Trade and Assistance Review 2015-16

Annual report series

The Trade and Assistance Review 2015-16 was released on 29 July 2017.

The review contains the Commission's latest quantitative estimates of Australian Government assistance to industry.

This year's review also explores how recent developments such as the Northern Australia Infrastructure Facility, assistance responses to Arrium going into receivership and other events in the Upper Spencer Gulf, government proposals for investment in electricity generation and storage, and a 'back to the future' reregulation of Queensland sugar marketing.

Download the report

On 8 November 2017, Appendix B (Recent Developments in Industry Assistance) was added to the original report, released on 29 July 2017.

- Trade and Assistance Review 2015-16 (PDF - 2012 Kb)

- Trade and Assistance Review 2015-16 (Word - 1125 Kb)

Methodological Annex

Estimates User Guides

- At a glance

- Infographic

- Supporting data

Key points

- For 2015-16, estimated assistance to industry (provided by the Australian Government) was $15.0 billion in gross terms.

- It comprised $6.8 billion in tariff assistance, $4.6 billion in budgetary outlays and $3.7 billion in tax concessions. While tariff assistance is inherently distortionary, not all budgetary outlays create distortions.

- After deducting the cost penalty of tariffs on imported inputs ($5.9 billion, two-thirds incurred by services industries), net assistance to industry was $9.1 billion.

- The incidence of assistance varies widely between sectors.

- Manufacturing received an estimated $6.2 billion in net assistance (largely due to tariff protection), Primary production received an estimated $1.6 billion (mostly through budgetary assistance), and Mining received a small positive net assistance ($0.3 billion).

- The measured industry assistance arrangements imposed a very small net cost on services industries (as the tariff cost penalty on inputs of $3.8 billion only just exceeded budgetary assistance of $3.8 billion).

- Of the eight categories of measured budgetary industry assistance the two largest are:

- R&D support (generally available to all industries and specific to rural industry), which made up around 47 per cent ($3.9 billion) of assistance, the majority of which relates to the R&D Tax Incentive (around $2.8 billion).

- Industry specific assistance, which consists of a range of grants and concessions, such as for the automotive, film, finance and ethanol industries, makes ups 15 per cent ($1.2 billion) of measured assistance.

- The measured estimates are conservative as they exclude significant assistance that is difficult to quantify. This includes: favourable finance (loans, debt, equity, guarantees); local purchasing preferences, such as for defence equipment; and regulatory restrictions on competition. It also excludes state and territory government support to industry.

- Four significant recent developments that may involve significant industry assistance are the:

- establishment of the $5 billion Northern Australia Infrastructure Facility (NAIF)

- provision of company-specific and regional assistance in response to Arrium (steel) entering administration

- announcements regarding specific investments in electricity generation and storage assets

- reregulation of sugar marketing in Queensland, and conferring charity status on Queensland Sugar Ltd.

- Australia (and the world) is at an important juncture in trade policy.

- The Doha disappointment does not mean multilateral approaches are doomed or should be put on the back-burner. On the contrary, there has been multilateral (and mega-regional) success.

- This success between like-minded countries should embolden further efforts. In the current climate of global trade angst there is an imperative to intensify efforts at multilateral and mega-regional reform.

- The benefits of bilateral trade preferences are much less than anticipated, including because of the use of other tariff concessions, and costly and protective Rules of Origin.

- Unilateral elimination of Australia's remaining tariffs is long overdue — Australian firms and consumers would avoid the higher input costs of around $6 billion a year.

Media release

Industry assistance by any other name

Australian industry received over $15 billion in assistance from the Australian Government in 2015-16, continuing the slight downward trend over recent years. Tariffs made up $6.8 billion of this figure; budgetary assistance $4.6 billion; and tax concessions $3.7 billion.

The bulk of industry assistance continues to favour manufacturing. The services sector, despite accounting for almost 85% of the Australian economy, carries most of the burden of this practice.

'We continue to penalise our largest employing sector by providing a broad variety of protection and support schemes,' Productivity Chair Peter Harris said.

The report says unilateral elimination of Australia’s remaining tariffs is long overdue — Australian firms and consumers would avoid the higher input costs of around $6 billion a year.

'Our figures for industry assistance are conservative as they don’t include the significant assistance provided by government such as favourable finance, local purchasing preferences, and regulatory restrictions on competition,' Mr Harris said.

The report provides analysis and comment on four recent developments that may well result in a misallocation of resources in the future:

- the establishment of the $5 billion Northern Australia Infrastructure Facility (NAIF)

- provision of company-specific assistance in response to threats of firm closures in the Spencer Gulf

- government investments in electricity generation and storage assets, without adequate governance arrangements or with only minimal analysis

- the backward step of reregulation of sugar marketing in Queensland, and awarding the sugar marketer, Queensland Sugar Ltd, charity status.

Contents

- Preliminaries: Cover, Copyright, Foreword, Contents, Abbreviations and explanations

- Key points

- Chapter 1 Key results and their interpretation

- 1.1 What is industry assistance?

