Optimal industry policy

Speech

Deputy Chair, Alex Robson, addressed the CSIRO Innovation for Impact Summit.

Download the speech

Read the speech

Introduction

Thank you for the invitation to speak today, it is a pleasure to address the CSIRO Innovation for Impact Summit. The conference topic is of vital importance. After all, innovation and the diffusion of ideas are key drivers of improvements in labour productivity – output per hour worked.

And over the last decade, Australia’s productivity growth has averaged just 1.1% per year – the slowest growth rate in 60 years. Over the year to March, productivity fell by 4.6%. These trends are concerning because in Australia, almost all sustained increases in real wages have been underpinned by improvements in labour productivity growth.

Real wages have been falling over the past year. Household budgets are being stretched, particularly when it comes to purchases of essentials. Our cost-of-living challenge is, in reality, a productivity challenge by another name. 1 And responding to many of the challenges highlighted by last week’s Intergenerational Report – fiscal consolidation, an ageing population, inter-generational equity, and decarbonising our economy – will be assisted by a return to healthy productivity growth.

On a more positive but not unrelated note, our unemployment rate remains low at 3.7% – below many economists’ estimates of full employment. While a low unemployment rate is obviously very welcome, it does present special challenges of its own – including for industry policy. Today I will discuss some recent developments in industry policy in Australia and around the world, and provide some remarks on the optimal design of these policies in light of these developments and Australia’s ongoing productivity challenge.

Missions

The CSIRO is engaged in a program of mission-oriented innovation 2, and much of the conference has been devoted to this topic. It’s an important discussion to have. As many of you would know, the idea is not new. Indeed, on one view it has been around for centuries.

For example, in ancient times a state of war helped to focus the minds of leaders and the population, providing a well-defined mission that sometimes encouraged innovation. A case in point is Caesar’s innovation of the double wall encirclement of Vercingetorix in 52BC at the Battle of Alesia, which enabled the Romans to starve out the Gallic troops and prevent reinforcements from joining the battle. This mission-led innovation arguably changed the entire history of the Roman empire. More recently, some argue that the Longitude Prize in the 18th century was an early example of mission-led innovation. 3

And we are all familiar with the example of the Apollo mission. The point is, the idea of carefully planning and coordinating innovation effort and resources around a well-defined problem, or directing those resources towards the achievement of a specific end goal – with all advantages and disadvantages that entails – has been around for quite a while, in both the private and public sectors.

Nevertheless, in the innovation space there are likely to be significant unexploited productivity gains from thinking carefully about the contours of the various tradeoffs involved with different organisational forms and models of coordination, and what mission-oriented innovation should actually look like in practice, as opposed to theory.

My own sense, based on limited knowledge of specifics, is that the terms of those tradeoffs probably vary quite a bit, and it is unlikely that a one-size fits all approach to missions is suitable for all forms of innovation.

But stepping back a bit, the question often encountered in the design of industry policy is: whose mission are we talking about? After all, in a market-based liberal democracy like Australia, everyone has their own mission: to pursue the best outcomes they can for themselves, their families, their friends, their neighbours and their community.

So the key policy question is: whose mission, and who does the planning – government, market participants, or some mix of both?

At one end of the industry policy spectrum, there are policies like the R&D tax incentive, which attempt to take advantage of individual decisions around innovation planning and execution, in what I will call market-led missions – where specific actions and innovation decisions tend to be guided by market prices and the desire to earn a profit and avoid losses.

Here it is important to emphasise, as the economist Ludwig von Mises did, that ‘the market is not a place, a thing, or a collective entity. It is a process, actuated by the interplay of the actions of the various individuals cooperating under the division of labor.’ 4

It all sounds very abstract, but a moment’s reflection suggests that a great deal of mission-oriented innovation probably takes place in this decentralised cooperative setting. Market-led missions can be huge in scope and bring together thousands of workers to co-ordinate their activities – such as how to export more than 80Mt of iron ore to China in three months. 5

Or they can be small, micro-missions, such as small businesses adopting a new technology to achieve modest ends. Indeed, Australia has over 2.5 million businesses 6, and, as outlined in our recent Advancing Prosperity report, 98% of them do not engage in new to the world innovation of the kind that CSIRO missions build on. Instead, they adopt and adapt the inventions of others to their own circumstances.

But the productivity gains from this diffusion – involving millions of market-led innovation missions – are likely to be significant. Indeed, it has been argued that the distinguishing feature of some of the world’s most successful economies – including the German speaking and Nordic countries – is less a commitment to radical innovation than long-established excellence in adapting and diffusing incremental innovation (Ergas 1986).

In this respect, as we also discussed in our recent Advancing Prosperity report, there is an important role for government in removing barriers that might be preventing the diffusion of best practice. And, with respect to the role of market prices, competition policy settings and policies around market dynamism and openness are critical.

After all, market prices ‘are a signal wrapped up in an incentive’ 7, conveying important information to producers and consumers regarding changes in preferences, opportunity costs and relative scarcity. Prices act as important coordination devices and a clearing-house of decentralised knowledge. 8 If market prices are distorted, businesses and consumers will get the wrong signals and engage in the wrong market-led missions.

At the other end of the spectrum are those commentators – notably Professor Mariana Mazzucato of the University College London – who have argued that we should extend the concept of highly planned mission-oriented change to the entire economy.

In her book Mission Economy, Mazzucato advocates a top-down approach to whole-of-society problems, where government defines grand social missions and attempts to put the whole economy on a guided trajectory, providing ‘systemic directionality’ for an extended period of time. 9

The scope for failure and spectacular waste under this approach seems great – and this historically proven to be so – but Mazzucato seems to view this as a feature rather than a bug. Mazzucato also seems to downplay the possibility of government failure. 10 Moreover, even when it has succeeded, this has relied on an economic context in which markets work well, both assisting in the mobilisation of resources and in rapidly spreading any resulting innovations into commercial activity.

The Commission sees substantial risks in the approach Mazzucato advocates. While there may be a place for more micro-mission-oriented approaches to specific innovation challenges – of the kind that the CSIRO is pursuing – the case for adopting more of a macro-mission-oriented approach to address broader social and economic problems is not strong. And waste in the name of a mission is still waste.

How, then, to think seriously about national industry policy?

The Productivity Commission has its own mission: 11 we are the Australian Government’s independent research and advisory body on a range of economic, social and environmental issues affecting the welfare of Australians. We apply robust, transparent, and consistent frameworks to our analysis of public policy issues, and we adopt a community-wide perspective when doing so.

Our independence is underpinned by the Productivity Commission Act 1998 and our processes and outputs are open to public scrutiny and are driven by concern for the wellbeing of the community as a whole. If you want to do national industry policy, or mission-based policies, we have the tools to understand and analyse those issues, and we have been doing that at the national level for a long time.

The Trade and Assistance Review

So, what do we mean by industry policy? A recent paper by leading researchers provides a useful definition:

Those government policies that explicitly target the transformation of the structure of economic activity in pursuit of some public goal. The goal is typically to stimulate innovation, productivity, and economic growth. But it could also be to promote climate transition, good jobs, lagging regions, exports, or import substitution. Since industrial policy targets structural change, a key characteristic is the exercise of choice and discretion by the public authorities: ‘we promote X but not Y,’ though the later part of this statement is typically left implicit. 12

This is broad but fully consistent with the way the Commission approaches the topic. Under s. 10 of the Productivity Commission Act 1998 (Cth), we have a statutory obligation to report annually on the effect of assistance on industry and on the economy as a whole. Our Act defines government assistance to industry as:

… any act that, directly or indirectly: assists a person to carry on a business or activity; or confers a pecuniary benefit on, or results in a pecuniary benefit accruing to, a person in respect of carrying on a business or activity.

We fulfil our statutory obligation by publishing an annual Trade and Assistance Review (TAR). In contrast with much of our other work, the TAR does not make recommendations to government. Nor does it undertake a detailed economic assessment of the desirability or otherwise of particular policies.

Governments often engage in industry policy for a variety of reasons, including – but not limited to – those related to conventional static notions of market failure 13, such as the provision of pure public goods, or subsidising the production of private goods and services that have positive spillover benefits or which are regarded as merit goods.

Whatever the reasons, it is clear that industry policy very deliberately involves interventions which:

- Tend to be selective or discriminatory in their treatment or promotion of certain sectors.

- Usually involve the exercise of discretion or choice by policy makers

From this, two further points follow.

- By definition, in a world of scarce resources, making selective choices about which sectors to support involves incurring an opportunity cost – the net gain of the next best alternative (for example, support could have been provided to a different sector). It is useful for policy makers and the public to know what those costs might be.

- In an open economy, depending on their design, selective industry policy choices can affect our trading position vis-a-vis the rest of the world. And the industry policy choices of our trading partners can affects us. Given Australia’s reliance on trade as a source of prosperity, it is important to have some idea of these trends and their impacts.

Thus, the primary task of the TAR is one of transparency. It sheds light upon – and quantifies the financial costs of – assistance to industry, in the form of tariffs, direct spending and tax concessions. And it presents a thorough overview of recent trade outcomes and policy developments in Australia and around the world.

Sometimes the TAR gets criticised. And it is true that it is not always perfect – in certain cases, due to the complexity of policies, estimates of assistance can involve more art than science. For example, the TAR has historically identified the ‘motor vehicle and parts’ sector as being amongst the most assisted sectors in the history of Australian industry policy, ranging from tariffs, to grants, concessional finance, procurement mandates, local content rules, and export incentives. And that was without counting all forms of assistance, and not counting assistance from State governments.

A previous Industry Assistance Commission Chair Bill Scales noted that ‘Assistance for the industry was so high that even the Industry Assistance Commission (a predecessor to the Productivity Commission) did not have the tools to measure the stratospheric effective rate of assistance to the sector from this complex labyrinth of protective assistance measures.’

The most recent edition of the TAR – our 49th – was released in July and covered the 2021-22 period. Several key points emerged from our analysis:

- Total Commonwealth government industry assistance was an estimated $13.8 billion (in nominal terms) in 2021-22, an increase of $460 million from 2020-21.

- Similar to previous years, budgetary assistance – spending and tax concessions – accounted for the vast majority of this assistance.

- Relative to their size, primary production and manufacturing attract the largest shares of budgetary assistance.

