, any mention of a relaxed approach to publication might be an automatic disqualifier, but the referee was right about Stretton’s suitability to successfully lead the department.

By the end of his tenure as chair in 1966 the School of History had gained a reputation as one of the best of its kind in Australia. 2 And much of this was down to Stretton’s reputation as a formidable thinker and public intellectual. 3 Ultimately in academia, and in life, the spirit of curiosity counts for much.

The second was Professor Stretton’s gift for turning new ideas into policy practice.

His most famous work, a book on urban planning called Ideas for Australian Cities, was so influential that when applicants were interviewed for positions in the Whitlam government’s Department of Urban Development, the first question was: ‘What do you think of Stretton?’. 4

While becoming the opener for a public service interview is a bar not many of us will reach, that spirit of marrying rigorous evidence with real world policy implications is one that I know that many of us strive for in our work.

And the third and perhaps most notable thing was Stretton’s unwavering belief in fairness and opportunity for all. He believed public thinkers have a responsibility to look for chances to make a difference, to reduce disadvantage and make Australia a place where anyone can prosper.

As he once said: “We should be doing all we can, by old and new means that fit our changing historical conditions, to leave Australia fairer than we found it”. 5

Tonight I hope to give you some ideas about how we take up Stretton’s challenge.

I’m going to take you through what we know about inequality in Australia today.

Using new analysis released this week by the Productivity Commission, I’ll show you the distribution of wealth and income in Australia and how it’s changed over time.

I also want to give you a sneak peek of some research we haven’t yet published on intergenerational mobility. This goes to the important question: how much does who your parents are, go on to influence your life outcomes?

To finish, I’m going to give you a ‘fair go toolbox’ – a set of policy allen keys that can fit the inequality problem at hand.

A few disclaimers...

But first let me start with a few disclaimers, and as I’m an economist rather than a lawyer I’m going to put these right upfront rather than buried in size 6 font in a footnote.

1. Economic inequality is a surprisingly slippery construct

‘The rich are different to you and me’, writer F Scott Fitzgerald once claimed. ‘Yes’, said Hemmingway, ‘they have more money’.

At one level inequality is that simple: some people have more money than others.

But as I will come to, economic inequality measures can vary a lot depending on what we are measuring – do we care about income, consumption or wealth?

And there can be a range of worthwhile questions to ask:

- How are those doing it toughest faring?

- How much do the most well off – say the top 10% or 1% – have compared to others?

- Or how are resources distributed across the population as a whole?

Each can give us different insights.

And that’s before we even get to the question of how opportunities and outcomes change over a person’s lifetime, or vary by gender, age or for First Nations Australians.

So, to manage this complexity, tonight I’m going with the maximalists – or perhaps the Strettonist – approach. I will take you through a range of indicators and cuts of the data to give you a broad account of the state of play. But I also want to talk about what this actually looks like in people’s lives.

As Stretton said:

“I’m not sure that much valuable reform has sprung from high theory about the dynamics of distribution. More has come from ...competent accounting, summarising and insistent publication of the patterns of inequality… and the effects of those distributions on the quality of people’s experience in life.” 6

2. Be a sceptic

It is somewhat uncomfortable to say this as the leader of the organisation that prides itself on evidence-based, often data-driven, analysis. But in almost all data analysis we deal with imperfect data and are forced to make choices about how to address that.

In inequality research those choices can make a big difference to the story.

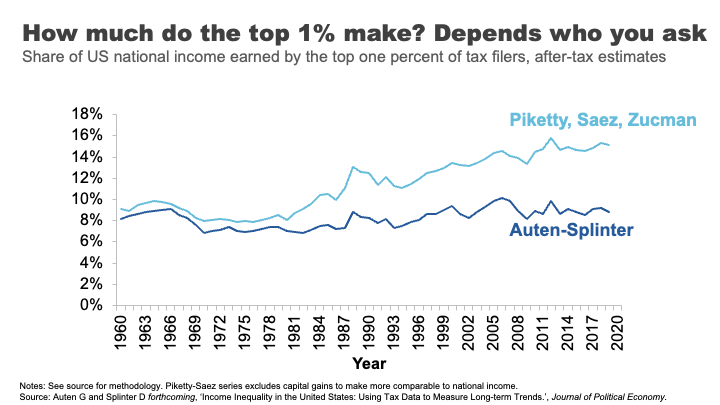

Very recently this challenge has jumped off the pages of academic journals and on to the front page of the Washington Post with the so called ‘inequality wars’.

On one side of the war you have famous inequality researchers, Thomas Piketty and Emmanuel Saez.

They have spent the better part of two decades analysing inequality, including by using American tax data to document a significant and growing share of US incomes flowing to the top 1%.

It’s rare to get rock star economists, but these guys are it.

(As an aside if you purchased but did not finish Piketty’s hefty Capital in the 21st Century back at the height of Pikettymania in 2011 you are not alone, on some measures it is the second most unfinished book on Kindle, after Hilary Clinton’s autobiography...). 7

On the other side of the war sit Gerald Auten and David Splinter – their names might not ring any bells.

These two relatively unknown tax code nerds come from the US Treasury Department and Congress Joint Committee on Taxation.

Using the same tax data as Piketty and Saez, they come up with the opposite conclusion: after tax, the share of US income going to the 1 % has barely moved since the 1960s.

Cue much triumph from some commentators and members of the press.

But beyond the simplistic discussions of Piketty and Saez being proved ‘wrong’ was the more nuanced truth – both sets of researchers had made a series of judgments around issues like how to estimate ‘missing money’ not included in tax returns, and how to attribute spending on health, education or defence across the population.

The appropriateness of each of these judgements is now the subject of further debate, but what is clear is that what might seem like technical judgments can sometimes have a big effect on conclusions.

In all the analysis I present tonight we’ve tried to be as robust and open as we can about any judgments made. But I encourage you to keep your sceptics hat on.

3. There will be graphs

I’m an economist, there will be lot of graphs this evening. But I’ll do my best to ‘use my words’ and hopefully we can avoid data overload.

Income inequality in Australia

Ok, let’s start with talking about the broad distribution of income in Australia.

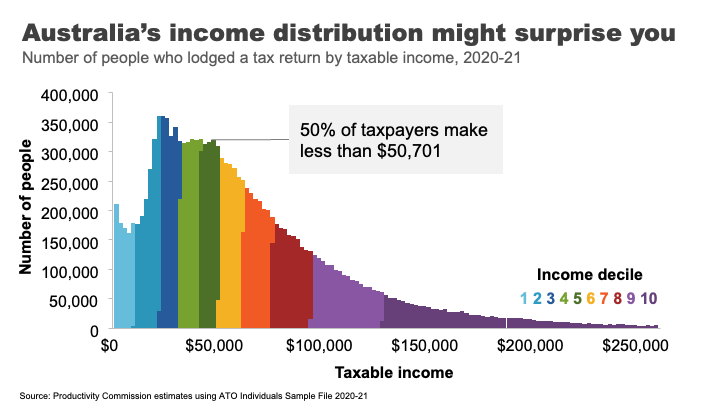

I know it’s not always au fait to talk about what you earn in public, so I’ll ask you to do this exercise in your heads. I want you to think about whether you consider yourself to be a low-income earner, a middle-income earner, or a high-income earner.

Let’s see how you went.

Here’s the distribution of Australian taxable income. That is, the income before tax but after you’ve made any allowable deductions.

If your taxable income is over about $51,000, you earn more than 50% of Australians who lodge a tax return. If you earn more than $95,000, that puts you in the top 20%. If you earn $336,000 or above – you are the 1%.

