Remote area tax concessions and payments

Study report

This report looks at the effects of the zone tax offset, remote area allowance and remote area concessions for fringe benefits tax on people and businesses in remote areas. The report makes recommendations on whether these remote area tax concessions and payments should continue and, if so, what form they should take.

Download the overview

Download the report

Key Points

- Remote area tax concessions and payments are outdated, inequitable and poorly designed. They should be rationalised and reconfigured to reflect contemporary Australia.

- Remote Australia has changed considerably since the introduction of the first of these concessions in 1945. Many areas once considered isolated are no longer so, and improvements in technology have reduced the difficulties of life in remote Australia, although to a lesser extent in very remote places.

- About half a million Australians live in remote areas far from cities and regional centres. The tyranny of distance makes living and doing business challenging, with many things taken for granted by most Australians unavailable or difficult to get. Yet for those in remote Australia there is frequently a strong personal or cultural connection to a place and community as well as to the way of life it offers. Others are attracted by job opportunities.

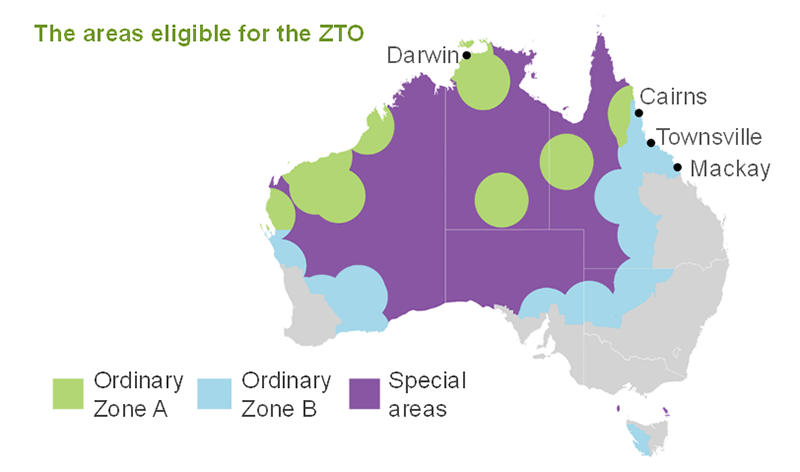

- The zone tax offset (ZTO), remote area allowance (RAA), and fringe benefits tax (FBT) remote area concessions are designed to redress some of the inherent challenges of living in, or to support, parts of regional and remote Australia.

- The ZTO - a small tax concession available to residents of specified areas - is outdated. As it currently operates, it is poorly-targeted, and ineffective as a magnet for remote living.

- It lacks a compelling contemporary rationale, and should be abolished. In many cases, higher remuneration for jobs in remote Australia compensates workers, at least to some extent, for the disadvantages of remote living.

- If the ZTO is retained, only those people living in very remote areas should be eligible.

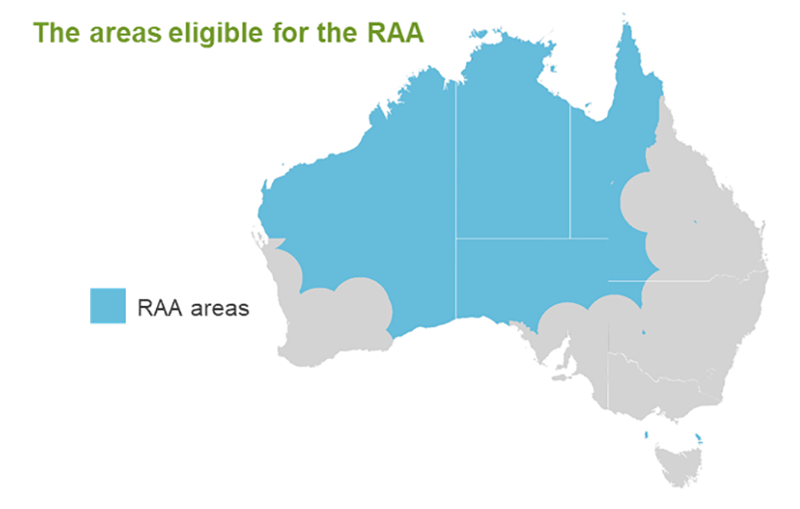

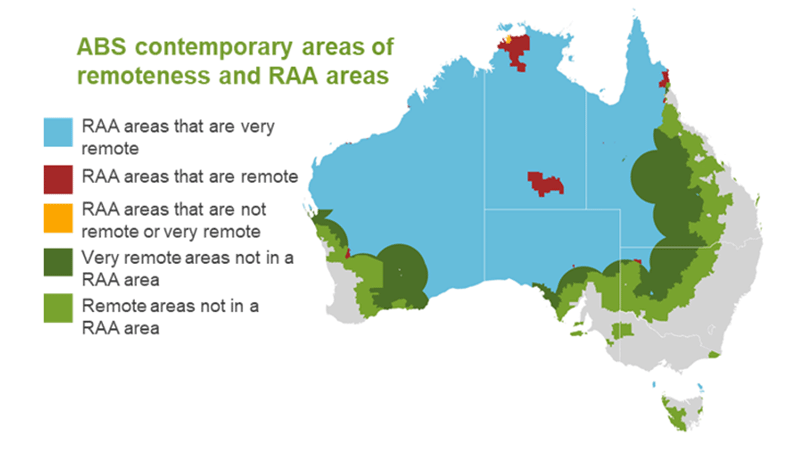

- The RAA is a supplementary payment for people on income support in remote areas. It partially compensates for higher living costs. The majority of recipients face socioeconomic disadvantage and barriers to mobility. Being out of the labour market, RAA recipients do not benefit from the remuneration premiums that apply to ZTO recipients.

- The RAA has a legitimate role — it can serve to partly compensate people on income support for higher living costs and less ready access to services. But it needs a refresh — with boundaries set around very remote Australia only and payment rates reviewed.

- FBT concessions for remote areas have dual objectives: equitable tax treatment where employers have operational reasons to provide goods and services to employees; and regional assistance goals.

- The most compelling argument for these concessions is the former. But current concessions are overly generous and complex, thereby creating other inequities. By virtue of their broad application, they are ineffective in supporting service delivery needs and regional development.

- The concessions should be redesigned to be more tax neutral. This would reduce the scope for differential tax treatment to distort investment decisions — delivering more efficient outcomes and generating tax revenue that could be used for other priorities.

- Most significantly, the exemption for employer-provided housing should be changed to a 50 per cent concession (as it was prior to 2000), and provisions allowing employers to claim housing exemptions solely because it is ‘customary’ should be removed.

- In looking at alternative mechanisms to support regions, governments should be cautious of top-down approaches. While there are few one-size-fits-all solutions, harnessing existing capabilities and locational advantages should be at the core of any such strategy.