Quarterly productivity bulletin - September 2025

PC productivity insights

Released 18 / 09 / 2025

Despite signs of improvement in the June quarter, it would be premature to say Australia’s productivity malaise has passed.

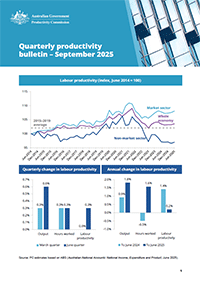

This latest quarterly productivity bulletin shows labour productivity increased by 0.3% in the June quarter and 0.2% over the year to June 2025.

The bulletin also makes the case for corporate tax reform to boost investment and increase productivity.

Australia’s productivity problem persists despite small gains

Labour productivity increased in the June quarter but remains close to where it was prior to the COVID-19 pandemic, according to the Productivity Commission’s September Quarterly Productivity Bulletin.

‘Despite signs of improvement, it would be premature to say Australia’s productivity malaise has passed,’ said Commission Deputy Chair Dr Alex Robson.

The bulletin finds that labour productivity increased by 0.3% in the June quarter and 0.2% over the year to June 2025.

‘While this increase is good news, Australia’s workforce is barely more productive now than it was prior to the COVID-19 pandemic. We will need sustained productivity growth to move the needle,’ said Dr Robson.

In this bulletin’s feature article, PC economist Daniel Arzhintar looks at investment and capital deepening, which are key drivers of productivity growth.

He finds that Australia has experienced little capital deepening in the past decade because we have tended to invest less of our national income in new capital.

‘Labour productivity tends to increase when workers have more or better capital (such as computers and buildings) to work with, which is known as “capital deepening”’, said Dr Robson.

‘In the interim report of our Creating a more dynamic and resilient economy inquiry, we recommended revenue-neutral changes to the corporate tax system that would help solve our investment problem.’

Under these changes, the company income tax rate would be reduced to 20% for companies with annual revenue below $1 billion and would remain at 30% for companies with annual revenue above $1 billion. A new 5% cash flow tax would be applied to all companies to maintain revenue neutrality.

‘These reforms would give the 99% of companies with annual revenue below $1 billion stronger incentives to invest, without significantly affecting investment for the remaining 1% of companies,’ said Dr Robson.

The latest Quarterly productivity bulletin is available from: pc.gov.au/productivity-insights.

Media requests

Media team – 02 6240 3330 / media@pc.gov.au

Quarterly productivity bulletin – September 2025

- Labour productivity update

- Update from Alex Robson

- Working with less: The decline of capital deepening

- References

- Copyright and publication detail

Appendix: Supporting evidence

- A primer on productivity

- Detailed productivity statistics

- Productivity data revisions

We value your comments about this publication and encourage you to provide feedback.