A surprising number of people get this wrong. In fact, the vast majority of us consider ourselves to be ‘middle income earners’. 8 This is probably because the people we tend to live near and associate with are more likely to be in a similar tax bracket to us.

This is presumably why every year or so high earners from the media and political class kick off passionate debates about whether $200,000 is really a high income 9 – while, I suspect, the 97 % of Australians earning less than that amount just roll their eyes.

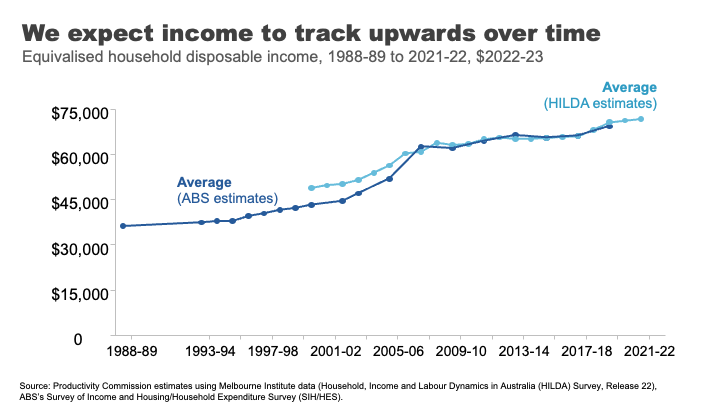

If we move to looking at using disposable income – that is income after tax and transfers – for an average Australian household, we can see that incomes have risen over time.

This is generally what we have come to expect, that outside of short dips during major economic shocks, income growth will continue its long march upwards over time.

And how has this growth been distributed?

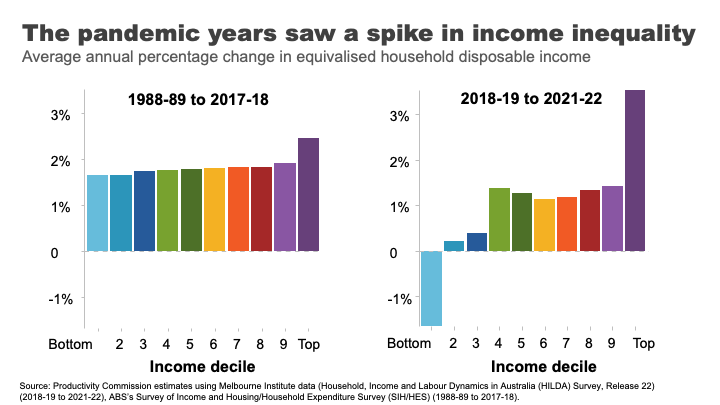

The answer is relatively equally across the population in recent decades.

Indeed, in the 30 years between 1989 and 2019, income grew pretty consistently across the income distribution. Those in the top 10% experienced slightly higher growth than other groups, but nothing like the strong growth in income inequality seen in the US that dominates much of our inequality discourse.

In contrast, the COVID period and its aftermath has seen greater dispersion with incomes at the top growing rapidly and those at the bottom going backwards.

The reasons are complicated, but reflect the roller coaster ride of lockdowns and recession, increases and withdrawals of government supports, and the healthy bounce back and high inflation that followed.

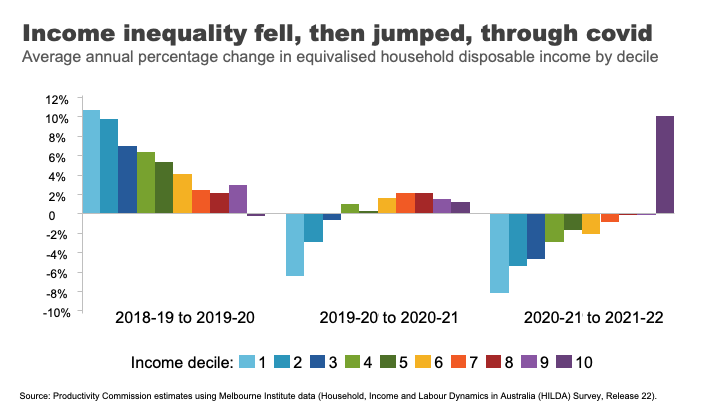

As you can see, the three years of the COVID period actually reflect three quite different inequality dynamics.

At the start of the COVID 19 pandemic, government-imposed lockdowns caused drastic declines in economic activity and widespread job losses. 10 In response, the Australian Government provided substantial support, which cushioned the economic harm across the community.

The effective doubling of the JobSeeker payment, and the flat $1500 per fortnight JobKeeper payment for workers in eligible businesses 11 produced high income growth for those at the bottom and middle of the income distribution.

As the economy re-opened, supports were withdrawn, those gains were reversed.

And despite the strong economy and labour market, high inflation meant real wages went backwards for most workers over the past two years.

In contrast, high income households benefited from rip-roaring growth in business income as well as decent investment income, as the economy recovered.

Overall, and barring any further major shocks, we can probably expect the next few years will bring a return to a more ‘normal’ income growth and certainly to the more consistent patterns seen across the distribution observed in the pre-COVID era.

It is also interesting to reflect on how we compare to other nations.

Egalitarianism is tied up with Australian identity. We are the land of the ‘fair go’, a place where your taxi driver, your boss, and even the Prime Minister can all be safely referred to as your ‘mate’.

But does the reality match the mythology?

Not entirely.

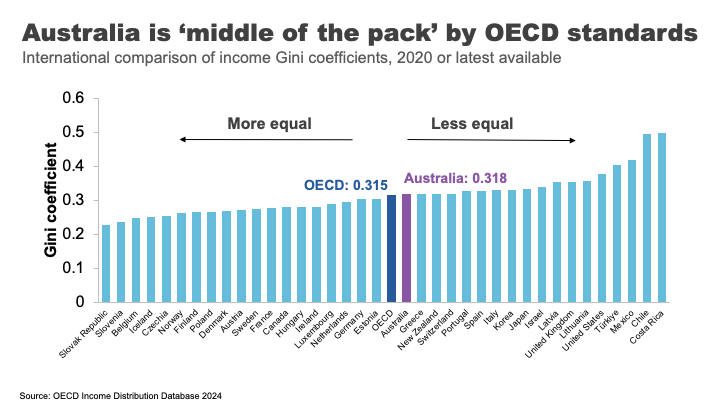

Australia’s income inequality is ‘middle of the pack’ by rich-country standards. Comparing based on the Gini coefficient – a measure of overall inequality – Australia is close the OECD average.

Overall, we not as unequal as our friends in the US and the UK, but nor are we as egalitarian as the Nordic countries.

One important reason for these large cross-country differences is differences in tax and transfer policies.

For example, the US starts relatively unequal, but by no means the most. But because they redistribute income less, they end up the most unequal of Western nations. 12 In contrast, Finland has close to US-levels of inequality before taxes and transfers. After, it is one of the most equal nations in the OECD. 13

These are important differences that highlight a point I want to come back to: policy choices matter to inequality.

But now we have a snapshot of how Australians across the distribution have fared over time and relative to elsewhere, I want to turn to another important part of the inequality story: outcomes and opportunities for the most disadvantaged.

Poverty in a rich country

It’s almost 40 years since Bob Hawke declared that no child would live in poverty by 1990. 14

But, according to ACOSS, one in eight people lived below the poverty line in 2019-20, including one in six children. 15

This measure of poverty looks at relative income poverty – it’s set at 50 % of the typical Australian household disposable income, less housing costs.

