Superannuation: Alternative Default Models - Draft report

We have developed four alternative models that use competitive processes to allocate default superannuation members to products. We want workable models for the future that overcome some of the legacy problems affecting the system today, such as members having multiple accounts.

Approach to developing models

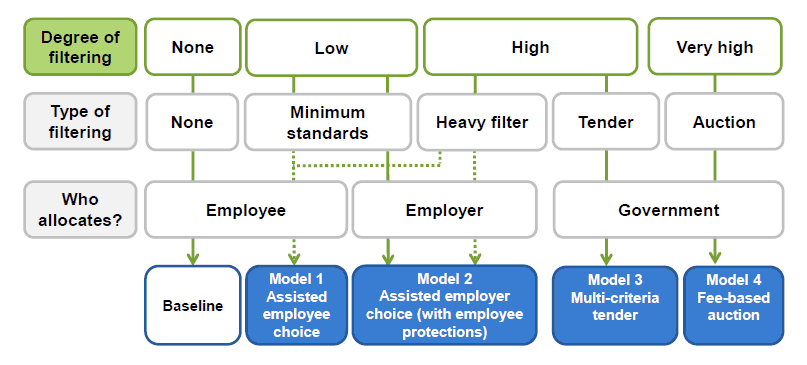

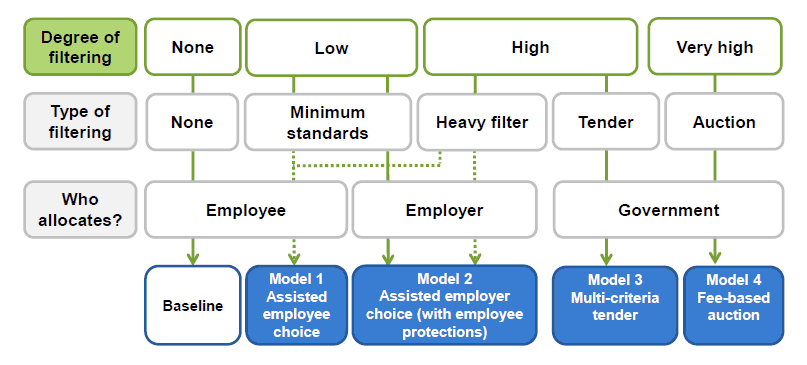

Superannuation is very complex and choosing the right product can be overwhelming for members and employers. The models all aim to address this complexity by either improving the quality and comparability of information and/or simplifying choice to a smaller set of products. The four models vary by the degree and type of filtering (which narrows the set of choices), and who ultimately allocates members to products.

Model 1: Assisted employee choice

In this model employees choose a superannuation product themselves (active choice), but are assisted by a set of policy interventions. The primary feature is a non mandatory shortlist of 4 to 10 high quality products that are selected using a thorough administrative filter. The shortlist would be accompanied by simple information on key features of each product in a consistent and comparable format.

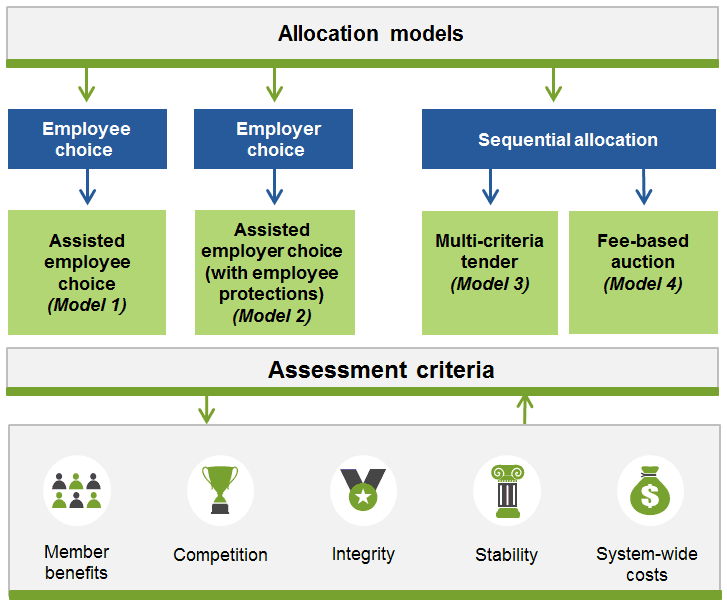

Overview of models

Supplementing this would be a voluntary system of product accreditation (a longer list of quality products involving minimal filtering), which would encourage funds to provide products which have a common, simple design that allows for easy comparisons across different products. Product accreditation would be akin to a strengthened MySuper authorisation process (with a stronger emphasis on minimum performance standards).

