Trade and Assistance Review 2020-21

Annual report series

The Trade and Assistance Review 2020-21 was released on 5 August 2022.

The review contains the Commission’s latest quantitative estimates of Australian Government assistance to industry, and provides a summary of developments in industry assistance, trade policy and foreign investment over the past year.

Download the report

This annex provides an overview of the Productivity Commission’s industry assistance measurement framework and information about how the Commission produces annual assistance estimates. From 2020-21, this annex replaces the annual annexes, published since 2000.

At A Glance

Assistance efficacy vital for meeting challenges to Australia’s prosperity

With the cost of living rapidly rising, Australia near full employment, and significant challenges to the global economic landscape, there has never been a more important time for the Commonwealth to ensure that assistance to industry is efficient and effective.

The Productivity Commission’s Trade and Assistance Review provides a record of assistance and a review of the trade and economic landscape facing Australia.

The report finds that the Government provided at least $16 billion in industry assistance during 2020-21 (excluding COVID-19 support).

“Australia’s prosperity relies on international trade and investment. In order to open up trade, assistance to local industry — such as tariffs, tax concessions and budgetary outlays — has been trending down for decades,” Productivity Commission Deputy Chair Dr Alex Robson said.

“However, our report found that in 2020-21 assistance — even without accounting for the major COVID response measures — increased to $16 billion. This is a 25 per cent increase compared to the last five years.”

The year 2020-21 saw the Government apply significant emergency measures in response to the COVID-19 pandemic. Four programs — JobKeeper, Boosting Cashflow for Employers, Backing Business Investment, and broader access to the Instant Asset Write-Off — amounted to around $90 billion.

“During the early stages of the pandemic, government assistance to Australian businesses and households rose. Many needed support at that time. The challenge is to roll back this assistance as conditions improve to avoid overheating the economy,” Dr Robson said.

“Disruptions from the pandemic, the transition to net-zero emissions by 2050 and the global surge of protectionism and uncertainty make for a challenging environment, particularly with strong inflationary pressures. This underscores the need for productivity enhancing reforms and the rigorous examination of the costs and benefits of proposed programs.”

“The task now is to make sure every dollar of assistance is efficient, effective and remains absolutely necessary. This includes making sure we aren’t creating trade barriers through costly and obsolete tariffs.”

The Trade and Assistance Review 2020-21 and The Nuisance Cost of Tariffs, an accompanying research paper that sets out findings on the fiscal and economic implications of current tariff settings, can be found at: www.pc.gov.au/trade-assistance