Some argue it is better to look at absolute measures (for example, the amount of money required to be sure a household can achieve a basic standard of living) or indicators of material deprivation.

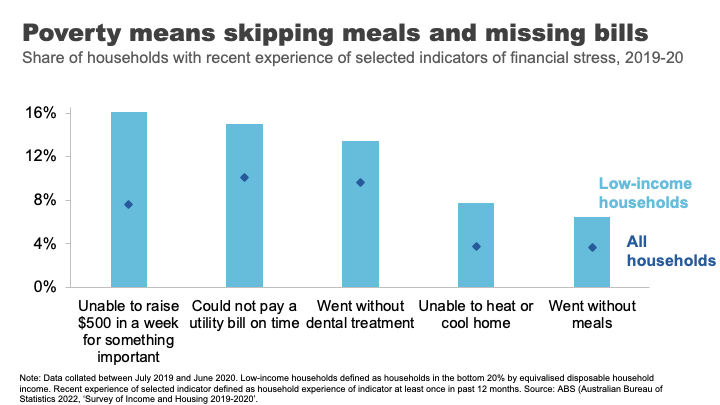

For example, amongst low-income households in 2019-20, 16% were unable to raise $500 for something important, 8% were unable to heat their homes, and 7% went without meals. 16

And it’s that sense of precariousness that pushes the impacts of poverty from the material to the mental. And those impacts can have a long tail.

As journalist Rick Morton writes about his own childhood growing up in a poor household: 17

I saw Mum’s daily, sometimes hourly, battles to stay solvent. I saw how hard she worked and what it did to her body and her mind. The stress of even thinking of it now is difficult to explain. It is built not only into my own mind but also in my flesh. The things I will do to avoid the feeling today. The things I try to do for Mum to make it so she never has to feel it again.

The biggest risk factors for poverty are: being on JobSeeker or Parenting Payment. 18

Policy and poverty remain inextricably linked.

Wealth inequality in Australia

Of course economic differences are not just found in incomes. Wealth or how much money you have ‘behind you’ is an important determinant of outcomes too. Wealth is a buffer – it can be converted into future consumption opportunities and provides a sense of financial security.

That is why we understand the pensioner who owns their home and has $250,000 in the bank is in a materially different economic position to the single part-time worker who records a similar $30,000 income but has few assets.

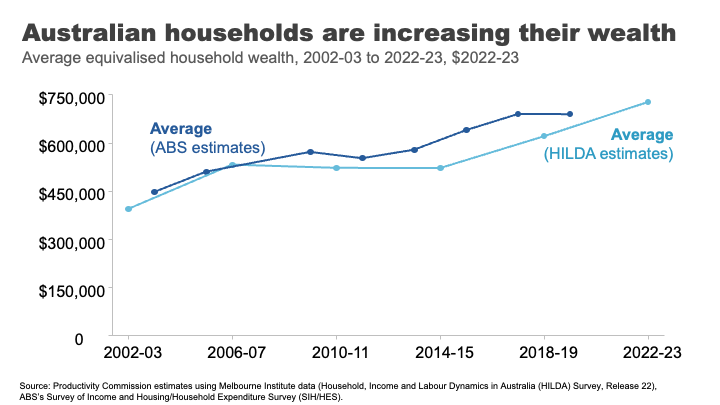

Wealth has grown significantly in Australia in recent decades.

I remember in primary school the shorthand for someone really, really, rich was a ‘millionaire.’ The average Australian household is now more than halfway to that benchmark. Indeed, a person that owns a typical house outright in Clarence Gardens is a ‘millionaire’. 19

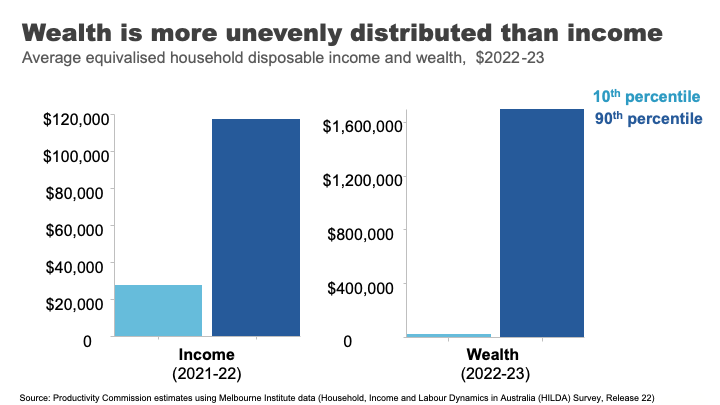

Wealth overall is much less evenly distributed than income.

If we take a household at the 90th %ile for wealth, they have almost 70 times as much wealth as the Australians at the 10th %ile. For income the figure is only four times as much.

Wealth also has much greater extremes.

In his 2013 book on inequality, Battlers and Billionaires, Parliamentarian and economist Andrew Leigh provided a memorable analogy, which I have updated today:

Imagine a ladder on which each rung represents a million dollars of wealth. If we were to put all Australian households on this ladder 50% of us are about halfway to the first rung, the top 10 % are about 1.5 rungs up, the top 1% are reaching for the fifth rung – just high enough to clean the gutters. 20 Gina Rinehart is more than 11kms off the ground. 21

But even with this very long ladder, Australia’s wealth inequality is lower than many other OECD countries. 22

But an important question is how has the distribution changed in recent decades?

The answer is: it’s complicated.

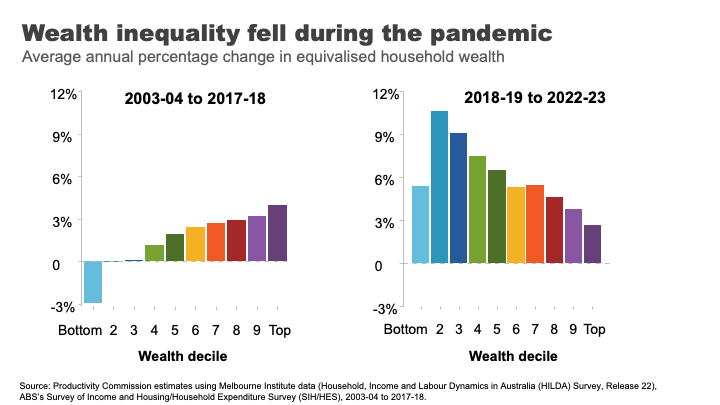

Pre-pandemic, wealth grew faster for the top half of the distribution.

But the pandemic once again, produced some surprising results.

This pattern flipped and wealth grew more quickly overall and significantly faster for lower and lower middle wealth groups during the COVID period.

The two main reasons for this are:

- The strong growth in housing prices, particularly in the regions and the smaller capital cities. This had the biggest impact for homeowners in the lower middle and middle parts of the wealth distribution.

- Higher income from increased government support during the pandemic and fewer opportunities to spend, helped boost bank balances and debt repayment among low-wealth households. 23

And while this is good news for many households at least in the short-term, the longer-term run-up house prices has produced a different set of inequality concerns.

A decaying dream? House prices and inequality across generations

Here I want to stop and reflect on the different ways in which the very strong growth in house prices has impacted economic outcomes for different groups in Australia.