- Industry assistance in Australia and overseas no longer principally takes the form of the ‘at the border’ quotas and tariffs as it has in decades past. Instead, it is increasingly implemented in less visible forms ‘behind the border’ – subsidies, tax concessions, tax credits, budget spending on favoured sectors, concessional finance, domestic reservation policies, and local content rules.

- Finally, around the world, industry policy and trade protectionism are on the rise.

The Global Rise of Industry Policy and Protectionism

It is worth focusing on this last point in a bit more detail. What is driving the global rise of industry policy and protectionism? At the risk of offering a penetrating glimpse of the obvious, five factors are key:

- An increase in mercantilist and protectionist sentiment over the last decade.

- Growing concerns about economic resilience and vulnerable supply chains, particularly in light of the COVID-19 pandemic.

- Growing geopolitical and geostrategic tensions, including Russia’s invasion of Ukraine – but also in other parts of the world.

- The enormous challenges posed by policy responses to climate change, including most notably decarbonisation of energy systems.

- Recent policy responses by major economies, which tend to evoke responses from other countries. 14

On this last point, the Made in China 2025 initiative provides large subsidies to domestic industries to increase self-sufficiency. And as outlined in this year’s TAR, the recent US Inflation Reduction Act (IRA) includes tax credits for businesses and consumers for clean energy purchases – benefitting solar equipment manufacturing, batteries, electric vehicle (EV) manufacturing and energy-intensive manufacturing. Subsidies are also provided to the hydrogen and nuclear energy sectors.

Most notably, the IRA introduces a system of local content-related ‘bonus’ tax credits – additional subsidies for investments in clean energy technology based on where those investments are made, where inputs to production are sourced from, and where final production occurs These are a good example of trade-distorting industry policy: they are effectively trade barriers, created not by directly imposing taxes on imported goods, but by providing additional subsidies for the purchase of goods produced in certain locations.

Similarly, the US CHIPS and Science Act is aimed at increasing US manufacturing of advanced microprocessors. And, partly in response to concerns that some European manufacturers might shift to the US to benefit from the IRA’s provisions, the EU has proposed similar local content rules.

In summary, the resurgence of major economy industry policy has sparked an increasingly hidden global trade war.

How should Australia respond?

The question for Australia is how to best respond to these developments. Given the size of major economy industry policies, it should come as no surprise that the TAR concludes that attempting to compete with major economy industry policy is likely to prove a net negative for small open economies like Australia.

We do not have the fiscal resources and it would be like bringing a slingshot to a tank battle. And even if we did engage directly in this trade war, we would need to think very carefully about the signal it would send to our trading partners and what it might suggest about our ongoing commitment to the rules based international order – something which has benefitted us greatly in the trade arena.

Instead, living standards in small open economies like ours will be best served by continuing to focus where they are best placed to fit within global production patterns. In other words, we should continue to focus on our comparative advantages and think carefully about new sources of comparative advantage that are likely to emerge.

But we should avoid turning inwards and using trade and other policy measures to encourage the domestic production of manufactured goods as a replacement for lower-cost manufactured goods imported from abroad. Some commentators claim that such import replacing measures would constitute a ‘new’ approach to industry policy.

There is nothing new about it. It is the very essence – indeed the exact definition – of import substitution industrialisation (ISI): an ancient idea which was last fashionable in some developing countries in the 1950s and 1960s. 15 Seventy years ago, a strong manufacturing base was regarded as a sign of economic strength and success in advanced economies. 16 Indeed, between 1901 and 1950, the GDP share of manufacturing in Australia doubled, from around 10% to 20%. 17

Many developing countries, particularly those in Latin America and Africa, 18 looked at these trends and attempted to emulate them via import substitution industrialisation. Their goal was to address balance of payments problems, reducing demand for foreign currency and dependence on other markets.

These inward-looking policies failed badly, and were abandoned in favour of more outward looking export promotion strategies, leading to some success in South East Asia in the second half of the 20th century. The extent to which these policies contributed to this success is highly contested. And, in any case, they were far from successful elsewhere in the world – and the Australian economy of 2023 is very different from these case studies.

Given this history and our current level of economic development, it should go without saying that it would be highly inadvisable for Australia to go down the import substitution path.

As discussed at length in our recent report entitled Advancing Prosperity, the epoch which equated manufacturing with overall economic strength has long since passed, going the way of Paul Keating’s Morphy Richards toaster, the Qualcast mower, the Astor TV, and the AWA radiogram. 19

Manufacturing as a share of value added has been declining in Australia for several decades, falling from over 20 percent of GDP in 1950 to just 5.8% last year. 20 Services now comprise 80% of Australia’s GDP, and account for 90% of employment, and a large service sector is a feature of a mature and prosperous economy. 21 Over the same period, income per capita experienced a nearly fivefold increase.22 These structural trends – with some notable exceptions – are common among advanced economies. 23

This is not to say sectors like agriculture, mining and manufacturing are not important sources of Australia’s prosperity. On the contrary, they are. Indeed, agriculture and mining are our two most productive sectors. Manufacturing employs nearly 1 million Australians. 24 And many services can only be delivered via manufactured goods (think of the lightbulb; the iPhone, the personal computer, the electric vehicle).

The point is that while manufacturing is an important source of jobs and income for many Australians, times have changed since the 1950s: the size of the manufacturing sector as a share of output is no longer an indicator of overall economic strength. What matters more is the extent to which our individual manufacturers can improve their productivity – working smarter, not harder or longer – remain competitive, and exploit existing and emerging comparative advantages.

And this leads me back to opportunity cost: the revealed preference of most Australian consumers and workers seems to be that they increasingly prefer an economy dominated by market and non-market services: retail and wholesale trade; financial and other services; transport services; housing services; digital services and telecommunications; education, and finally the care economy – aged care, healthcare, and disability support.

We see headlines every day noting shortages of many of these workers – particularly in education, health care and aged care where there are genuine fears of overwork. More generally, business has legitimate concerns about skill shortages.

In some ways this is a nice problem to have. Australia’s economy is characterised by full employment and high-capacity utilisation, and the vast majority of workers are employed in services – where they are desperate for more workers. But under these circumstances, any industry policy that seeks to direct resources into other sectors and wishes to be taken seriously must confront two basic (but potentially very uncomfortable) questions:

- From which sectors are the additional workers going to be drawn? And, as a follow up,

- Which of the services sectors would you therefore like to shrink?

Conclusion: Towards an Optimal Industry Policy

Questions like this lie at the heart of opportunity cost and comparative advantage. Given the selective choices that are inevitably involved in industry policy and the opportunity costs involved, what is the best way forward? How should Australia respond to current developments? We cannot avoid risks. We can only manage them.

While it is obvious that we should not go down certain paths, there will often be a role for individual policies. What is best way to manage the risks? What are the policy interventions that will maximise the difference between benefits and costs?

Oddly enough, only a cost-benefit analysis can tell us the answer.

The Commission’s statutory obligations, our mission and our framework for assessing policies compels us to consistently apply a transparent, well-articulated, rigorous and evidence-based framework that takes into account economic, social and environmental factors from a community-wide perspective, noting that Australia is an open, market-based economy, and noting that certain policies may have different distributional impacts across the community.

Some have argued that this cost-benefit approach reflects old thinking. Others might counter that in the post-truth era and the dearth of hard-headed rigorous policy thinking, conventional cost-benefit analysis based on sound reasoning and carefully gathered evidence is actually a refreshing counter-culture, hitting back against a woolly-minded policy establishment. It’s an interesting debate for another time.

My own view is that the cost-benefit approach reflects – and is consistent with – the very best thinking in modern economics and the statements of Australian governments over many decades. For example, our framework is consistent with the Government’s own recently updated Guide to Policy Impact Analysis (OIA 2023) 25 which asks:

- What is the problem you are trying to solve and what data is available?

- What are the objectives, why is government intervention needed to achieve them, and how will success be measured?

- What policy options are you considering?

- What is the likely net benefit of each option?

- Who did you consult and how did you incorporate their feedback?

- What is the best option from those you have considered and how will it be implemented?

- How will you evaluate your chosen option against the success metrics?

As I said earlier, the Trade and Assistance Review does not undertake such cost-benefit exercises and makes no formal recommendations. But we welcome the Government’s recent commitment to rigorously measure the costs and benefits of industry policies. 26

A good cost benefit analysis of industry policies should account for economic, social and environmental factors and, given the recent global developments I have spoken about today, it should – where relevant – also incorporate analysis of risks related to supply chain resilience, geopolitical developments and national security concerns. 27 Such analysis should be clear-eyed, transparent and forward looking in its assessment of such risks.

While cost-benefit analysis should not be the final determinant of policy choices, in my experience it is a vitally important input into the policymaking process and a powerful decision-making tool, particularly when it sets out unintended consequences and conducts sensitivity analysis.

In the context of cost-benefit analysis, there are a range of questions which we believe – given what is at stake – policymakers should ask when thinking about different industry policy options:

- What are the prospects of additionality, per dollar spent?

- Is the proposed sector one that has a reasonable chance of being self-sustaining over the medium-to-long run, (for example because we expect world prices to rise over time)?

- If so, why aren’t investors jumping on board?

- If not, it is important to note that the costs of the initial industry assistance are likely just the beginning – the sector could be expecting taxpayer support in perpetuity.

- More generally, international trade is actually just another form of technology. 28

- Why is it necessary for the industry to be located in Australia, when Australia could import the same product from overseas?

- Is it because it’s a ‘charismatic’ industry and we like the idea of it being located in Australia?

- Is that really a sufficient reason for taxpayers to fund it?

- If there is a concern about supply chain disruptions, would the good be identified by a data-based approach to assessing supply chain vulnerabilities (such as that undertaken by the Commission in it’s Vulnerable Supply Chains report 29). And if so, would the same conclusion still apply in, say, 5 or 10 years time? (Recognising that major economy industry policy is already diversifying global sources of goods judged to be ‘critical’.)

- On the other hand, if a domestic production capacity was established in that good, what would stop the domestic producer of that good from simply exporting the good to take advantage of higher prices during periods of supply chain disruptions?

In other words, why do we think that domestic production of a globally traded good would safeguard Australia from global supply chain disruptions (a domestic gas production capacity did not safeguard Australia from global energy supply disruptions).