Media requests

Media team – 02 6240 3330 / media@pc.gov.au

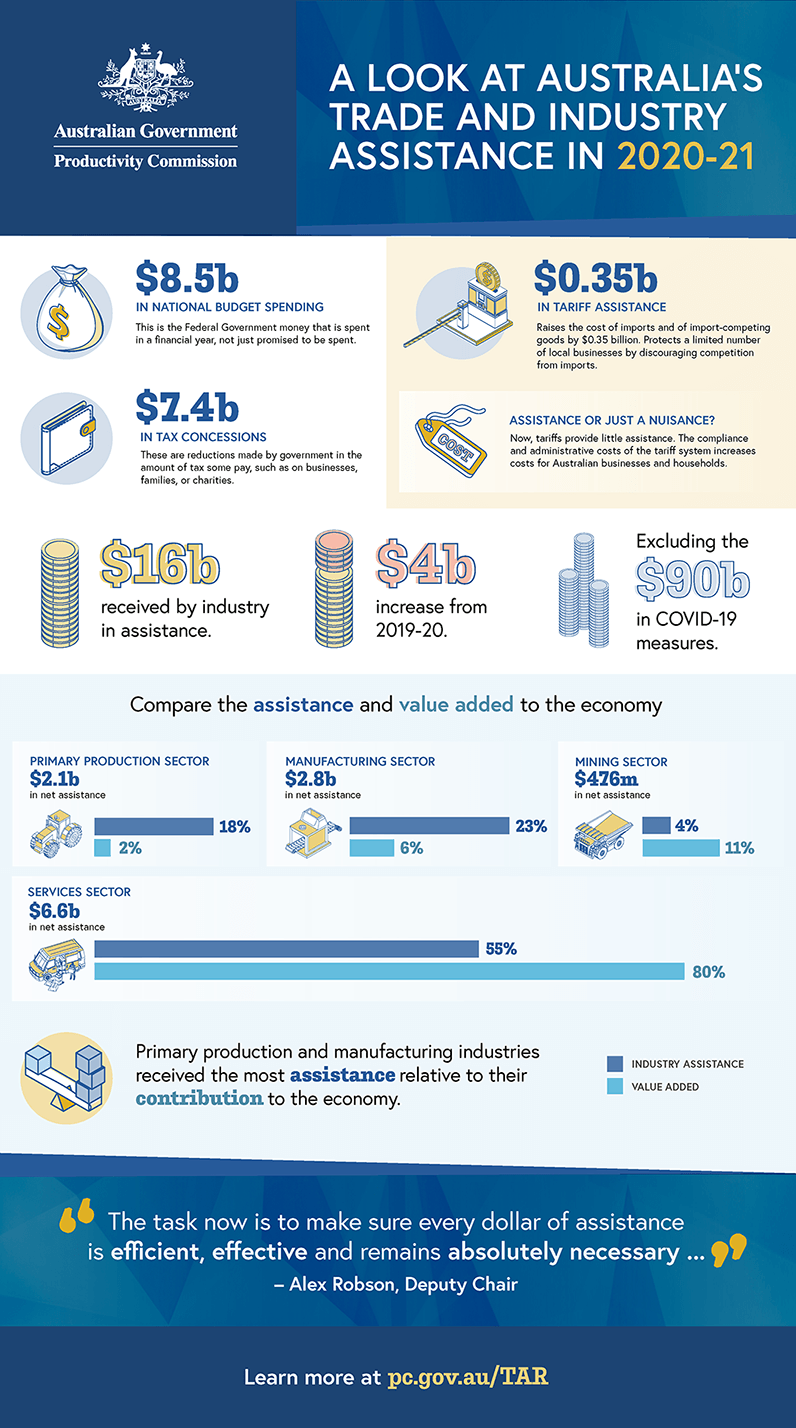

A look at Australia's trade and industry assistance in 2020-21

$8.5 billion in National Budget Spending

This is the Federal Government money that is spent in a financial year, not just promised to be spent.

$7.4 billion in tax concessions

These are reductions made by government in the amount of tax some pay, such as on businesses, families, or charities.

$0.35 billion in tariff assistance

Raises the cost of imports and of import-competing goods by $0.35 billion. Protects a limited number of local businesses by discouraging competition from imports.

Assistance or just a nuisance?

Now, tariffs provide little assistance. The compliance and administrative costs of the tariff system increases costs for Australian businesses and households.

- $16 billion received by industry in assistance

- $4 billion increase from 2019-20

- Excluding the $90 billion in COVID-19 measures.

Compare the assistance and value added to the economy

Primary production sector

- $2.1 billion in net assistance

- 18% Industry assistance

- 2% Value added

Manufacturing sector

- $2.8 billion in net assistance

- 23% Industry assistance

- 6% Value added

Mining sector

- $476 million in net assistance

- 4% Industry assistance

- 11% Value added

Services sector

- $6.6 billion in net assistance

- 55% Industry assistance

- 80% Value added

Primary production and manufacturing industries received the most assistance relative to their contribution to the economy.

"The task is to make sure every dollar of assistance is efficient, effective and remains absolutely necessary..."

Alex Robson, Deputy Chair

Learn more at pc.gov.au/TAR

Related publications

Printed copies