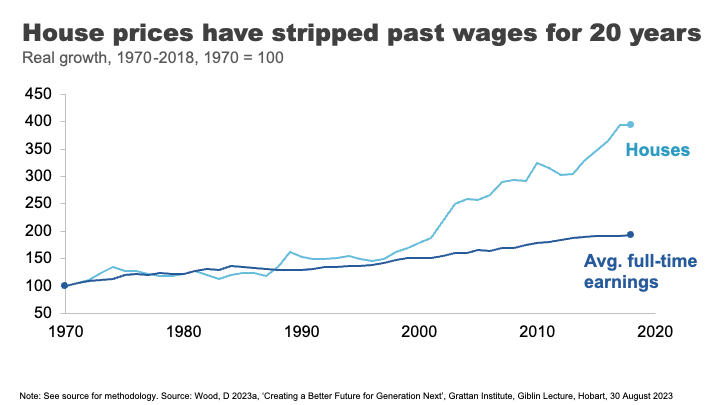

Until the 1990s, house prices broadly tracked growth in incomes. But between 1992 and 2018 they grew at almost three times the pace on average. 24

The effect has been an increase in the upfront barrier to home ownership and increasingly also the ongoing costs for those that are able to clear that hurdle.

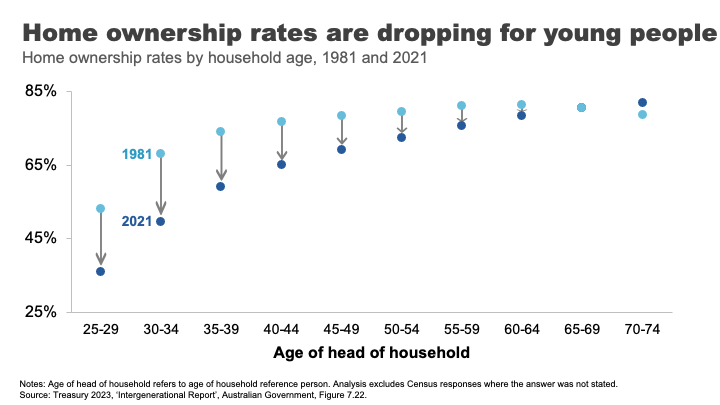

The result, unsurprisingly, has been falling home ownership.

In the early 1980s, when my parents were buying their first home, around 70% of those in their early 30s owned a home. Today that figure is just 50%. And the drops have been particularly acute amongst low-income young people. 25

The declining opportunities for homeownership are a particular source of dissatisfaction and unrest amongst many non-homeowning younger Australians. Amongst the so-called Generation Z non-homeowners, 93% want to own their own home. But only 63% think it is likely that they ever will. 26

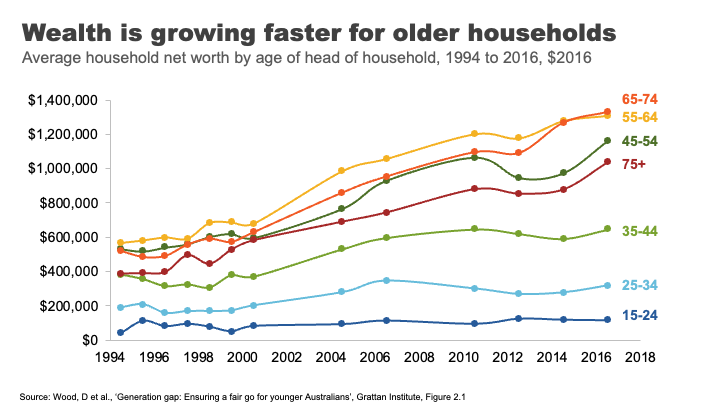

The rise in house prices has also contributed to rising generational disparities in wealth accumulation.

Older households have always had more assets on average than younger ones. But the run up in house prices has created windfall gains for existing homeowners. This has been a major contributor to the rapid growth in wealth among older households.

A household headed by someone aged 65-74 had on average $1.3 million in assets in 2016, up from $900,000 for the same age group in 2004. Rising asset prices over the past seven years mean this figure is almost certainly substantially higher now.

In contrast, the wealth of households under 35 has barely moved in 15 years. And poorer young Australians have less today than poorer young Australians did 15 years ago. 27

Overall the developments in the housing market over recent decades have left many, particularly many older Australians, very well off. But the cost has been considerable housing stress amongst the vulnerable, and a generation of younger Australians who will reach middle age with substantially lower rates of home ownership than their parents.

Land of the fair go? Social mobility in Australia

Now I want to move from the photo to the movie: from talking about disparity in economic outcomes at a point in time to talking about how these outcomes can evolve over someone’s life.

A question that has rightly been of interest to those concerned about inequality, is how does inequality in outcomes influence equality of opportunity. ;Or to be more specific – how much are economic opportunities determined by who are our parents are?

Generational mobility has historically been a hard thing to study. To understand its dynamics we need linked data on parental economic outcomes and those of their children over a long duration.

In the absence of this type of data, at least until recently, people got creative.

In one of my favourite studies, Parliamentarian Andrew Leigh alongside co-authors Gregory Clark and Mike Pottenger, identified rare surnames in the 2014 electoral roll among doctors and university graduates from 1870. They found, nearly 150 years later, that people with those rare surnames are more likely to be in the so called ‘elite’ professions than people with surnames such as Smith.28

Indeed, they found that so called ‘status persistence’ for surnames was as high in Australia as for England or the United States. 29

In somewhat brighter news, more recent studies using linked administrative data point to a more optimistic picture on social mobility in Australia.

Looking at economic outcomes for a million individuals born between 1978 and 1982 Economists Nathan Deutscher and Bhashkar Mazumder find that Australia is one of the more economically mobile advanced economies. 30>

Indeed, they find Australia’s ‘intergenerational elasticity of income’ (a measure of how much your family’s income affects your own) is similar to Canada and close to those of the Nordic countries, and considerably more mobile than places like the United States. 31

In forthcoming work the Productivity Commission uses family-linked tax data that confirms that estimates of intergenerational mobility remain comparatively high.

But in contrast, things may be stickier for those doing it toughest.

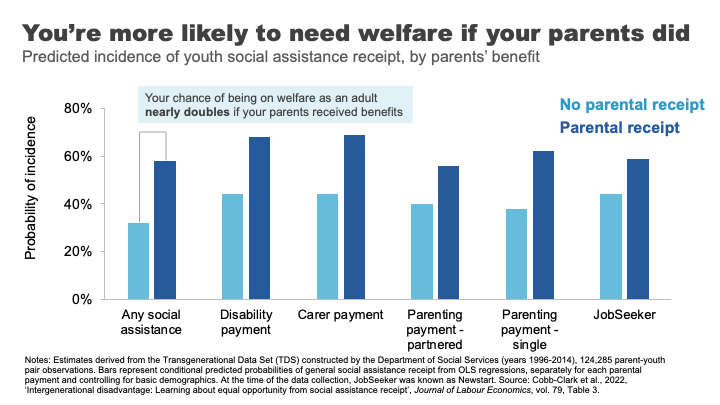

In a 2017 study, Professor Deborah Cobb-Clarke and her co-authors showed that young people are 1.8 times more likely to need social assistance if their parents have a history of receiving social assistance themselves. 32

Consistent with this, the Productivity Commission’s forthcoming work shows that people in their late 20s whose parents received social transfer payments were about one and a half times more likely to receive social transfer payments themselves.

The Cobb-Clarke work showed that these transmission effects were particularly pronounced for disability payments, payments for those with caring responsibilities, and parenting payments for single parents. Interestingly, disadvantage stemming from parents’ poor labour market outcomes was much less persistent. 33

Cobb-Clarke and her co-authors posit that parental disadvantage may be more harmful to children’s later life outcomes if it is more strongly driven by circumstances rather than personal choice.