- What exactly is the shock we are concerned about?

- How many times would the supply of a good need to be disrupted, and for what length of time, to justify the additional costs of domestic production?

- Would there be another way of insuring against supply chain disruptions, such as pursuing alternative supply chains with trading partners, or maintaining a stockpile of that good?

- What other supply chain vulnerabilities and risks are we exposing ourselves to by insisting upon domestic production?

- If the policy goal is to address uncompensated negative externalities, such as those associated with climate change:

- Why isn’t possible to import the technologies and goods that address these externalities?

- And if we cannot import some of those technologies and goods, would the costs of establishing and maintaining a domestic production capacity be lower than alternative ways of addressing those externalities?

- Finally, is the industry policy goal to transition Australia workers out of sectors in decline? If so, in a full employment economy, why do industry policy proponents think that workers in affected sectors in decline will be unable to transition to new sectors? Why do we regard establishing and maintaining a domestic production capacity in a particular good as preferable to retraining for sectors that will naturally grow and emerge over time?

These are big questions, and there are many others. The Commission very much looks forward to thinking further about these issues and contributing to the policy debate.

References

Australian Government (2023a) Australian Government guide to policy impact analysis, Department of Prime Minister and Cabinet, Office of Impact Analysis, March. https://oia.pmc.gov.au/sites/default/files/2023-05/oia-impact-analysis-guide-march-2023_0.pdf

—— (2023b) Cost benefit analysis guidance note, Department of Prime Minister and Cabinet, Office of Impact Analysis, July. https://oia.pmc.gov.au/sites/default/files/2023-08/cost-benefit-analysis.pdf

Chakrabortty, A (2021) ‘The moonshot delusion’, New Statesman, 21 April. https://www.newstatesman.com/culture/2021/04/mariana-mazzucato-mission-economy-review

Commonwealth of Australia (2006a) Introduction to cost-benefit analysis and alternative evaluation methodologies, January. https://web.archive.org.au/awa/20080727204245mp_

/http://www.finance.gov.au/publications/finance-circulars/2006/docs/Handbook_of_CB_analysis.pdf

—— (2006b) Handbook of cost benefit analysis, January. https://web.archive.org.au/awa/20080727204245mp_/http://www.finance.gov.au/publications/finance-circulars/2006/docs/Handbook_of_CB_analysis.pdf

Cowen, T and Tabarrok, A (2015) Modern principles: microeconomics, 3rd Edition, NY: Worth Publishers.

Devarajan, S (2016) ‘Three reasons why industrial policy fails’, Commentary, Brookings Institution, 14 January. https://www.brookings.edu/articles/three-reasons-why-industrial-policy-fails/

The Economist (2020) ‘Why is the idea of import substitution being revived?’, November 6. https://www.economist.com/

finance-and-economics/2020/11/06/why-is-the-idea-of-import-substitution-being-revived

Ehrlich, I and Becker, G (1972) ‘Market insurance, self-insurance, and self-protection’, Journal of Political Economy, vol. 80 (4), p. 623–48.

Ergas, H (1986) Does technology policy matter?, Centre for European Policy Studies.

Garfinkel, M and Skaperdas, S (2007) ‘Economics of conflict: an overview’, Chapter 22 in Sandler, T and Hartley, K Handbook of Defense Economics, Volume 2, Elsevier.

Glazer, A and Rothenburg, L (2001) Why government succeeds, and why it fails, Cambridge, MA: Harvard University Press.

Hartcher, P (2023) ‘Saving globalisation from itself’, Sydney Morning Herald, 22 July, p. 32.

Hayek, F (1945) ‘The use of knowledge in society,’ American Economic Review, v.35(4), p. 519–30.

Irwin, D (2020) ‘Import substitution is making an unwelcome comeback’, Peterson Institute for International Economics, July 8. https://www.piie.com/blogs/trade-and-investment-policy-watch/import-substitution-making-unwelcome-comeback

—— (2020) ‘The rise and fall of import substitution’, Working Paper 20-10, Peterson Institute for International Economics. https://www.piie.com/sites/default/files/documents/wp20-10.pdf

—— (2023) ‘The return of industrial policy’, Finance and Development, June, 21-14.

Juhász, R et al. (2023) ‘The new economics of industrial policy’, Annual Review of Economics, 16: Submitted. DOI: https://doi.org/10.1146/annurev-economics-081023-024638 .

Kalish, I and Wolf, M (2023) ‘The return of industrial policy’, Deloitte, 12 June. https://www2.deloitte.com/us/en/insights/economy/industrial-policy-us.html

Krueger, A (1997) ‘Trade policy and economic development: how we learn’, American Economic Review, vol. 87(1), p. 1-22

Mazzucato, M (2021) Mission economy: a moonshot guide to changing capitalism, Harper Business.

McGuire, M (2000) ‘Provision for adversity: managing supply uncertainty in an era of globalization’, Journal of Conflict Resolution, December, pp 730-52.

Mingardi, A (2021) ‘Failing at liftoff’, City Journal, 5 April. https://www.city-journal.org/article/failing-at-liftoff .

Mulgan, G (2018) ‘Making mission-oriented innovation more than just words’, NESTA, 3 May. https://www.nesta.org.uk/blog/mission-oriented-innovation-seven-questions-search-better-answers/

Productivity Commission (2021a) Things you can’t drop on your feet: an overview of Australia’s services sector productivity, PC Productivity Insights, Canberra, April.

—— (2021b) Vulnerable Supply Chains, Study Report, July.

—— (2023a) 5-year Productivity Inquiry: Advancing Prosperity, Inquiry Report no. 100, Canberra.

—— (2023b) Trade and assistance review 2021-22, Annual report series, Canberra.

Robson, A (2022) ‘Future ready? Australia and international trade in the post-pandemic global economy]’, Griffith Business School and Economic Society of Australia (ESA), Brisbane, 6 May.

—— (2023) ‘Australia’s cost of living challenge’, Opening statement to Senate Select Committee on the Cost of Living, 23 June.

Rodrik, D et al (2023) ‘Economists reconsider industrial policy’, Project Syndicate, 4 August.

Salanie, B (2000) The microeconomics of market failures, Cambridge, MA: MIT Press.

Schuck, P (2014) Why government fails so often, and how it can do better, Princeton University Press.

Skaperdas, S et al (2022) ‘Trade, Insecurity, and the Costs of Conflict’, CESifo Working Paper No. 10033, October. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4259630

Waterbury, J (1999) ‘The long gestation and brief triumph of import-substituting industrialisation,” World Development, vol. 27(2), p. 323–41.

Winston, C (2006) Government failure versus market failure, AEI-Brookings Joint Center for Regulatory Studies, Washington DC.

Wolf, C (1993) Markets or governments: choosing between alternatives, Cambridge: MIT Press.

Footnotes

- Robson (2023). Return to text

- To the best of my knowledge, Ergas (1986) introduced the terms ‘mission-oriented innovation’ and ‘diffusion-oriented innovation’. Return to text

- Mulgan (2018). Return to text

- Von Mises (1949), p. 258. Return to text

- https://www.bloomberg.com/news/articles/2023-07-18/rio-tinto-s-second-quarter-iron-ore-shipments-decline-1 . Return to text

- ABS Cat. No. 8165.0. Return to text

- Cowen, T. and Tabarrok, A. (2015), p. 120. Return to text

- Hayek (1945). Return to text

- For critiques of the Mazzucato thesis, see Chakrabortty (2021) and Mingardi (2021). Return to text

- Shuck (2014), Glazer and Rothenburg (2001), Winston (2006), Wolf (1993). Return to text

- Productivity Commission Corporate plan 2022-23, p. 4. Return to text

- Juhasz et al (2023) p. 4. Return to text

- See Salanie (2000) for a thorough overview. Return to text

- On the return of industry policy see Kalish and Wolf (2023); Rodrik et al. (2023); Juhasz et al. (2023); and Irwin (2023). Return to text

- See Waterbury (1999); Irwin (2020a, 2020b); The Economist (2020). Return to text

- Krueger (1997) sets out the evolution of economic thinking on import substitution. Return to text

- Maddison Project Database 2020. Return to text

- Waterbury (1999). Return to text

- Keating, PJ (1992), 27 February: https://australianpolitics.com/1992/02/27/keating-blasts-liberal-party-fogies.html . Return to text

- Maddison Project Database 2020 and ABS Cat. No. 5204.0. Return to text

- Productivity Commission (2021a), p. 1. Return to text

- Maddison Project Database 2020. Return to text

- The OECD average share has declined from 18% to 13% over the last 25 years. Declines have been experienced in many OECD members, including Japan, Germany, France, the UK, and the US. Korea is a standout exception, maintaining a share of around 25% over the period. Return to text

- ABS Cat. No. 6291.0.55.001, Labour Force, Australia, Detailed, Table 4. Return to text

- See also Cth of Australia (2006a, 2006b). Return to text

- Hartcher (2023). Return to text

- There is a significant literature on the economics of conflict, trade and conflict, provision for adversity and self-insurance. See, for example, Garfinkel and Skaperdas (2007), Skaperdas et al (2022); McGuire (2000), Ehrlich and Becker (1972). Return to text

- Robson (2022). Return to text

- PC (2021b). Return to text

Hugh Stretton Oration

Chair Danielle Wood delivered the 2024 Hugh Stretton Oration at the University of Adelaide.

Download the oration

Read the oration

I would also like to begin by recognising the Kaurna people as the traditional owners of the land on which we meet today. I acknowledge their deep connection to this place and pay my respects to their elders, past and present and to any Aboriginal or Torres Strait Islander people with us this evening.

Thank you everyone for being here. It is very special for me to be back at the University of Adelaide, the place where I experienced the heady years of my undergraduate Economics degree. Lots of long afternoons in the Reading Room of the Barr Smith library, the occasional equally long one at the Uni Bar (RIP), but an incredible spirit of learning, thinking and debate that was so foundational for me.

A huge thank you to the Provost, Professor John Williams AM, Deputy Vice-Chancellor and Vice-President (Academic) Professor Jennie Shaw and Professor Adam Graycar for having me back. I am honoured to have the Governor Her Excellency the Honourable Frances Adamson in attendance, as well as the University Chancellor, the Honourable Catherine Branson AC KC.