- 1.2 Key findings

- Chapter 2 Assistance estimates

- 2.1 Tariff assistance

- 2.2 Australian Government budgetary assistance

- 2.3 Combined assistance and effective rates of assistance

- 2.4 Effective rates of assistance since 1970

- Chapter 3 Recent developments in industry assistance

- 3.1 Northern Australia Infrastructure Facility

- 3.2 Assistance to Arrium and adjustment in the Upper Spencer Gulf region

- 3.3 Government investment in electricity generation and storage

- 3.4 Sugar reregulation: back to the future

- Chapter 4 Trade policy developments

- 4.1 Global trade protection uncertainty

- 4.2 Multilateral agreements

- 4.3 Mega-regional trade agreements

- 4.4 Bilateral trade agreements

- 4.5 The case for removing the remaining tariffs

- Appendix A Detailed estimates of Australian Government assistance to industry

- Appendix B Recent developments in industry assistance

- References

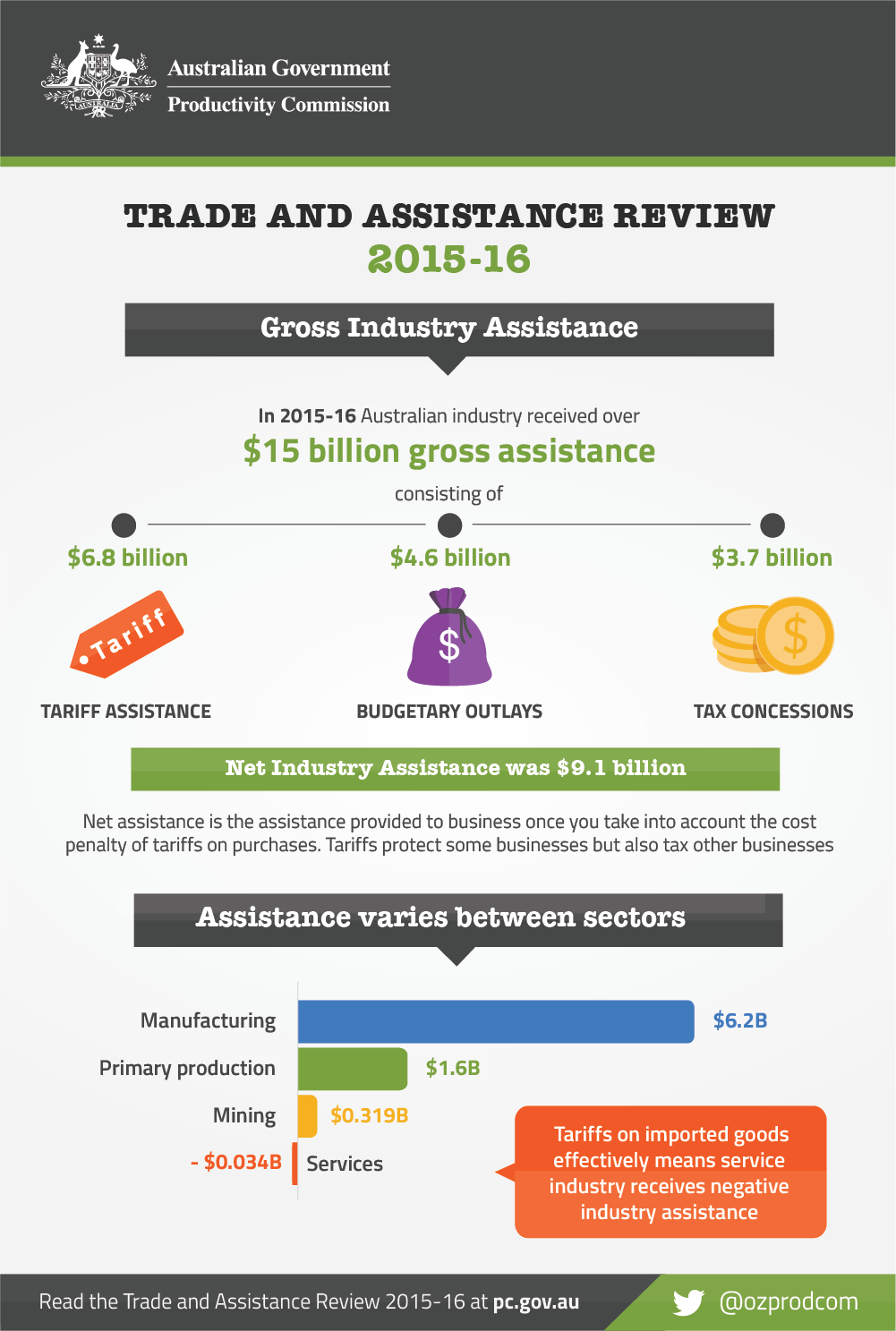

Infographic: Trade and Assistance Review 2015-16

Download the infographic

Trade and Assistance Review 2015-16 (text version of the infographic)

Gross Industry Assistance

In 2015-16 Australian industry received over $15 billion gross assistance consisting of:

- $6.8 billion tariff assistance

- $4.6 billion budgetary outlays

- $3.7 billion tax concessions.

Net industry assistance was $9.1 billion.

Net assistance is the assistance provide to business once you take into account the cost penalty of tariffs on purchases. Tariffs protect some businesses but also tax other businesses.

Assistance varies between sectors

- Manufacturing $6.2 billion

- Primary production $1.6 billion

- Mining $0.319 billion

- Services -$0.034 billion.

Tariffs on imported goods effectively means service industry receives negative industry assistance.

Read the report above.

The following excel files contain tables of data used to make the charts within the Trade and Assistance Review 2015-16. There is also an extra file with data of Australian Government budgetary assistance by program.