This aligns with the growing appreciation by economists of the impact of lack of hope or despair in shaping life choices and outcomes. 34

This was the sentiment expressed by a Tasmanian woman on welfare supports: 35

It’s not so much what we are missing out on, it’s the next generation and it is a hard cycle to break because they look at it and think, well, what’s the point? We’re always going to be poor, things are hard, nothing’s going to get better. Why should we bother?

Schools under stress: a red flag for future mobility?

One of the foundational supports for economic mobility is a strong education system.

Indeed, educational attainment has been estimated to explain up to 30 % of the transmission of economic advantage between parents and children. 36

Australia has historically had a strong system of school education that has supported opportunities across the population.

But there are some red flags for future prosperity and mobility that we should heed.

Indeed, despite growing funding in recent years, Australia’s school system has not been delivering the results we want for our young people.

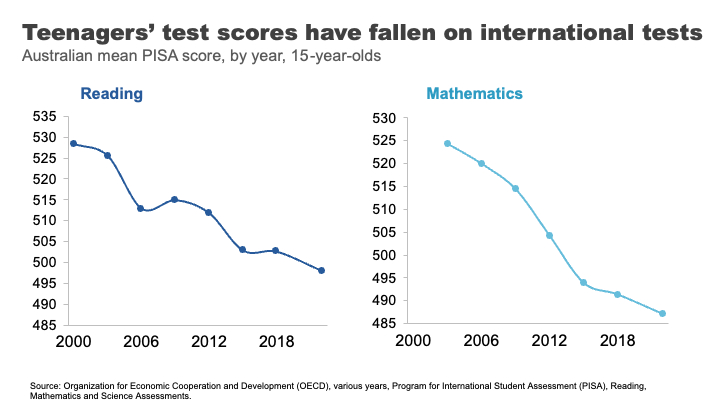

Data from the OECD suggest that the performance of Australian school students in Reading and Maths is going backwards, with significant falls in our levels of achievement since 2000.

Estimates based on this data suggest the average Australian Year 10 student in 2018 was eight months behind in reading compared to where Year 10 students were at the turn of the century, and results have largely flatlined since. 37 We’ve seen even sharper declines in mathematics scores, where the decline for Year 10 students by 2018 was almost a year of learning.

But how much does parental background make a difference to how students fare?

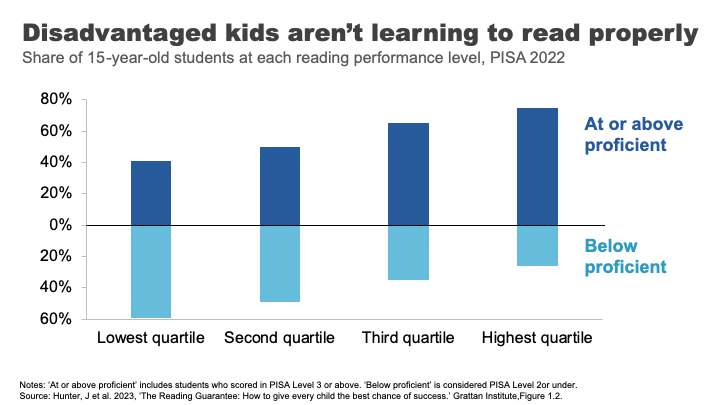

The answer is a lot. More than half of the most economically disadvantaged 15-year-old students in Australia are not proficient readers.

Analysis from the Grattan Institute shows that the disparity in outcomes was worse in Australia than in Canda or the UK and on par with the US. 38

These gaps in performance widen through the schooling process.

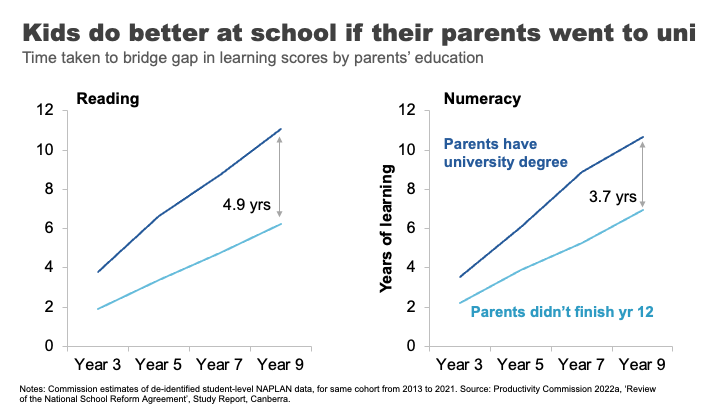

The Productivity Commission looked at this using NAPLAN data. 39 We compared the average reading outcomes of students whose parents did not finish high school to those whose parents have a bachelor’s degree or higher. We found the learning gap – equivalent to almost two years of reading achievement in Year 3, progressively widens to an almost 5-year learning gap by the time students reach Year 9.

For mathematics, the gap widens from 1.3 to almost 4 years.

If we take education as an indicator of both a country’s future economic prosperity and its social mobility – this data must concern us.

It has been pleasing to see senior leaders, including here in South Australia, engage with this issue and its implications. But turning the ship around will require significant shifts in the way we deliver education in Australia.

A nation divided: why mixing matters for mobility

Another less obvious mobility-enhancer is where we grow up, and more specifically, who we grow up with.

US economist Raj Chetty and co-authors made a splash in 2014, when their study using administrative records on the incomes of more than 40 million children and their parents found very large variations in social mobility across the US. For example, they estimated a child from the poorest 20% of families had nearly a 3 times better chance of making it into the top 20% of income earners as an adult if they lived in Silicon Valley rather than Charlotte North Carolina. 40

In a later paper, Chetty and another co-author reinforced the importance of these neighbourhood effects by studying outcomes for families who moved to different parts of the Unites States.

They found that outcomes for children whose families move to a better neighbourhood improve the more time they spend there.

Indeed, every additional year in a ‘good neighbourhood’ sees that child’s outcomes converge closer to the average for that neighbourhood by about 4 %.41

And if you are thinking that this type of locational lottery could only exist in a place as unequal as the United States – think again.

Economist Nathan Deutscher has replicated this work for Australia. 42

And while the dipartites between regions are less pronounced here, we see the same convergence in outcomes, the longer a child is exposed to a ‘good neighbourhood’.

Deutscher finds that place matters most during the teenage years and suggests it might be ‘peer effects’ that explain locational differences in outcomes.

In other words, who you hang around with in those formative years makes a difference. Which may well be a validating result for any parent that has ever uttered the immortal phrase: “If Tanya jumped off a cliff, would you do it too?”.

This is consistent with more recent work that suggests it is economic connectedness – the capacity of low socioeconomic people to make friends with those from higher socioeconomic groups – that is the principal driver of social mobility. 43

And this is the very thing that gets lost as neighbourhoods and schools become more stratified and we participate less in social mixing opportunities. This means that observed declines in the types of activities that help build the social glue – from volunteering, to local sport, to attending church – over time might further erode social mobility.

What’s a policy maker to do?

Where does all this leave policy makers?

How much policy makers should seek to address inequality is not a straightforward question. It has been dissected by philosophers since Plato. And economists have been at intellectual fisticuffs over it for much of the past century.

Today, even the strongest advocates for greater equality will acknowledge that some inequality is inevitable and that it is important to maintain incentives for innovation and effort.

Many of the richest people in the world – Gates, Dyson, Musk – are innovators whose work has reshaped our lives. It is at least partly the ‘size of the prize’ available to successful innovation that drives the efforts and risks of would-be innovators and entrepreneurs.44

On a more relatable level, let’s think of the University we are at tonight. Would we expect students to flow through these gates to spend years of their lives learning about engineering or medicine or economics, and to work long hours while establishing themselves in their career, without some return for these efforts? In other words, incentives are important for growing the pie, even if they result in a somewhat unequal distribution of it.