There are also a couple of other very special guests in the audience, my parents Rae and Simon Wood, who are hearing me speak for the first time in a professional setting this evening. And I am grateful that after listening to my almost constant talking from the age of two, they are still willing to come back for more.

Hugh Stretton’s legacy

It is also a huge privilege to have the opportunity to honour the professional contribution of Professor Hugh Stretton AC. Professor Stretton’s incredible intellect and impressive CV has been well detailed by the Vice Chancellor.

Three things stood out to me in reading about his professional life.

The first was his intellectual energy and imagination. I particularly enjoyed the reference provided by one of his former supervisors on his application to lead the School of History:

The first impression is of extremely high intelligence. He uses his gifts quietly, however, and is given as much to listening as to talking... He is quite clearly an exact and energetic scholar, though … I am not at all confident that he will publish either quickly or much. I have no doubt that he would build a School of History soundly and with imagination. 1

Now today, any mention of a relaxed approach to publication might be an automatic disqualifier, but the referee was right about Stretton’s suitability to successfully lead the department.

By the end of his tenure as chair in 1966 the School of History had gained a reputation as one of the best of its kind in Australia. 2 And much of this was down to Stretton’s reputation as a formidable thinker and public intellectual. 3 Ultimately in academia, and in life, the spirit of curiosity counts for much.

The second was Professor Stretton’s gift for turning new ideas into policy practice.

His most famous work, a book on urban planning called Ideas for Australian Cities, was so influential that when applicants were interviewed for positions in the Whitlam government’s Department of Urban Development, the first question was: ‘What do you think of Stretton?’. 4

While becoming the opener for a public service interview is a bar not many of us will reach, that spirit of marrying rigorous evidence with real world policy implications is one that I know that many of us strive for in our work.

And the third and perhaps most notable thing was Stretton’s unwavering belief in fairness and opportunity for all. He believed public thinkers have a responsibility to look for chances to make a difference, to reduce disadvantage and make Australia a place where anyone can prosper.

As he once said: “We should be doing all we can, by old and new means that fit our changing historical conditions, to leave Australia fairer than we found it”. 5

Tonight I hope to give you some ideas about how we take up Stretton’s challenge.

I’m going to take you through what we know about inequality in Australia today.

Using new analysis released this week by the Productivity Commission, I’ll show you the distribution of wealth and income in Australia and how it’s changed over time.

I also want to give you a sneak peek of some research we haven’t yet published on intergenerational mobility. This goes to the important question: how much does who your parents are, go on to influence your life outcomes?

To finish, I’m going to give you a ‘fair go toolbox’ – a set of policy allen keys that can fit the inequality problem at hand.

A few disclaimers...

But first let me start with a few disclaimers, and as I’m an economist rather than a lawyer I’m going to put these right upfront rather than buried in size 6 font in a footnote.

1. Economic inequality is a surprisingly slippery construct

‘The rich are different to you and me’, writer F Scott Fitzgerald once claimed. ‘Yes’, said Hemmingway, ‘they have more money’.

At one level inequality is that simple: some people have more money than others.

But as I will come to, economic inequality measures can vary a lot depending on what we are measuring – do we care about income, consumption or wealth?

And there can be a range of worthwhile questions to ask:

- How are those doing it toughest faring?

- How much do the most well off – say the top 10% or 1% – have compared to others?

- Or how are resources distributed across the population as a whole?

Each can give us different insights.

And that’s before we even get to the question of how opportunities and outcomes change over a person’s lifetime, or vary by gender, age or for First Nations Australians.

So, to manage this complexity, tonight I’m going with the maximalists – or perhaps the Strettonist – approach. I will take you through a range of indicators and cuts of the data to give you a broad account of the state of play. But I also want to talk about what this actually looks like in people’s lives.

As Stretton said:

“I’m not sure that much valuable reform has sprung from high theory about the dynamics of distribution. More has come from ...competent accounting, summarising and insistent publication of the patterns of inequality… and the effects of those distributions on the quality of people’s experience in life.” 6

2. Be a sceptic

It is somewhat uncomfortable to say this as the leader of the organisation that prides itself on evidence-based, often data-driven, analysis. But in almost all data analysis we deal with imperfect data and are forced to make choices about how to address that.

In inequality research those choices can make a big difference to the story.

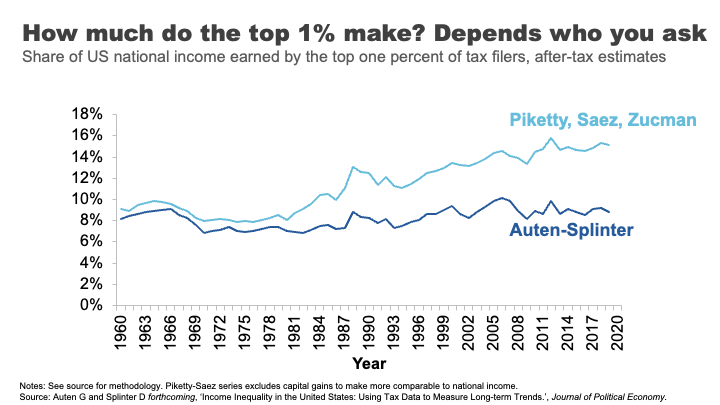

Very recently this challenge has jumped off the pages of academic journals and on to the front page of the Washington Post with the so called ‘inequality wars’.

On one side of the war you have famous inequality researchers, Thomas Piketty and Emmanuel Saez.

They have spent the better part of two decades analysing inequality, including by using American tax data to document a significant and growing share of US incomes flowing to the top 1%.

It’s rare to get rock star economists, but these guys are it.

(As an aside if you purchased but did not finish Piketty’s hefty Capital in the 21st Century back at the height of Pikettymania in 2011 you are not alone, on some measures it is the second most unfinished book on Kindle, after Hilary Clinton’s autobiography...). 7

On the other side of the war sit Gerald Auten and David Splinter – their names might not ring any bells.

These two relatively unknown tax code nerds come from the US Treasury Department and Congress Joint Committee on Taxation.

Using the same tax data as Piketty and Saez, they come up with the opposite conclusion: after tax, the share of US income going to the 1 % has barely moved since the 1960s.

Cue much triumph from some commentators and members of the press.

But beyond the simplistic discussions of Piketty and Saez being proved ‘wrong’ was the more nuanced truth – both sets of researchers had made a series of judgments around issues like how to estimate ‘missing money’ not included in tax returns, and how to attribute spending on health, education or defence across the population.

The appropriateness of each of these judgements is now the subject of further debate, but what is clear is that what might seem like technical judgments can sometimes have a big effect on conclusions.

In all the analysis I present tonight we’ve tried to be as robust and open as we can about any judgments made. But I encourage you to keep your sceptics hat on.

3. There will be graphs

I’m an economist, there will be lot of graphs this evening. But I’ll do my best to ‘use my words’ and hopefully we can avoid data overload.

Income inequality in Australia

Ok, let’s start with talking about the broad distribution of income in Australia.

I know it’s not always au fait to talk about what you earn in public, so I’ll ask you to do this exercise in your heads. I want you to think about whether you consider yourself to be a low-income earner, a middle-income earner, or a high-income earner.

Let’s see how you went.

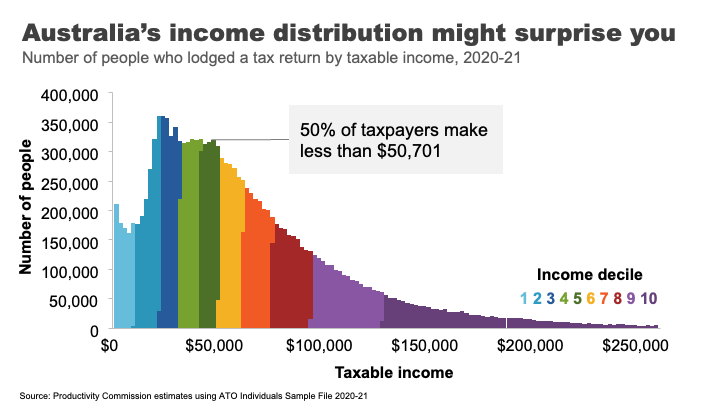

Here’s the distribution of Australian taxable income. That is, the income before tax but after you’ve made any allowable deductions.

If your taxable income is over about $51,000, you earn more than 50% of Australians who lodge a tax return. If you earn more than $95,000, that puts you in the top 20%. If you earn $336,000 or above – you are the 1%.

A surprising number of people get this wrong. In fact, the vast majority of us consider ourselves to be ‘middle income earners’. 8 This is probably because the people we tend to live near and associate with are more likely to be in a similar tax bracket to us.

This is presumably why every year or so high earners from the media and political class kick off passionate debates about whether $200,000 is really a high income 9 – while, I suspect, the 97 % of Australians earning less than that amount just roll their eyes.

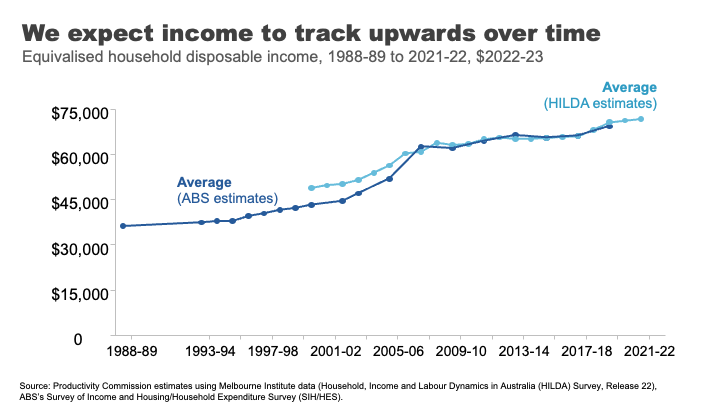

If we move to looking at using disposable income – that is income after tax and transfers – for an average Australian household, we can see that incomes have risen over time.

This is generally what we have come to expect, that outside of short dips during major economic shocks, income growth will continue its long march upwards over time.