Finally, a simple, low cost last resort fund would hold contributions from employees who fail to exercise choice and encourage them to choose their own product.

Model 2: Assisted employer choice (with employee protections)

In this model, employers choose a default product for their employees who do not exercise choice. A long list of default products that meet mandatory minimum standards (the light filter) is the primary feature. These minimum standards are important to protect member interests given the potential for conflicts of interests in the employer choice environment. The light filter would be akin to a strengthened MySuper authorisation process (with more emphasis on minimum performance standards).

Second, a thorough filter would apply criteria around investment performance and other product features to identify a 'preferred default' list of the best performing default products. This would be voluntary for employers and designed to assist those not well placed to select default products for their employees.

The model recognises that some (mainly larger) employers are well placed to choose a default product and negotiate favourable arrangements for their employees, while many (mainly small and medium size) employers are not and would benefit from some assistance.

Model 3: Multi-criteria tender

In this model, fund participants compete for rights to a share of the default pool by making proposals against a number of different assessment criteria, which are weighted by their relative importance. A well designed multi criteria tender could therefore engender a product that performs well on the key areas that matter to members.

Funds would submit bids against criteria such as past performance on net returns and member satisfaction, investments strategy, member services, fees, and innovation in unspecified areas. Five to ten of the best product offerings are chosen by a Government appointed selection body, with a best and final offer stage used to encourage convergence where proposals are close. The winning products are then allocated new entrant default members on a sequential basis.

Model 4: Fee-based auction

A fee based auction would see funds compete for default status by out bidding each other on fees. To the extent that investment returns are largely market driven, competition on fees would promote long term net returns. Funds would submit a sealed bid to the Government appointed selection body specifying their investment and administration fees, and combined with a best and final offer process, this would produce one to five winning products that would be allocated new entrant default members on a sequential basis. A set of minimum standards would address non fee product characteristics like investment strategy and member services.

What features are common across all models?

Defining the default pool — Employees who fail to exercise choice will be allocated to a default product only once — typically on joining the workforce — and will retain that account unless they actively switch (employees maintain the right to choose their own fund and product at any time in all models). Restricting the default pool to first timers would reduce wasteful account proliferation, particularly among younger members. Under all models, any fund whose product is awarded default status must extend the same fees and service terms to its existing members in the default product.

The default product — Default products selected under all models should be simple and provide the minimum services necessary to meet the Government’s stated objective for superannuation — that is, to provide income in retirement to substitute or supplement the Aged Pension. The quality or range of ancillary services should not be the main driving factor in selecting default products — funds should compete primarily on long term net returns and costs for a threshold level of service.

Default product selection process — All of the models require a body responsible for selecting eligible products. The Commission considers that this body should be established and overseen by the Australian Government. Its composition and conduct should be subject to several key principles including: a strong focus on member interests, sufficient expertise to evaluate products, be free of conflicts of interest, and accountable for its decisions. The product selection process should initially be repeated every four years and can be reduced in the future.

How has the Commission assessed and compared the models?

The assessment framework involves promoting members best interests and more broadly, the wellbeing of Australians. The alternative models were assessed against five assessment criteria: member benefits, competition, integrity, stability and system wide costs. Models were compared to a baseline of unassisted employee choice. The baseline should not be interpreted as an alternative model but rather an objective starting point against which to compare the relative merits of the models.

What next?

The Productivity Commission is keen to hear your feedback on this draft report. You are welcome to make a written submission to the Commission, by 28 April 2017. Alternatively you can leave a brief comment. Public hearings will be held in early May 2017 — likely locations are Sydney and Melbourne. Information on making submissions and hearing dates is available on the inquiry website: www.pc.gov.au/inquiries-and-research/superannuation/alternative-default-models

The final report will be provided to the Australian Government in August 2017. The Australian Government may consider implementing one of these models following the Commission’s future review of the efficiency and competitiveness of the superannuation system, which will take place after 1 July 2017.