On the other hand, even many of capitalism’s biggest cheerleaders raise concerns about the social and economic implications of stark economic dispersion.

Recently the IMF has warned that high inequality and especially poor social mobility can impact on long-term economic growth. 45 Others have shown that physical and mental health problems are worse in more unequal societies, predominantly due to the physiological stress of operating within a steep economic hierarchy. 46 And still others have linked rising inequality, or declining social mobility, 47 with the rise of populism as the ‘left behind’ lodge their protests vote against the so called elite.

All of this is to say that targeting inequality is complex. And while the ‘line’ across which inequality flips to doing more harm than good is far from clear, what is clear is that policy makers have a broad set of tools that can help push in their desired direction.

A policy makers’ toolbox

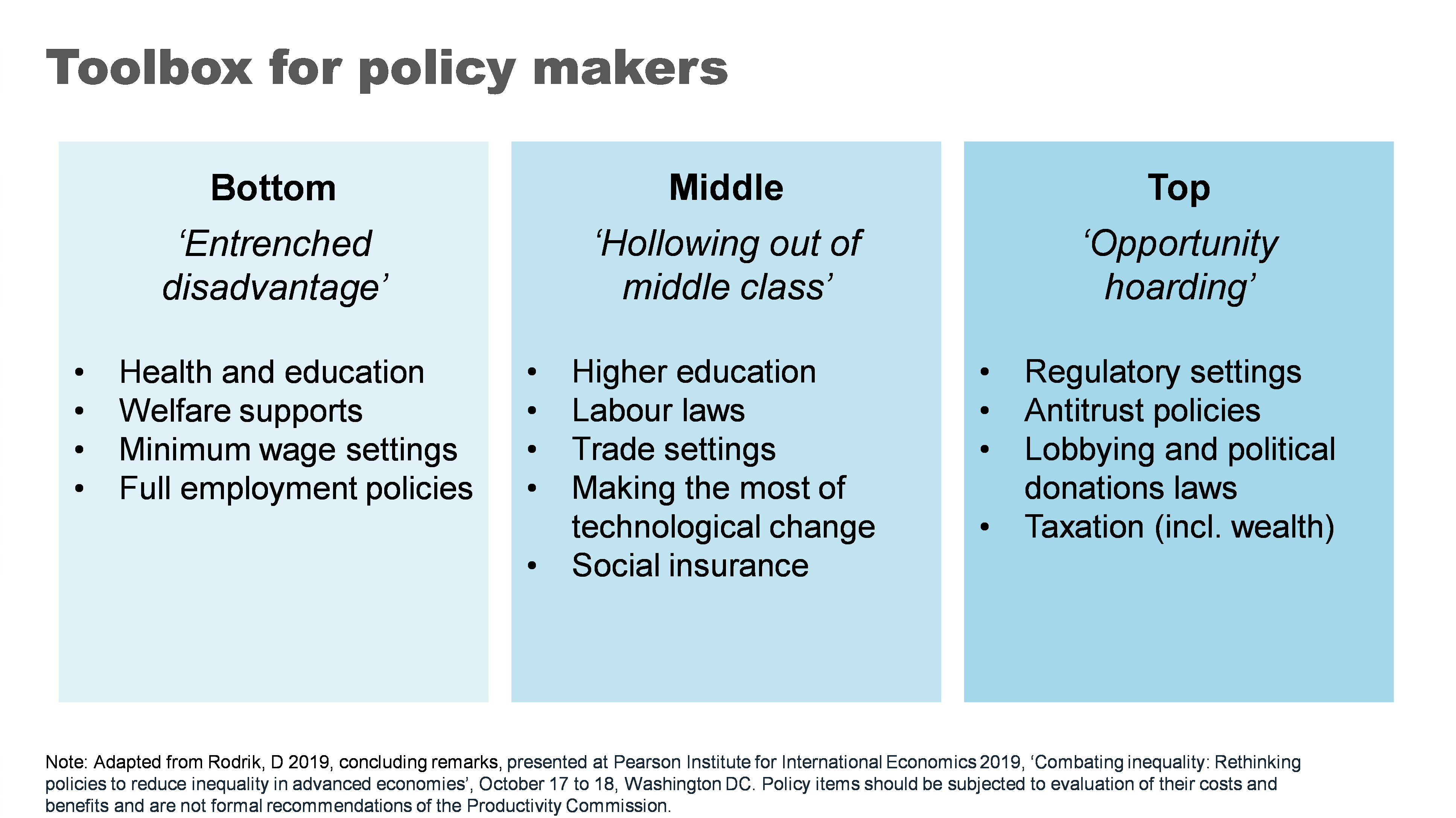

A few years ago, a group of high-profile economists organised an international conference on combatting inequality with a mission of engaging with the full suite of policy responses. 48

Their conclusion, although not revolutionary, provides helpful clarity: that the right policy response depends on why you care about inequality.

In particular, they draw a distinction between policies concerned with:

- outcomes for most disadvantaged – particularly for addressing entrenched poverty

- boosting opportunities for a ‘hollowed out’ middle class – a much greater concern in the United States than here, where, as we have seen, income growth has been broader based

- opportunity hoarding – or the way wealthy people might leverage their economic and political power to entrench their position.

The right policy tool will also depend crucially on whether policy makers are more concerned with equality of opportunity or outcomes.

Below is an adapted version of the taxonomy they created. It shows the breadth – and importantly the targeting of different levers that a would-be inequality buster might pull.

Now I do not advocate for all of the policies proposed. Indeed, whether any of these policies would be a good idea would require careful analysis of the costs and benefits in the particular context you might use them. There are probably good ideas that have been left out too.

But I did want to talk very briefly about four of the ‘biggies’ that I think really matter in an Australian context.

Growing the pie can mean bigger slices for all

Now in a presentation largely focused on distribution of the pie, I want make the case for making the pie bigger.

A cross-country and cross time evaluation suggests that growth is effective in reducing poverty. 49 Indeed, incomes for the bottom 10% are highly correlated with overall economic growth – a rising tide lifts some very important boats. We could put this beyond doubt for Australia by addressing some of the weaknesses in the current social safety net - a point I’ll return to.

The impact of higher economic growth on overall inequality is less clear. 50 But what is clear is that faster economic growth gives governments more room to support more generous welfare policies as well as other social spending on areas like education and health that particularly benefit those at the bottom and middle of the income distribution.

More generally healthy income growth can also support the political ‘buy in’ for these types of policies. 51

As for what governments can do to grow the pie – that would be a whole other lecture. But if the pie is of interest: ‘here’s one I prepared earlier’. My colleagues have published a comprehensive 1000-page guide for governments looking for ways to boost productivity and growth. 52

Fixing the housing mess

A functioning housing system is critical for improving our social and economic outcomes. Building more houses closer to jobs and amenities is needed to help younger and poorer Australians access the same opportunities as previous generations.

Australia’s population has grown strongly over the past two decades and will likely continue to do so. We can choose to push people out to the ever-expanding fringes of our cities or accommodate them through boosting supply in the inner and middle ring suburbs where most would prefer to live.

Allowing greater density in these areas not only expands supply but also boosts variety in housing choices, supporting more of the cross-socio economic mixing critical to social mobility.

After at least two decades of letting the ‘housing market frog’ slowly boil, there have been some positive steps from both Commonwealth and State governments to support the planning changes needed to boost supply. In particular, the Commonwealth government has offered incentives for states to target the construction of 1.2 million new homes over the next five years. 53

Similarly, moves to boost social housing are also a positive step, particularly where they’re targeted to those with the highest need.