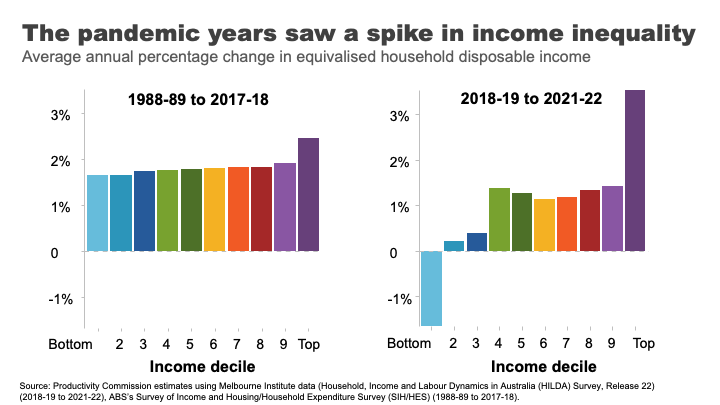

And how has this growth been distributed?

The answer is relatively equally across the population in recent decades.

Indeed, in the 30 years between 1989 and 2019, income grew pretty consistently across the income distribution. Those in the top 10% experienced slightly higher growth than other groups, but nothing like the strong growth in income inequality seen in the US that dominates much of our inequality discourse.

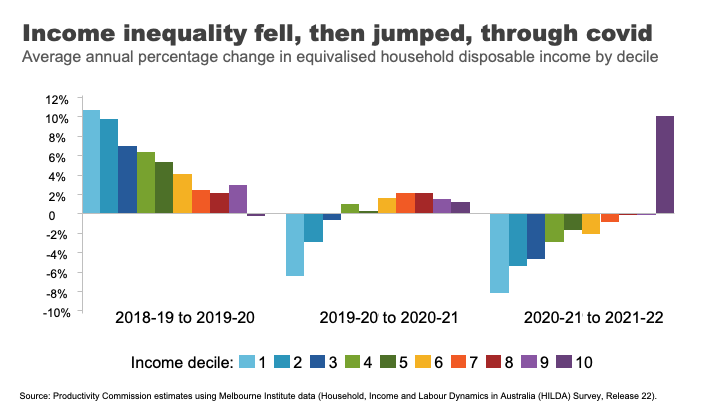

In contrast, the COVID period and its aftermath has seen greater dispersion with incomes at the top growing rapidly and those at the bottom going backwards.

The reasons are complicated, but reflect the roller coaster ride of lockdowns and recession, increases and withdrawals of government supports, and the healthy bounce back and high inflation that followed.

As you can see, the three years of the COVID period actually reflect three quite different inequality dynamics.

At the start of the COVID 19 pandemic, government-imposed lockdowns caused drastic declines in economic activity and widespread job losses. 10 In response, the Australian Government provided substantial support, which cushioned the economic harm across the community.

The effective doubling of the JobSeeker payment, and the flat $1500 per fortnight JobKeeper payment for workers in eligible businesses 11 produced high income growth for those at the bottom and middle of the income distribution.

As the economy re-opened, supports were withdrawn, those gains were reversed.

And despite the strong economy and labour market, high inflation meant real wages went backwards for most workers over the past two years.

In contrast, high income households benefited from rip-roaring growth in business income as well as decent investment income, as the economy recovered.

Overall, and barring any further major shocks, we can probably expect the next few years will bring a return to a more ‘normal’ income growth and certainly to the more consistent patterns seen across the distribution observed in the pre-COVID era.

It is also interesting to reflect on how we compare to other nations.

Egalitarianism is tied up with Australian identity. We are the land of the ‘fair go’, a place where your taxi driver, your boss, and even the Prime Minister can all be safely referred to as your ‘mate’.

But does the reality match the mythology?

Not entirely.

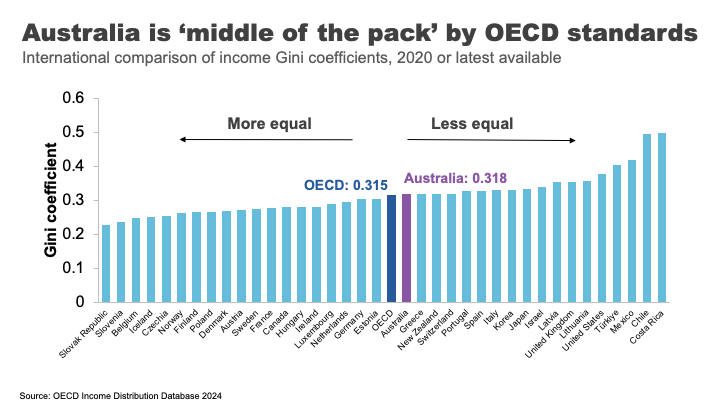

Australia’s income inequality is ‘middle of the pack’ by rich-country standards. Comparing based on the Gini coefficient – a measure of overall inequality – Australia is close the OECD average.

Overall, we not as unequal as our friends in the US and the UK, but nor are we as egalitarian as the Nordic countries.

One important reason for these large cross-country differences is differences in tax and transfer policies.

For example, the US starts relatively unequal, but by no means the most. But because they redistribute income less, they end up the most unequal of Western nations. 12 In contrast, Finland has close to US-levels of inequality before taxes and transfers. After, it is one of the most equal nations in the OECD. 13

These are important differences that highlight a point I want to come back to: policy choices matter to inequality.

But now we have a snapshot of how Australians across the distribution have fared over time and relative to elsewhere, I want to turn to another important part of the inequality story: outcomes and opportunities for the most disadvantaged.

Poverty in a rich country

It’s almost 40 years since Bob Hawke declared that no child would live in poverty by 1990. 14

But, according to ACOSS, one in eight people lived below the poverty line in 2019-20, including one in six children. 15

This measure of poverty looks at relative income poverty – it’s set at 50 % of the typical Australian household disposable income, less housing costs.

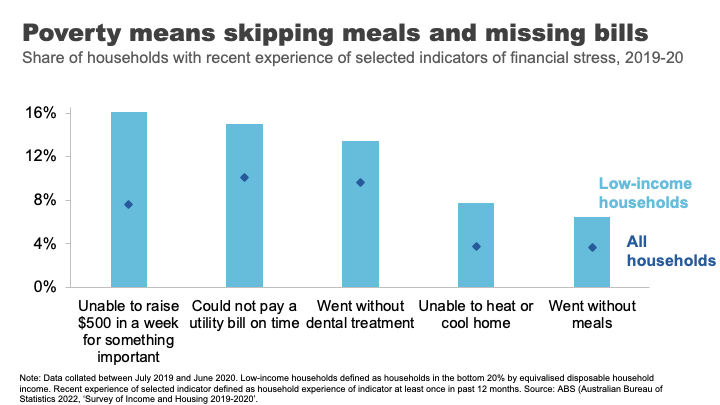

Some argue it is better to look at absolute measures (for example, the amount of money required to be sure a household can achieve a basic standard of living) or indicators of material deprivation.

For example, amongst low-income households in 2019-20, 16% were unable to raise $500 for something important, 8% were unable to heat their homes, and 7% went without meals. 16

And it’s that sense of precariousness that pushes the impacts of poverty from the material to the mental. And those impacts can have a long tail.

As journalist Rick Morton writes about his own childhood growing up in a poor household: 17

I saw Mum’s daily, sometimes hourly, battles to stay solvent. I saw how hard she worked and what it did to her body and her mind. The stress of even thinking of it now is difficult to explain. It is built not only into my own mind but also in my flesh. The things I will do to avoid the feeling today. The things I try to do for Mum to make it so she never has to feel it again.

The biggest risk factors for poverty are: being on JobSeeker or Parenting Payment. 18

Policy and poverty remain inextricably linked.

Wealth inequality in Australia

Of course economic differences are not just found in incomes. Wealth or how much money you have ‘behind you’ is an important determinant of outcomes too. Wealth is a buffer – it can be converted into future consumption opportunities and provides a sense of financial security.

That is why we understand the pensioner who owns their home and has $250,000 in the bank is in a materially different economic position to the single part-time worker who records a similar $30,000 income but has few assets.

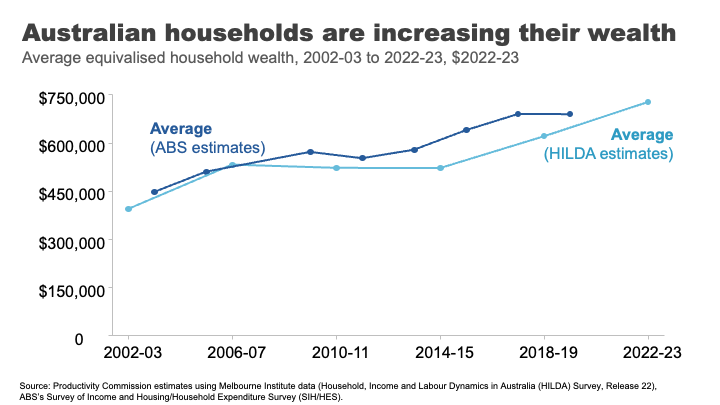

Wealth has grown significantly in Australia in recent decades.

I remember in primary school the shorthand for someone really, really, rich was a ‘millionaire.’ The average Australian household is now more than halfway to that benchmark. Indeed, a person that owns a typical house outright in Clarence Gardens is a ‘millionaire’. 19

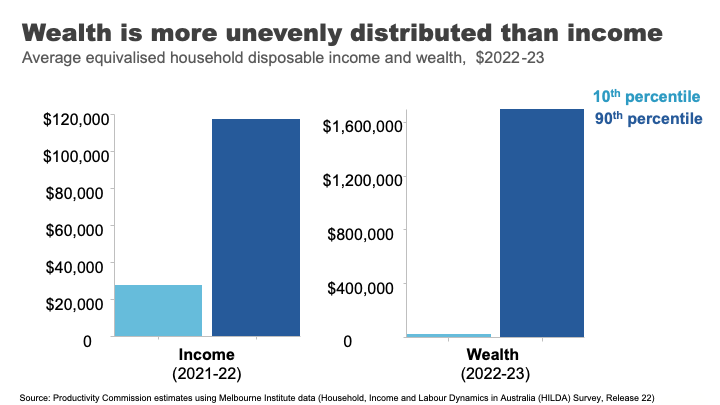

Wealth overall is much less evenly distributed than income.

If we take a household at the 90th %ile for wealth, they have almost 70 times as much wealth as the Australians at the 10th %ile. For income the figure is only four times as much.

Wealth also has much greater extremes.

