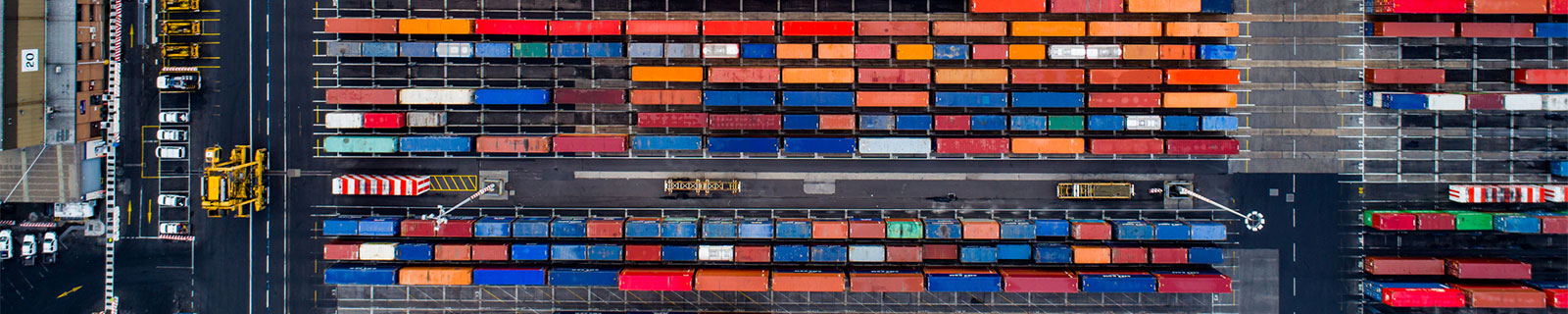

Australia's maritime logistics system

Final report released

Final Report

The report examines the performance of Australia's maritime logistics system, long-term trends in system performance, competition, industrial relations, infrastructure constraints and technology uptake.

The final inquiry report was handed to the Australian Government on 21 December 2022 and publicly released on 9 January 2023.

Inquiry timeline

Terms of reference

Call for submissions and comments

Initial submissions due

Draft report

Final submissions due

Public hearing

Final report sent to Government

Final report released