Unfortunately, this new-found policy energy has come at the same time as the building industry faces challenges in ramping up.

But over time, if ambitious growth targets can be met, this could be a powerful shift in reducing inequality both within and between generations.

An education revolution?

School education is fundamental to supercharging opportunities for the next generation.

And while some of the problems our system faces are thorny, some of the solutions are surprisingly straightforward.

Our focus should start with getting the basics right – our schools should be supported and held accountable for delivering basic levels of literacy and numeracy. 54 My former colleagues at Grattan have called for a ‘Reading Guarantee’ – whereby governments would commit to ensuring at least 90 % of Australian students learn to read proficiently at school. 55

Supporting schools and teachers to deliver on these basics would require:

- making sure all teachers adopt evidence-based teaching practices such as phonics decoding for reading 56

- providing all schools and teachers access to a bank of well-sequenced high-quality curriculum materials 57

- reducing low value tasks for teachers to free them up to spend time on what really matters, 58 and

- providing better career paths to help schools attract and retain top teachers, and allowing top teachers to support and develop others in the profession. 59

Boosting social safety net

The Federal Government’s Economic Inclusion Committee just released its second report designed to inform the budget process.

Its lead recommendation remained unchanged from last year: to increase the rate of the JobSeeker and related income support payments.

The Committee finds that Australia’s unemployment benefits have been slipping further and further behind community living standards for two decades. 60

And while the recent 10% increase to Commonwealth Rent Assistance will provide much needed relief – as did the extra 15% in the last Budget – the Committee’s report demonstrates that the value of the payments has fallen significantly relative to average rents for the past 25 years. 61

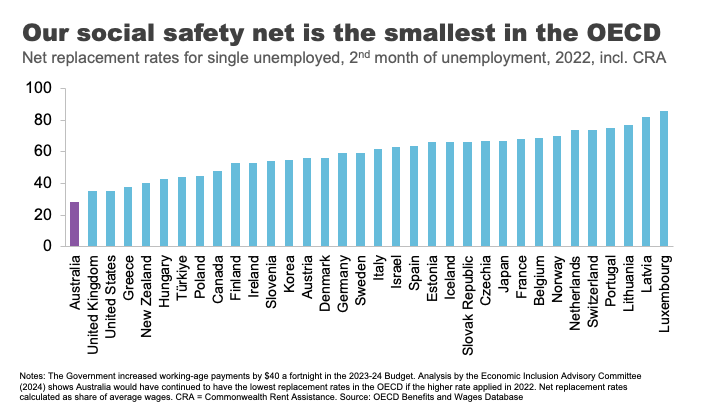

Today, Australia’s payments to the short-term unemployed, including housing benefits, are the least generous in the OECD. 62

No single measure would do more to alleviate poverty than a material change in these payments.

What’s stopping us?

Partly it’s likely to be well-meaning concerns about the impact on incentives to work.

But consistent with previous work, the Economic Inclusion Advisory Committee finds that the negative effect on incentives is likely to be small, because current levels of the payment are so far below incomes from working. 63

Indeed, for those facing economic exclusion, higher income support payments may improve the capacity to search for and accept employment. 64

Second, is the cost. Moving as far as the Economic Inclusion Advisory Committee recommends on JobSeeker and related payments could cost up to $4.6 billion per year, 65 which is not straightforward for governments balancing a range of competing priorities. But as targeted interventions to address poverty go, there is very little waste.

Finally, there is the question of community support. Boosting Jobseeker payments rarely garners majority support across the population. 66 As I have previously argued, this is less a case of Australians being mean spirited and more about the grip of some persistent and unhelpful myths about welfare recipients. Your regular community service reminder tonight: the median Jobseeker recipient is a 45-year-old woman. 67

Finding our inner Stretton

And with that I want to wrap up where I began, with Stretton’s legacy.

Inequality is one of those topics where it is easy to simply revert to tired tropes, particularly off shelf ones from elsewhere.

Stretton encouraged us to look with curiosity and rigour, but also with an open heart. In doing so, everyone may take away something different from the numbers and analysis I have shared tonight.

To me, there are bright spots in the story. Australia has grown its income and wealth over several decades, and it has shared those gains broadly. Social mobility is relatively high.

On the other hand, many relying on payments are in poverty and the long shadow of that experience can be hard for children to escape. Our schools and suburbs are becoming less of a springboard for mobility. And we have made the Australian dream out of reach for a generation of young people.

Policy matters – there are many levers that governments can pull to make a difference to these outcomes. But it is up to Australians to decide which ones we want them to use.

Footnotes

- Munro, D 2016, ‘The House that Hugh Built, the Adelaide history department during the Stretton era, 1954-1996’, History of Education vol. 46, no. 5, p.634.. Return to text

- Ibid, p.631. Return to text

- Spoehr, J 2015, ‘Hugh Stretton: a great Australian public intellectual’, The Adelaide Review, 7 September. Return to text

- Davison, G 2018, ‘Watching a brilliant thinker stretching his mind’, Inside Story, 11 October. Return to text

- Spoehr, J 2015. Return to text

- Gibilisco, P and Stretton, H 2003, ‘A pragmatic social democrat: an interview with Hugh Stretton’, The Journal of Australian Political Economy, vol. 51, pp. 13. Return to text

- The Guardian 2014, ‘Can the Hawking Index tell us when people give up on books?’, 8 July.Return to text

- Hoy, C, and Mager, F 2021 ‘Why are relatively poor people not more supportive of redistribution? Evidence from a randomized survey experiment across ten countries.’ American Economic Journal: Economic Policy, vol. 13, no. 4, pp. 299–328.Return to text

- Hobman, J 2022, ‘EXCLUSIVE: 'It barely cuts it': Aussie finance guru exposes why $200,000 a year is NOT a big salary anymore - despite most of the country earning MUCH less - but not everyone agrees’, The Daily Mail, 14 July; Martin, P 2021, ‘Other Australians don’t earn what you think. $59,538, is typical.’ The Conversation, 8 June. Return to text

- Coates, B and Ballantyne, A 2020, ‘No one left behind: Why Australia should lock in full employment’, Grattan Institute. The unemployment rate surged from 5.2% in March 2020 to a peak of 7.5% in July 2020. ABS (Australian Bureau of Statistics) 2024, ‘Labour Force, Australia, Detailed, February 2024’. Return to text

- The Australian Government provided JobKeeper payments of $1,500 per fortnight to eligible businesses, which had to be paid to their employees, to minimise job losses and maintain employment and job attachment. AIHW (Australian Institute of Health and Welfare) 2021, ‘Australia’s welfare 2021: data insights’, pp. 84–86. The flat payment of $1,500 per fortnight meant some people – particularly part time workers – received more than their salary, while for others it led to a reduction in their salary. Treasury 2023, ‘The Australian Government Independent Evaluation of the JobKeeper Payment Final Report’, 28 September. Return to text

- Hasell, J 2023, ‘Income inequality before and after taxes: How much do countries redistribute income?’, Our World in Data Return to text.