In his 2013 book on inequality, Battlers and Billionaires, Parliamentarian and economist Andrew Leigh provided a memorable analogy, which I have updated today:

Imagine a ladder on which each rung represents a million dollars of wealth. If we were to put all Australian households on this ladder 50% of us are about halfway to the first rung, the top 10 % are about 1.5 rungs up, the top 1% are reaching for the fifth rung – just high enough to clean the gutters. 20 Gina Rinehart is more than 11kms off the ground. 21

But even with this very long ladder, Australia’s wealth inequality is lower than many other OECD countries. 22

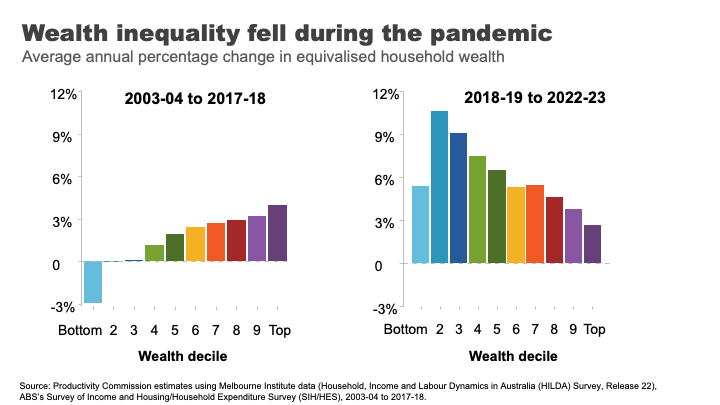

But an important question is how has the distribution changed in recent decades?

The answer is: it’s complicated.

Pre-pandemic, wealth grew faster for the top half of the distribution.

But the pandemic once again, produced some surprising results.

This pattern flipped and wealth grew more quickly overall and significantly faster for lower and lower middle wealth groups during the COVID period.

The two main reasons for this are:

- The strong growth in housing prices, particularly in the regions and the smaller capital cities. This had the biggest impact for homeowners in the lower middle and middle parts of the wealth distribution.

- Higher income from increased government support during the pandemic and fewer opportunities to spend, helped boost bank balances and debt repayment among low-wealth households. 23

And while this is good news for many households at least in the short-term, the longer-term run-up house prices has produced a different set of inequality concerns.

A decaying dream? House prices and inequality across generations

Here I want to stop and reflect on the different ways in which the very strong growth in house prices has impacted economic outcomes for different groups in Australia.

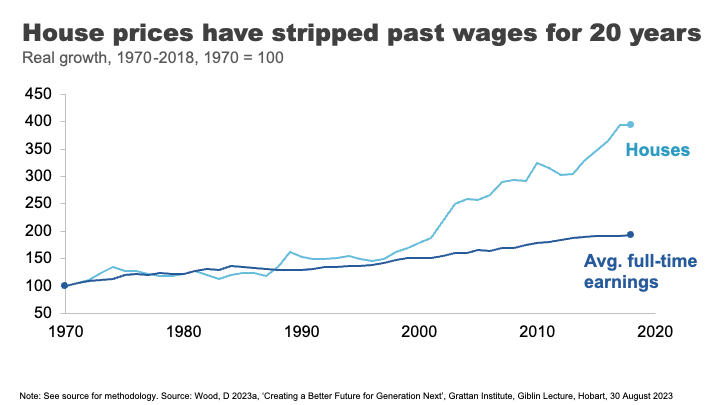

Until the 1990s, house prices broadly tracked growth in incomes. But between 1992 and 2018 they grew at almost three times the pace on average. 24

The effect has been an increase in the upfront barrier to home ownership and increasingly also the ongoing costs for those that are able to clear that hurdle.

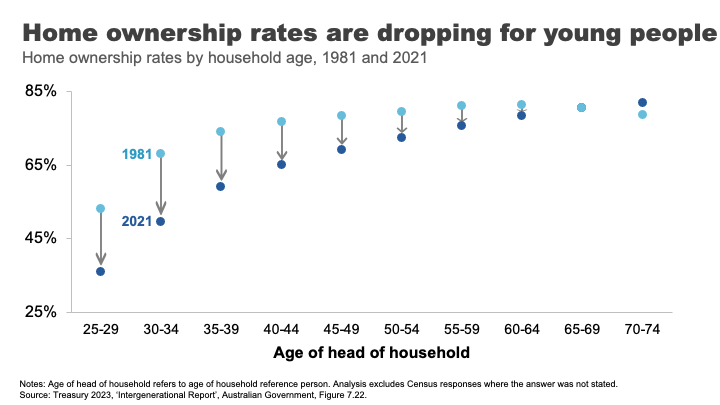

The result, unsurprisingly, has been falling home ownership.

In the early 1980s, when my parents were buying their first home, around 70% of those in their early 30s owned a home. Today that figure is just 50%. And the drops have been particularly acute amongst low-income young people. 25

The declining opportunities for homeownership are a particular source of dissatisfaction and unrest amongst many non-homeowning younger Australians. Amongst the so-called Generation Z non-homeowners, 93% want to own their own home. But only 63% think it is likely that they ever will. 26

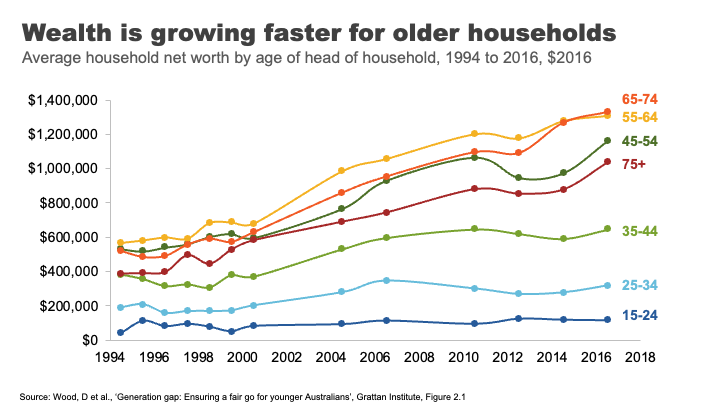

The rise in house prices has also contributed to rising generational disparities in wealth accumulation.

Older households have always had more assets on average than younger ones. But the run up in house prices has created windfall gains for existing homeowners. This has been a major contributor to the rapid growth in wealth among older households.

A household headed by someone aged 65-74 had on average $1.3 million in assets in 2016, up from $900,000 for the same age group in 2004. Rising asset prices over the past seven years mean this figure is almost certainly substantially higher now.

In contrast, the wealth of households under 35 has barely moved in 15 years. And poorer young Australians have less today than poorer young Australians did 15 years ago. 27

Overall the developments in the housing market over recent decades have left many, particularly many older Australians, very well off. But the cost has been considerable housing stress amongst the vulnerable, and a generation of younger Australians who will reach middle age with substantially lower rates of home ownership than their parents.

Land of the fair go? Social mobility in Australia

Now I want to move from the photo to the movie: from talking about disparity in economic outcomes at a point in time to talking about how these outcomes can evolve over someone’s life.

A question that has rightly been of interest to those concerned about inequality, is how does inequality in outcomes influence equality of opportunity. ;Or to be more specific – how much are economic opportunities determined by who are our parents are?

Generational mobility has historically been a hard thing to study. To understand its dynamics we need linked data on parental economic outcomes and those of their children over a long duration.

In the absence of this type of data, at least until recently, people got creative.

In one of my favourite studies, Parliamentarian Andrew Leigh alongside co-authors Gregory Clark and Mike Pottenger, identified rare surnames in the 2014 electoral roll among doctors and university graduates from 1870. They found, nearly 150 years later, that people with those rare surnames are more likely to be in the so called ‘elite’ professions than people with surnames such as Smith.28

Indeed, they found that so called ‘status persistence’ for surnames was as high in Australia as for England or the United States. 29

In somewhat brighter news, more recent studies using linked administrative data point to a more optimistic picture on social mobility in Australia.

Looking at economic outcomes for a million individuals born between 1978 and 1982 Economists Nathan Deutscher and Bhashkar Mazumder find that Australia is one of the more economically mobile advanced economies. 30>

Indeed, they find Australia’s ‘intergenerational elasticity of income’ (a measure of how much your family’s income affects your own) is similar to Canada and close to those of the Nordic countries, and considerably more mobile than places like the United States. 31

In forthcoming work the Productivity Commission uses family-linked tax data that confirms that estimates of intergenerational mobility remain comparatively high.

But in contrast, things may be stickier for those doing it toughest.

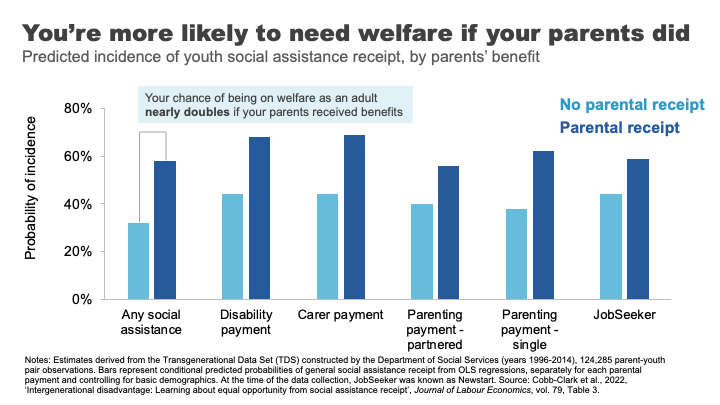

In a 2017 study, Professor Deborah Cobb-Clarke and her co-authors showed that young people are 1.8 times more likely to need social assistance if their parents have a history of receiving social assistance themselves. 32

Consistent with this, the Productivity Commission’s forthcoming work shows that people in their late 20s whose parents received social transfer payments were about one and a half times more likely to receive social transfer payments themselves.

The Cobb-Clarke work showed that these transmission effects were particularly pronounced for disability payments, payments for those with caring responsibilities, and parenting payments for single parents. Interestingly, disadvantage stemming from parents’ poor labour market outcomes was much less persistent. 33

Cobb-Clarke and her co-authors posit that parental disadvantage may be more harmful to children’s later life outcomes if it is more strongly driven by circumstances rather than personal choice.