- Ibid. Return to text

- As Prime Minister, Bob Hawke made the declaration in 1987, with the intention to reach the goal by 1990. Hawke, B 1987, speech delivered at Sydney, NSW, June 23rd, Museum of Modern Democracy: Election Speeches. Return to text

- Davidson, P, Bradbury, B and Wong, M 2023, ‘Poverty in Australia 2023: Who is affected’, Poverty and Inequality Partnership Report no. 20, Australian Council of Social Service and UNSW Sydney. Return to text

- ABS (Australian Bureau of Statistics) 2022, ‘Survey of Income and Housing 2019-20’, Australian Government. Return to text

- Morton, R 2020, On Money, Hachette Australia, p.18. Return to text

- Davidson, P, Bradbury, B and Wong, M 2023. Return to text

- ‘Clarence Gardens Adelaide - Greater Region, SA 5039’, https://www.realestate.com.au/sa/clarence-gardens-5039/, accessed 12 May 2024. Return to text

- Leigh, A 2013, Battlers and Billionaires: The Story of Inequality in Australia, Schwartz Publishing, Melbourne, updated according to Productivity Commission estimates using Melbourne Institute data (Household, Income and Labour Dynamics in Australia (HILDA) Survey, Release 22). Return to text

- Estimate based on data from AFR (Australian Financial Review), ‘Rich List 2023’, https://www.afr.com/rich-list, accessed 12 May 2024. Return to text

- Shorrocks, Lluberas, Davies and Waldenström 2023, ‘Global Wealth Report 2023’, Credit Suisse and UBS Global Wealth Databook. Return to text

- See Productivity Commission 2024, ‘A snapshot of inequality in Australia’, Research paper, Canberra, pp. 25-30 for a discussion. Return to text

- Wood, D 2023a, ‘Creating a Better Future for Generation Next’, Grattan Institute, Giblin Lecture, Hobart, 30 August 2023. Return to text

- Coates, B 2022, ‘Levelling the playing field: it’s time for a national shared equity scheme’, Grattan Institute. Return to text

- Susan McKinnon Foundation 2023, ‘McKinnon Poll: Understanding attitudes towards housing in Australia’, September, p.90. Return to text

- Wood, D 2023a. Return to text

- The authors define a set of elite ‘rare’ surnames in 1900 as those surnames where 29 or fewer people held the name in Australia in 2014 in the voting roll, and where someone holding that name graduated from Melbourne or Sydney universities 1870-1899. Clark, G, Leigh, A, and Pottenger, M 2020, ‘Frontiers of mobility: Was Australia 1870–2017 a more socially mobile society than England?’, Explorations in Economic History, vol. 76. Return to text

- Ibid. Return to text

- Deutscher, N and Mazumder, B 2020, ‘Intergenerational mobility across Australia and the stability of regional estimates’, Labour Economics, vol. 66. Return to text

- Ibid. Return to text

- Cobb-Clark et al., 2022, ‘Intergenerational disadvantage: Learning about equal opportunity from social assistance receipt’, Journal of Labour Economics, vol. 79. Return to text

- Ibid, pp.16-17. Return to text

- Case, A and Deaton, A 2020, Deaths of despair and the future of capitalism, Princeton University Press, Princeton. Return to text

- TASCOSS 2022, ‘Wellbeing First: A budget proposal to ease the cost of living and invest in the long-term wellbeing of Tasmanians’, 2023-24 TASCOSS Budget Priorities Statement, p.12. Return to text

- Breunig, R and Taylor, M 2023, ‘Success in life is tied to parental education. That’s why we need to track intergenerational school performance’, The Conversation, 14 February. Return to text

- Hunter, J et al. 2023, ‘The Reading Guarantee: How to give every child the best chance of success.’ Grattan Institute. Return to text

- Ibid, p.10. Return to text

- Productivity Commission 2022a, ‘Review of the National School Reform Agreement’, Study Report, Canberra. Return to text

- The authors found a child whose family is amongst the 20% most disadvantaged has a probability of ending up in the top 20% of income earners of just 4.4% if they live in Charlotte North Carolina, but 12.9% if they live in San Jose, in the heart of Silicon Valley. Chetty, R et al. 2014, ‘Where is the land of opportunity? The geography of intergenerational mobility in the United States’, The Quarterly Journal of Economics, vol. 129, no. 4, November, pp. 1553-1623. Return to text

- Chetty, R and Hendren, N 2018, ‘The impacts of neighborhoods on intergenerational mobility I: Childhood exposure effects’, The Quarterly Journal of Economics, vol. 133, no. 3, August, pp. 1107-1162https://academic.oup.com/qje/article/133/3/1107/4850660?login=false Return to text

- Deutscher, N 2020, ‘Place, peers, and the teenage years: Long-run neighborhood effects in Australia’, American Economic Journal: Applied Economics, vol. 12, no. 2, pp. 220-49. Return to text

- Chetty, R et al. 2022, ‘Social capital I: Measurement and associations with economic mobility’, Nature vol. 608, pp. 108-121. Return to text

- Deaton, A, ‘What’s wrong with inequality?’, The IFS Deaton Review, panellist introduction, https://ifs.org.uk/inequality/themes/whats-wrong-with-inequality/, accessed 19 May 2024. Return to text

- Cerra et al. 2021, ‘Links between growth, inequality, and poverty: A survey’, IMF Working Papers, Working Paper No. 2021/068. Return to text

- Wilkinson, RG and Pickett, KE 2009, ‘Income inequality and social dysfunction’, Annual Review of Sociology, vol. 35, pp. 493–511. Return to text

- Protzer, ESM 2019, ‘Social Mobility Explains Populism, Not Inequality or Culture’, Center for International Development at Harvard University, Working Papers, no.118. Return to text

- Pearson Institute for International Economics 2019, ‘Combating inequality: Rethinking policies to reduce inequality in advanced economies’, conference papers, October 17 to 18, Washington DC. Return to text

- Cerra et al. 2021. Return to text

- Ibid. Return to text

- Weisstanner, D 2023, ‘Stagnating incomes and preferences for redistribution: The role of absolute and relative experiences’, European Journal of Political Research, vol. 62, pp. 551-570. Return to text

- Productivity Commission 2023, ‘5-year Productivity Inquiry: Advancing prosperity’, vol. 1, Inquiry Report no. 100, Canberra. Return to text

- Productivity Commission 2022a, ‘Review of the National School Reform Agreement’, Study Report, Canberra. Return to text

- Hunter, J et al. 2023, ‘The Reading Guarantee: How to give every child the best chance of success’, Grattan Institute. Return to text

- Ibid. Return to text

- Hunter, J et al. 2022, ‘Ending the lesson lottery: How to improve curriculum planning in schools’, Grattan Institute. Return to text

- Productivity Commission 2022a. Return to text

- Goss, P and Sonnemann, J 2020, ‘Top teachers: Sharing expertise to improve teaching’, Grattan Institute; Gonski, D et al. 2011, ‘Review of funding for schooling: Final report’, Australian Government Department of Education, Employment and Workplace Relations. Return to text

- EIAC (Economic Inclusion Advisory Committee) 2024, ‘2024 Report to Government’, Australian Government Department of Social Services. Return to text

- EIAC 2024, p.62. See also Productivity Commission 2022b, ‘In need of repair: The National Housing and Homelessness Agreement’, Study Report, Canberra. Return to text

- EIAC 2024, p.54. Return to text

- EIAC 2024, pp.49-55. Return to text

- Ibid, p.55. Return to text

- EIAC, p.47. Return to text

- Wood, D 2023b, ‘The three myths that keep Australians in poverty’, The Sydney Morning Herald, 25 April. Return to text

- Ibid. Return to text

Acknowledgment

I would like to thank Productivity Commission staff especially Carmela Chivers, Sara Collard and the inequality team for their assistance with this speech. The speech draws heavily on their most recent work: A snapshot of inequality in Australia. All good ideas and analysis theirs – all mistakes my own.