This aligns with the growing appreciation by economists of the impact of lack of hope or despair in shaping life choices and outcomes. 34

This was the sentiment expressed by a Tasmanian woman on welfare supports: 35

It’s not so much what we are missing out on, it’s the next generation and it is a hard cycle to break because they look at it and think, well, what’s the point? We’re always going to be poor, things are hard, nothing’s going to get better. Why should we bother?

Schools under stress: a red flag for future mobility?

One of the foundational supports for economic mobility is a strong education system.

Indeed, educational attainment has been estimated to explain up to 30 % of the transmission of economic advantage between parents and children. 36

Australia has historically had a strong system of school education that has supported opportunities across the population.

But there are some red flags for future prosperity and mobility that we should heed.

Indeed, despite growing funding in recent years, Australia’s school system has not been delivering the results we want for our young people.

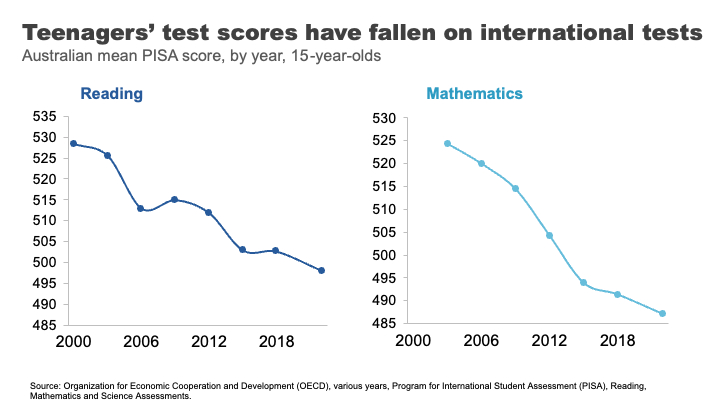

Data from the OECD suggest that the performance of Australian school students in Reading and Maths is going backwards, with significant falls in our levels of achievement since 2000.

Estimates based on this data suggest the average Australian Year 10 student in 2018 was eight months behind in reading compared to where Year 10 students were at the turn of the century, and results have largely flatlined since. 37 We’ve seen even sharper declines in mathematics scores, where the decline for Year 10 students by 2018 was almost a year of learning.

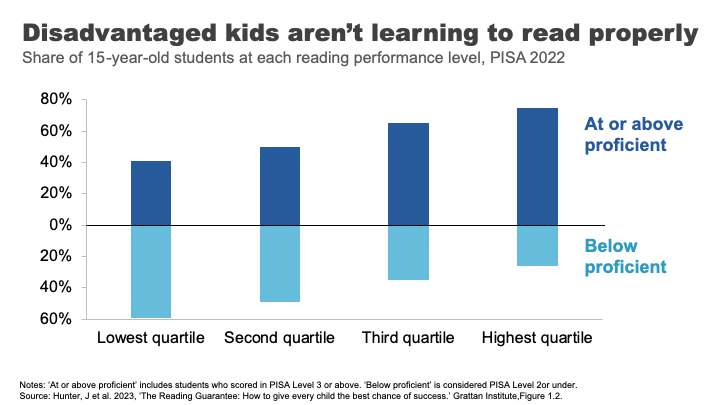

But how much does parental background make a difference to how students fare?

The answer is a lot. More than half of the most economically disadvantaged 15-year-old students in Australia are not proficient readers.

Analysis from the Grattan Institute shows that the disparity in outcomes was worse in Australia than in Canda or the UK and on par with the US. 38

These gaps in performance widen through the schooling process.

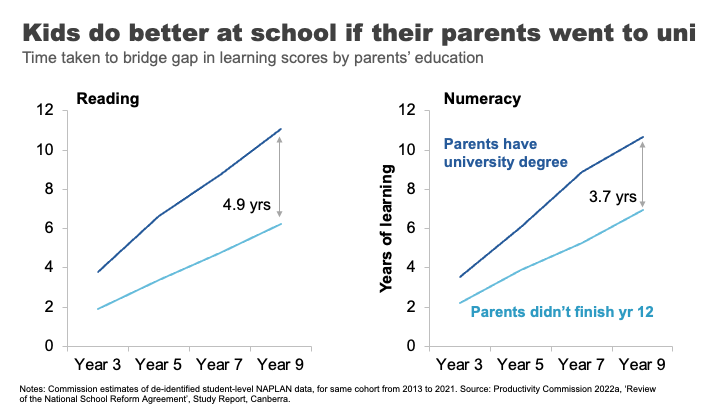

The Productivity Commission looked at this using NAPLAN data. 39 We compared the average reading outcomes of students whose parents did not finish high school to those whose parents have a bachelor’s degree or higher. We found the learning gap – equivalent to almost two years of reading achievement in Year 3, progressively widens to an almost 5-year learning gap by the time students reach Year 9.

For mathematics, the gap widens from 1.3 to almost 4 years.

If we take education as an indicator of both a country’s future economic prosperity and its social mobility – this data must concern us.

It has been pleasing to see senior leaders, including here in South Australia, engage with this issue and its implications. But turning the ship around will require significant shifts in the way we deliver education in Australia.

A nation divided: why mixing matters for mobility

Another less obvious mobility-enhancer is where we grow up, and more specifically, who we grow up with.

US economist Raj Chetty and co-authors made a splash in 2014, when their study using administrative records on the incomes of more than 40 million children and their parents found very large variations in social mobility across the US. For example, they estimated a child from the poorest 20% of families had nearly a 3 times better chance of making it into the top 20% of income earners as an adult if they lived in Silicon Valley rather than Charlotte North Carolina. 40

In a later paper, Chetty and another co-author reinforced the importance of these neighbourhood effects by studying outcomes for families who moved to different parts of the Unites States.

They found that outcomes for children whose families move to a better neighbourhood improve the more time they spend there.

Indeed, every additional year in a ‘good neighbourhood’ sees that child’s outcomes converge closer to the average for that neighbourhood by about 4 %.41

And if you are thinking that this type of locational lottery could only exist in a place as unequal as the United States – think again.

Economist Nathan Deutscher has replicated this work for Australia. 42

And while the dipartites between regions are less pronounced here, we see the same convergence in outcomes, the longer a child is exposed to a ‘good neighbourhood’.

Deutscher finds that place matters most during the teenage years and suggests it might be ‘peer effects’ that explain locational differences in outcomes.

In other words, who you hang around with in those formative years makes a difference. Which may well be a validating result for any parent that has ever uttered the immortal phrase: “If Tanya jumped off a cliff, would you do it too?”.

This is consistent with more recent work that suggests it is economic connectedness – the capacity of low socioeconomic people to make friends with those from higher socioeconomic groups – that is the principal driver of social mobility. 43

And this is the very thing that gets lost as neighbourhoods and schools become more stratified and we participate less in social mixing opportunities. This means that observed declines in the types of activities that help build the social glue – from volunteering, to local sport, to attending church – over time might further erode social mobility.

What’s a policy maker to do?

Where does all this leave policy makers?

How much policy makers should seek to address inequality is not a straightforward question. It has been dissected by philosophers since Plato. And economists have been at intellectual fisticuffs over it for much of the past century.

Today, even the strongest advocates for greater equality will acknowledge that some inequality is inevitable and that it is important to maintain incentives for innovation and effort.

Many of the richest people in the world – Gates, Dyson, Musk – are innovators whose work has reshaped our lives. It is at least partly the ‘size of the prize’ available to successful innovation that drives the efforts and risks of would-be innovators and entrepreneurs.44

On a more relatable level, let’s think of the University we are at tonight. Would we expect students to flow through these gates to spend years of their lives learning about engineering or medicine or economics, and to work long hours while establishing themselves in their career, without some return for these efforts? In other words, incentives are important for growing the pie, even if they result in a somewhat unequal distribution of it.

On the other hand, even many of capitalism’s biggest cheerleaders raise concerns about the social and economic implications of stark economic dispersion.

Recently the IMF has warned that high inequality and especially poor social mobility can impact on long-term economic growth. 45 Others have shown that physical and mental health problems are worse in more unequal societies, predominantly due to the physiological stress of operating within a steep economic hierarchy. 46 And still others have linked rising inequality, or declining social mobility, 47 with the rise of populism as the ‘left behind’ lodge their protests vote against the so called elite.

All of this is to say that targeting inequality is complex. And while the ‘line’ across which inequality flips to doing more harm than good is far from clear, what is clear is that policy makers have a broad set of tools that can help push in their desired direction.

A policy makers’ toolbox

A few years ago, a group of high-profile economists organised an international conference on combatting inequality with a mission of engaging with the full suite of policy responses. 48

Their conclusion, although not revolutionary, provides helpful clarity: that the right policy response depends on why you care about inequality.

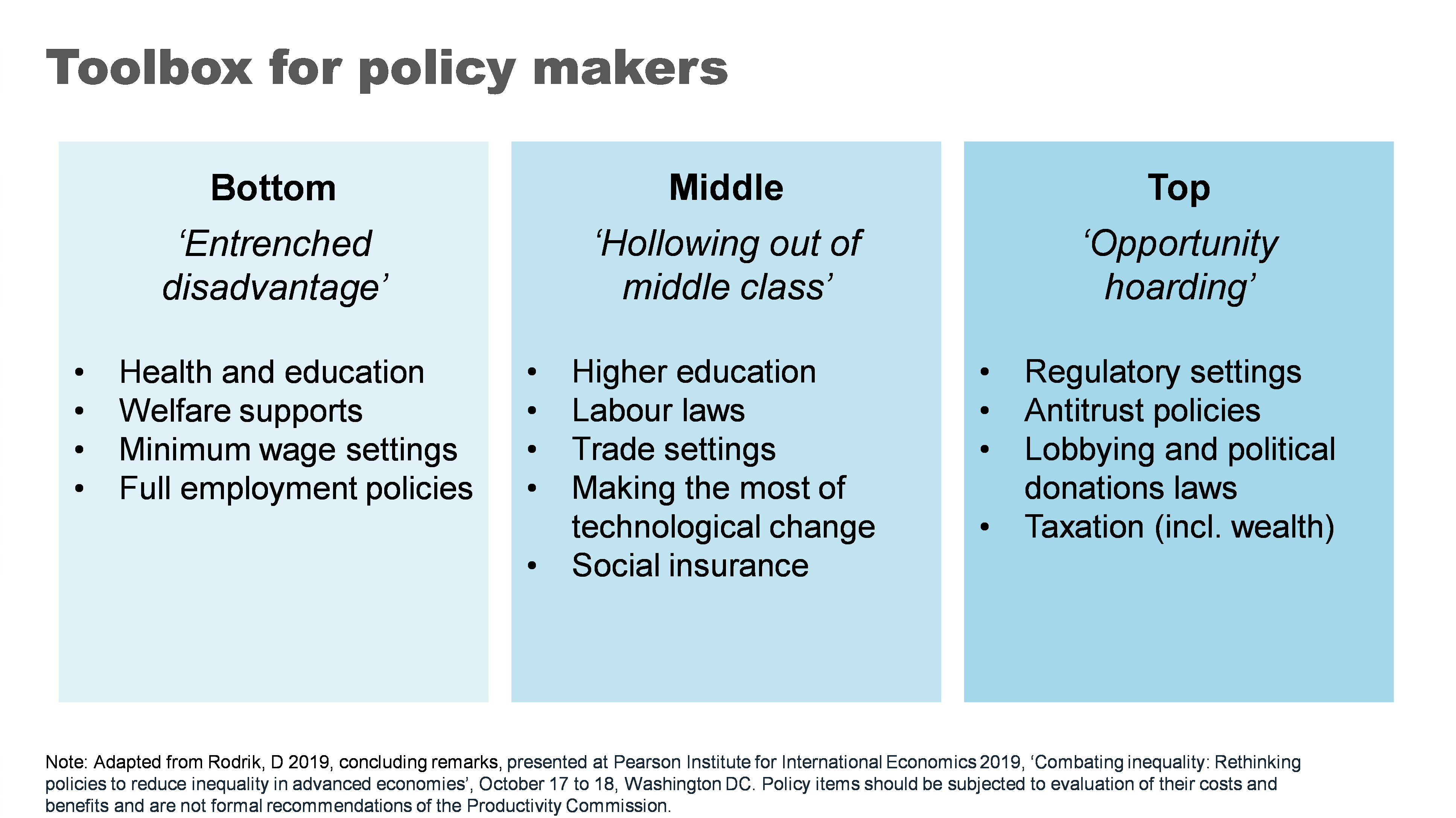

In particular, they draw a distinction between policies concerned with:

- outcomes for most disadvantaged – particularly for addressing entrenched poverty

- boosting opportunities for a ‘hollowed out’ middle class – a much greater concern in the United States than here, where, as we have seen, income growth has been broader based

- opportunity hoarding – or the way wealthy people might leverage their economic and political power to entrench their position.

The right policy tool will also depend crucially on whether policy makers are more concerned with equality of opportunity or outcomes.

Below is an adapted version of the taxonomy they created. It shows the breadth – and importantly the targeting of different levers that a would-be inequality buster might pull.

Now I do not advocate for all of the policies proposed. Indeed, whether any of these policies would be a good idea would require careful analysis of the costs and benefits in the particular context you might use them. There are probably good ideas that have been left out too.

But I did want to talk very briefly about four of the ‘biggies’ that I think really matter in an Australian context.

Growing the pie can mean bigger slices for all

Now in a presentation largely focused on distribution of the pie, I want make the case for making the pie bigger.

A cross-country and cross time evaluation suggests that growth is effective in reducing poverty. 49 Indeed, incomes for the bottom 10% are highly correlated with overall economic growth – a rising tide lifts some very important boats. We could put this beyond doubt for Australia by addressing some of the weaknesses in the current social safety net - a point I’ll return to.

The impact of higher economic growth on overall inequality is less clear. 50 But what is clear is that faster economic growth gives governments more room to support more generous welfare policies as well as other social spending on areas like education and health that particularly benefit those at the bottom and middle of the income distribution.

More generally healthy income growth can also support the political ‘buy in’ for these types of policies. 51

As for what governments can do to grow the pie – that would be a whole other lecture. But if the pie is of interest: ‘here’s one I prepared earlier’. My colleagues have published a comprehensive 1000-page guide for governments looking for ways to boost productivity and growth. 52

Fixing the housing mess

A functioning housing system is critical for improving our social and economic outcomes. Building more houses closer to jobs and amenities is needed to help younger and poorer Australians access the same opportunities as previous generations.

Australia’s population has grown strongly over the past two decades and will likely continue to do so. We can choose to push people out to the ever-expanding fringes of our cities or accommodate them through boosting supply in the inner and middle ring suburbs where most would prefer to live.

Allowing greater density in these areas not only expands supply but also boosts variety in housing choices, supporting more of the cross-socio economic mixing critical to social mobility.

After at least two decades of letting the ‘housing market frog’ slowly boil, there have been some positive steps from both Commonwealth and State governments to support the planning changes needed to boost supply. In particular, the Commonwealth government has offered incentives for states to target the construction of 1.2 million new homes over the next five years. 53

Similarly, moves to boost social housing are also a positive step, particularly where they’re targeted to those with the highest need.

Unfortunately, this new-found policy energy has come at the same time as the building industry faces challenges in ramping up.

But over time, if ambitious growth targets can be met, this could be a powerful shift in reducing inequality both within and between generations.

An education revolution?

School education is fundamental to supercharging opportunities for the next generation.

And while some of the problems our system faces are thorny, some of the solutions are surprisingly straightforward.

Our focus should start with getting the basics right – our schools should be supported and held accountable for delivering basic levels of literacy and numeracy. 54 My former colleagues at Grattan have called for a ‘Reading Guarantee’ – whereby governments would commit to ensuring at least 90 % of Australian students learn to read proficiently at school. 55

Supporting schools and teachers to deliver on these basics would require:

- making sure all teachers adopt evidence-based teaching practices such as phonics decoding for reading 56

- providing all schools and teachers access to a bank of well-sequenced high-quality curriculum materials 57

- reducing low value tasks for teachers to free them up to spend time on what really matters, 58 and

- providing better career paths to help schools attract and retain top teachers, and allowing top teachers to support and develop others in the profession. 59

Boosting social safety net

The Federal Government’s Economic Inclusion Committee just released its second report designed to inform the budget process.

Its lead recommendation remained unchanged from last year: to increase the rate of the JobSeeker and related income support payments.

The Committee finds that Australia’s unemployment benefits have been slipping further and further behind community living standards for two decades. 60

And while the recent 10% increase to Commonwealth Rent Assistance will provide much needed relief – as did the extra 15% in the last Budget – the Committee’s report demonstrates that the value of the payments has fallen significantly relative to average rents for the past 25 years. 61

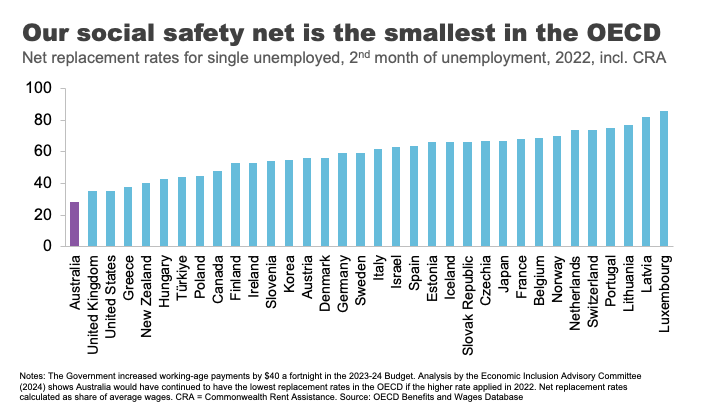

Today, Australia’s payments to the short-term unemployed, including housing benefits, are the least generous in the OECD. 62

No single measure would do more to alleviate poverty than a material change in these payments.

What’s stopping us?

Partly it’s likely to be well-meaning concerns about the impact on incentives to work.

But consistent with previous work, the Economic Inclusion Advisory Committee finds that the negative effect on incentives is likely to be small, because current levels of the payment are so far below incomes from working. 63

Indeed, for those facing economic exclusion, higher income support payments may improve the capacity to search for and accept employment. 64

Second, is the cost. Moving as far as the Economic Inclusion Advisory Committee recommends on JobSeeker and related payments could cost up to $4.6 billion per year, 65 which is not straightforward for governments balancing a range of competing priorities. But as targeted interventions to address poverty go, there is very little waste.

Finally, there is the question of community support. Boosting Jobseeker payments rarely garners majority support across the population. 66 As I have previously argued, this is less a case of Australians being mean spirited and more about the grip of some persistent and unhelpful myths about welfare recipients. Your regular community service reminder tonight: the median Jobseeker recipient is a 45-year-old woman. 67

Finding our inner Stretton

And with that I want to wrap up where I began, with Stretton’s legacy.

Inequality is one of those topics where it is easy to simply revert to tired tropes, particularly off shelf ones from elsewhere.

Stretton encouraged us to look with curiosity and rigour, but also with an open heart. In doing so, everyone may take away something different from the numbers and analysis I have shared tonight.

To me, there are bright spots in the story. Australia has grown its income and wealth over several decades, and it has shared those gains broadly. Social mobility is relatively high.

On the other hand, many relying on payments are in poverty and the long shadow of that experience can be hard for children to escape. Our schools and suburbs are becoming less of a springboard for mobility. And we have made the Australian dream out of reach for a generation of young people.

Policy matters – there are many levers that governments can pull to make a difference to these outcomes. But it is up to Australians to decide which ones we want them to use.

Footnotes

- Munro, D 2016, ‘The House that Hugh Built, the Adelaide history department during the Stretton era, 1954-1996’, History of Education vol. 46, no. 5, p.634.. Return to text

- Ibid, p.631. Return to text

- Spoehr, J 2015, ‘Hugh Stretton: a great Australian public intellectual’, The Adelaide Review, 7 September. Return to text

- Davison, G 2018, ‘Watching a brilliant thinker stretching his mind’, Inside Story, 11 October. Return to text

- Spoehr, J 2015. Return to text

- Gibilisco, P and Stretton, H 2003, ‘A pragmatic social democrat: an interview with Hugh Stretton’, The Journal of Australian Political Economy, vol. 51, pp. 13. Return to text

- The Guardian 2014, ‘Can the Hawking Index tell us when people give up on books?’, 8 July.Return to text